What Does November Hold for the Gold Miners? / Commodities / Gold and Silver 2021

As a new month begins, the downtrendin the GDX and GDXJ should resume. When will a new buying opportunity finallypresent itself?

Let’s compare the behavior of the GDX ETFand the GDXJ ETF. Regarding the former, the GDX ETF reversed sharply afterreaching its 200-day moving average and a confluence of bearish indicatorssignaled a similar outcome. For context, I wrote on Oct. 25:

Smallbreakout mirrors what we witnessed during the senior miners’ downtrend in late2020/early 2021. Moreover, when the GDX ETF’s RSI (Relative Strength Index)approached 70 (overbought conditions) back then, the highs were in (or near)and sharp reversals followed.

Furthermore,after a sharp intraday reversal materialized on Oct. 22, the about-face issimilar to the major reversal that we witnessed in early August. On top ofthat, with the GDX ETF’s stochastic indicator also screaming overbought conditions, the senior miners are likely to movelower sooner rather than later.

Also,please note that the GDX ETF reversed right after moving close to its 200-daymoving average, which is exactly what stopped it in early August. Yes – that’s another link between now and early August.

And after declining sharply on Oct. 28and Oct. 29, the senior miners further cemented their underperformance of gold.Moreover, with relative underperformance often a precursor to much largerdeclines, the outlook for the GDX ETF remains quite bearish.

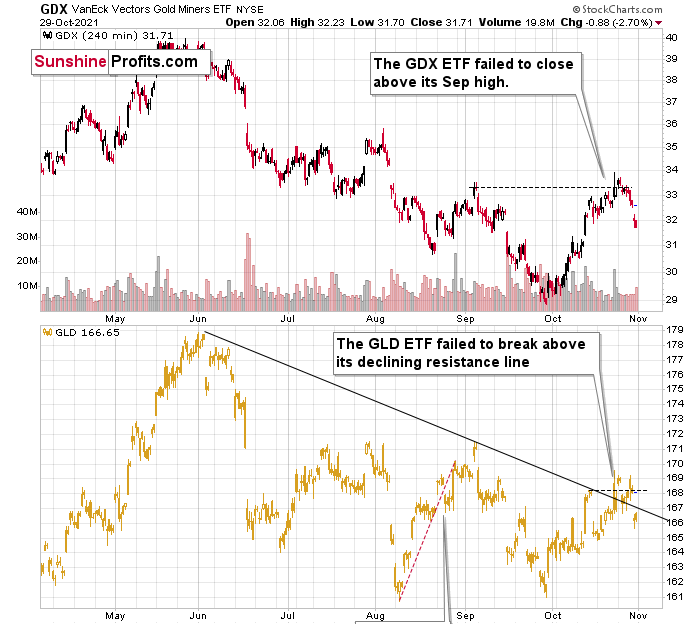

Please see below:

As further evidence, the GDX ETF’sfour-hour chart offers some important insights. To explain, the senior minersfailed to hold their early September highs and last week’s plunge removed anyand all doubt. Likewise, the GLD ETF suffered a sharp drawdown and its recentbreakout was also invalidated.

Furthermore, my three-day rule forconfirming breakouts/breakdowns proved prescient once again. Conversely,investors that piled into mining stocks are likely regretting their decision toact on unconfirmed signals.And as we look ahead, the technicals imply that caution is warranted and moredownside is likely for the GDX ETF.

As for the GDXJ ETF, the gold junior miners suffered a similar swoon last week. For context, I warned of theprospective reversal on Oct. 25. I wrote:

Thejunior miners’ RSI also signals overbought conditions and history has beenunkind when similar developments have occurred. Moreover, the GDXJ ETF’s recentrally follows the bearish patterns that we witnessed in late May and in early2021. Likewise, the intraday reversal on Oct. 22 mirrors the bearish reversalfrom early August and a confluence of indicators support a continuation of thedowntrend over the coming weeks.

And as we begin a new month, the GDXJETF’s downtrend should resume and a retracement to the ~35 level will likelymaterialize in the coming months.

Please see below:

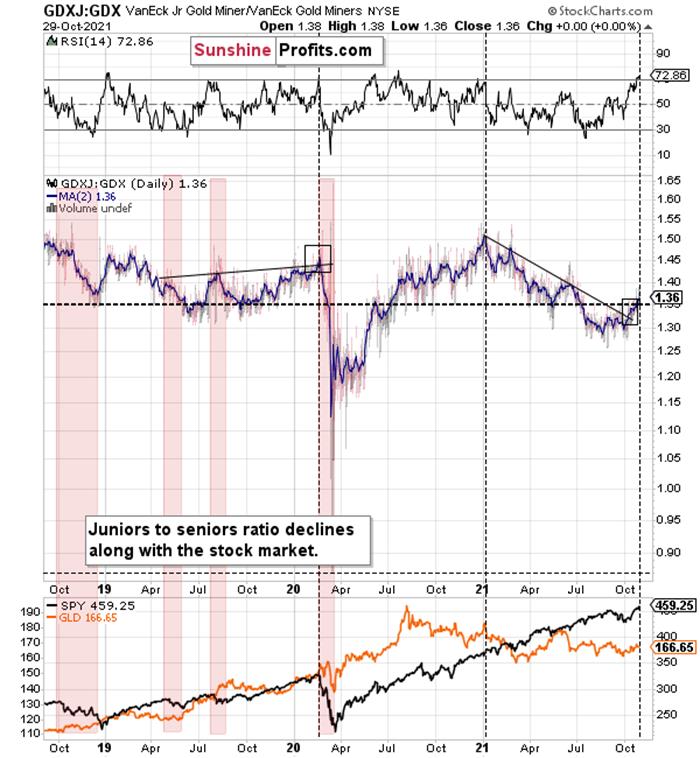

Finally, while I’ve been warning formonths that the GDXJ/GDX ratio was destined for devaluation, the ratio hasfallen precipitously in 2021. And after the recent short-term rally, theratio’s RSI has reached extremely elevated levels (nearly 73) and similarperiods of euphoria have preceded major drawdowns (marked with the blackvertical dashed lines below).

To that point, the ratio showcased asimilar overbought reading in early 2020 – right before the S&P 500plunged. On top of that, the ratio is still below its mid-to-late 2020 lows andits mid-2021 lows. As a result, the GDXJ ETF will likely underperform the GDXETF over the next few months. It’s likely to underperform silver in the near term as well.

The bottom line?

If the ratio is likely to continue itsdecline, then on a short-term basis we can expect it to trade at 1.27 or so. If the general stock market plunges, the ratio could move much lower, but let’s assume that stocks declinemoderately or that they do nothing or rally slightly. They’ve done all theabove recently, so it’s natural to expect that this will be the case.Consequently, the trend in the GDXJ to GDX ratio would also be likely tocontinue, and thus expecting a move to about 1.26 - 1.27 seems rational.

If the GDX is about to decline toapproximately $28 before correcting, then we might expect the GDXJ to declineto about $28 x 1.27 = $35.56 or $28 x 1.26 = $35.28. In other words, ~$28 in the GDX is likely to correspond toabout $35 in the GDXJ.

Is there any technical support around $35that would be likely to stop the decline? Yes. It’s provided by the late-Feb.2020 low ($34.70) and the late-March high ($34.84). There’s also the late-Aprillow at $35.63.

Consequently, it seems that expecting theGDXJ to decline to about $35 is justified from the technical point of view aswell.

In conclusion, mining stocks reprised their roleas ‘The Boy Who Cried Wolf.’ And after overzealous investors rushed to theirdefense last week, another false alarm led to another bout of disappointment.Moreover, with the technical and fundamental backdrops for gold, silver andmining stocks continuing to deteriorate, lower lows should materialize over themedium term. As a result, we may have to wait until 2022 before reliable buyingopportunities emerge once again.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.