Went Long the Crude Oil? Beware of the Headwinds Ahead... / Commodities / Crude Oil

Falling oil demand and bearish USinventories are not of any good to WTI investors. However, a deeper slide mightbe a great place to enter the trade…

FundamentalAnalysis

The Organization of Petroleum ExportingCountries (OPEC) has downgraded its estimate of world oil demand for 2021. Thedemand has been lower than expected so far despite strong prospects for the endof the year.

In fact, in its monthly report, thecartel estimates that oil demand will rebound by 5.82 million barrels per day(mb/d) this year, while it forecast 5.96 mb/d last month.

Global crude demand is therefore expectedto reach 96.6 mb/d this year.

As a reminder, the member countries ofthe cartel and their allies (OPEC+) chose at the beginning of October to renewtheir strategy of a modest increase in production, ignoring the calls to openthe floodgates further and thus propelling prices upwards.

By the way, the two oil-producingcountries that contributed the most to this increase are Nigeria and SaudiArabia.

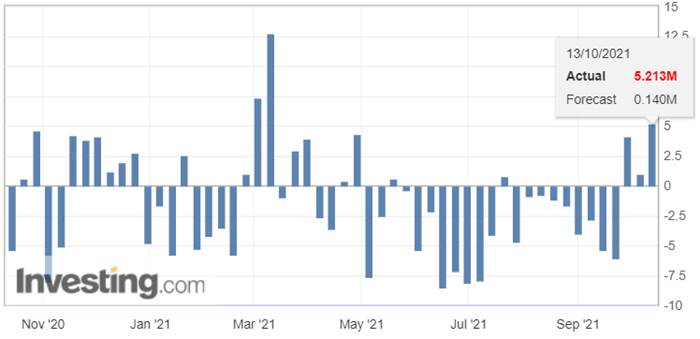

U.S.API Weekly Crude Oil Stock

Inventory levels of US crude oil, gasoline and distillates stocks, AmericanPetroleum Institute (API) via Investing

Regarding the API figures published onWednesday, the increase in crude inventories (with 5.213 million barrels versus140k) was more than expected — this implies weaker demand and is bearish forcrude prices. However, we have yet to see whether or not these figures areconfirmed by the weekly Energy Information Administration's (EIA) reportpublished later today.

If this scenario is confirmed by theEIA’s figures later today, then the black gold will be well set for a deepercorrection, possibly back to its lower support levels – levels which, by theway, were providedyesterday to our premium subscribers, alongwith our most recent projections.

WTI Crude Oil (CLX21) Futures (November contract, daily chart)

Finally, to wrap up today’s article, wehave seen a few choppy days on the energy markets with some contradictory datato interpret. This uncertainty usually leads to a ranging market, which can bean interesting place for some shorter-term trades. For a longer-term tradehorizon, it is necessary to combine some fundamental analysis with yourcharting and be patient.

This is exactly what we do here, and weare happy to help you surf on the waves of uncertainty! You can find moreinformation about exact positions and outlooks in our premium Oil TradingAlerts.

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.