What Could Possibly Derail The Gold Rally?

Things still look good for gold, but a "devil's advocate" approach is needed.

U.S.-China trade war resolution could potentially reverse gold's rally.

A conservative money management discipline is, therefore, needed.

In the last few months, I've used this report to make the bullish intermediate-term (3-9 months) case for gold. That outlook appears to still be sound based on the weight of technical and fundamental evidence. But sometimes it's important to consider all that could go wrong to upset one's investment thesis. The purpose of this exercise is not to introduce the element of doubt and thereby undermine confidence in your market stance. Rather, it's to prepare for the possibility of a market reversal so as not to be taken unawares. To that end, in today's report, we'll discuss some developments that, however unlikely, could potentially derail the gold rally.

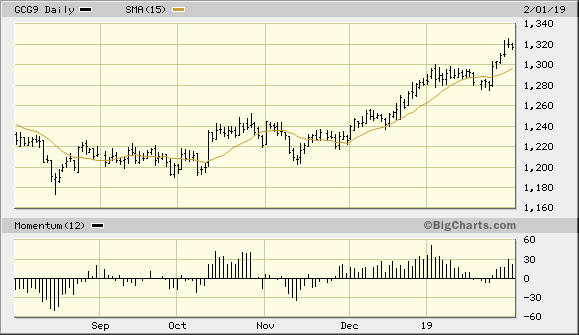

Before we look at some counter-rally possibilities, let's review the latest strides the yellow metal has made. Last week, the February gold futures price gained some $20/oz. and, despite a late-week pullback, posted its best weekly performance for the year to date. Gold has established a clearly visible stair-stepping pattern of higher highs and lows since bottoming last August and is advancing in a gradual, orderly fashion. This is how an incipient bull market should ideally progress, so from strictly a technical standpoint, there are no complaints with gold's performance in the last five months.

Source: BigCharts

Fund flows also continue to be positive as interest in gold on both the individual and institutional levels has gradually increased in recent weeks. Holdings of the SPDR Gold ETF (GLD), the largest gold-based exchange-traded fund, were near their highest levels since late June 2018 last week. As it now stands, things look as good for gold as they have in almost a year.

Now let's discuss what could possibly go wrong with the gold market in the coming weeks. Probably, the biggest concern which investors are beginning to ponder is the potential for a positive resolution to the U.S.-China trade war. It was, after all, the increasing worries generated by the trade tariff dispute which gave gold much of its safety appeal in late 2018. As investors worried about the likelihood of a global economic slowdown resulting from this, gold suddenly looked attractive to defensive-minded investors.

The U.S. equity market plunge in October, which was partly the result of these fears, also stimulated interest in gold. As money poured out of equities and into gold beginning in the final months of 2018, the metal's upside potential was continuously bolstered by the widespread perception that there would be no quick fixes for the U.S.-China trade spat. Gold's $140/oz. rise since last August has served as a continual reminder that its intermediate-term prospects have indeed drastically improved as geopolitical and economic concerns strengthen gold's "fear factor".

Yet now, for the first time in a long while, there seems to be a real possibility of a positive resolution to the tariff dispute between both trading partners. According to news reports, representatives of both nations are optimistic that a deal could be made before higher tariffs are implemented on March 2. President Trump has also touted the "tremendous progress" which has been made on the particularly contentious issue of forced technology transfers. If indeed a deal is made before March 2 to end the trade war, this could easily result in higher demand for risk assets like equities while blunting the demand for safety assets such as gold. As remote as the possibility of an end to the trade dispute by March may be, gold investors should nonetheless keep it in mind in order to guard against it.

Let's also consider another possibility which could reverse gold's winning ways. Aside from the fear factor, the metal's currency component has been the strongest contributor to gold's gains in recent months. Last year, the rising U.S. dollar index created a huge headwind for gold and pushed prices sharply lower from April until August. Starting in November, however, the dollar's rally stalled out and was followed by a pullback in December to early January.

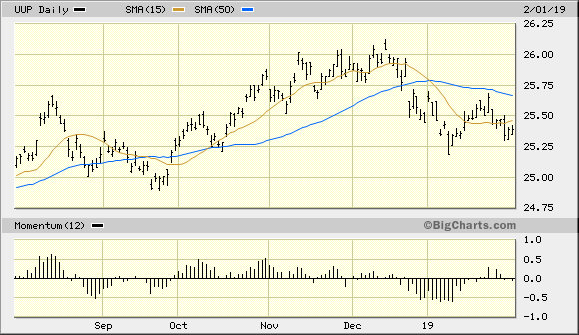

As of Feb. 3, the Invesco DB US Dollar Index Bullish Fund (UUP), my favorite dollar proxy, remains under the 15-day and 50-day moving averages (below). This tells us that the dollar is still technically weak while gold's currency remains strong. However, a rally above the widely watched and psychologically significant 50-day MA in the coming weeks would at least temporarily halt gold's short-term upside bias. If the dollar then continued to rally, it could eventually even reverse gold's intermediate-term forward progress.

Source: BigCharts

Granted that the dollar's current condition still benefits gold, what could potentially cause the dollar to rally in the weeks to come? Continued strength in the U.S. economy is one possibility especially since the currency has tended to benefit from a strengthening economic performance in recent years. A resurgence in the global trade outlook could also benefit the dollar as foreign money flows into the U.S. based on brighter economic prospects. This is by no means a certainty, but it's something that participants should ponder as we head further into the year.

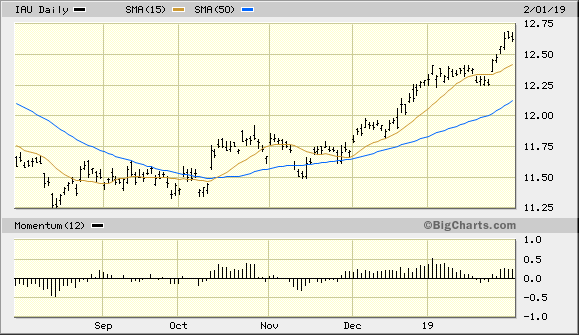

In the final analysis, how should investors approach the possibility that the gold rally could be derailed in the coming weeks? My answer to this conundrum is that as long as the near-term weight of evidence is mostly positive, investors should continue to lean bullish on gold. Our trading position in the iShares Gold Trust (IAU), which is the gold-tracking vehicle I utilize for this report, remains above its rising 15-day and 50-day moving averages. This is all the technical evidence we require for now to let us know that gold's immediate-term and intermediate-term trends are still up.

Source: BigCharts

More than just evaluating gold's prevailing trend, a conservative money management discipline is needed at all times in order to ensure profits are locked in. It's also necessary to practice money management in order to protect against counter-trend developments like the ones we've been discussing here. This means using a rolling stop-loss on open trading positions during gold's rallies. For short-term traders, I've advocated using a level slightly under the $12.35 level in our IAU trading position. A move below $12.35 would protect the profits we've made in this long position since October.

Intermediate-term oriented investors will no doubt want to use a looser stop-loss. A good all-purpose rule-of-thumb is to use a decisive violation of the 50-day moving average as a stopping out point. But whichever stop-loss level one chooses, a protective stop is needed as an insurance policy against the bullish case getting upended in the coming weeks. For now, though, the trend remains up for gold and investors are fully justified in remaining bullish on the metal's intermediate-term prospects.

On a strategic note, we are still long the iShares Gold Trust after recently taking some profit. I also recently recommended raising the stop loss for the remainder of this trading position to slightly under the $12.35 level on an intraday basis. A violation of $12.35 in the IAU would signal a decisive shift in the gold ETF's immediate-term trend by putting the price under the 15-day moving average.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts