What Does the New Long Term Gold Chart Portend?

While looking at an annotated long-term gold chart from Larry Fike, Technical Analyst Clive Maund also shares his insight on where he believes gold is headed.

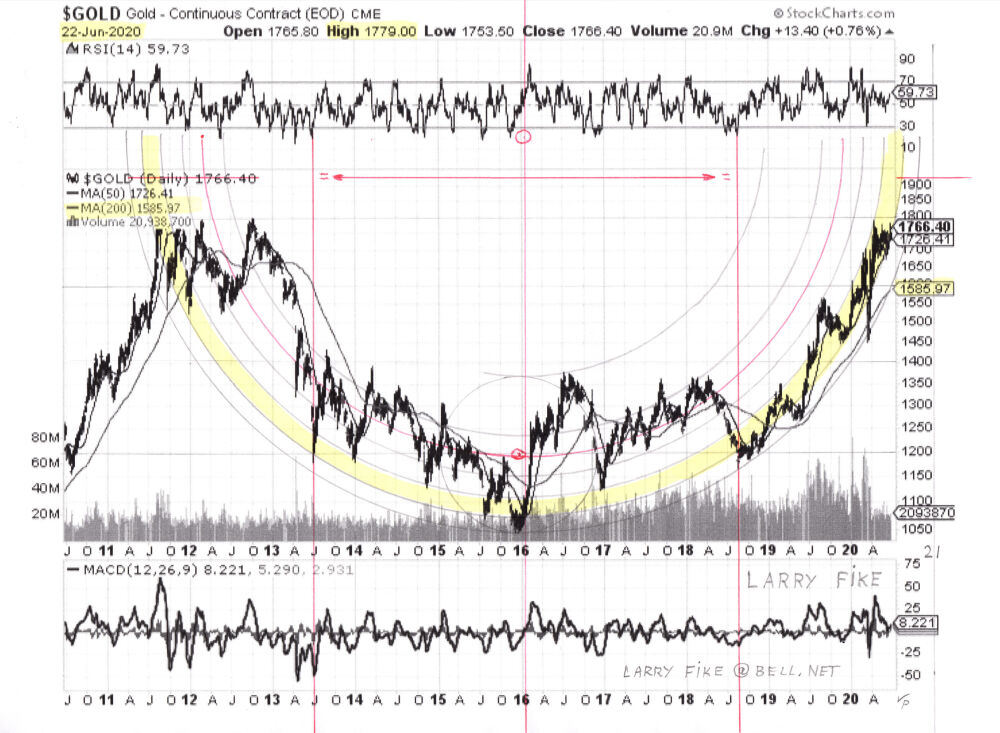

I have received an annotated long-term gold chart from Larry Fike. Long-time subscribers may remember seeing Larry's very long-term gold chart some years back that portended a massive gold bull market which is what we are seeing get underway right now.

The last of these charts that I received was dated June 22, 2020, and as a refresher, it is shown below. The chart shows the gigantic Cup that formed from the 2011 highs, which at the time of this chart was not quite completed, although just a couple of months later, it was after gold rose sharply during the last half of July and the early part of August to hit a peak at $2089.20 on August 7, 2020.

After that, gold settled into a long and vexing Handle consolidation that continued for more than three and a half years, with it finally breaking out to start the current major bull market phase in March of this year.

Having reviewed Larry's older gold chart showing the giant Cup pattern in detail, we will now proceed to look at his latest 25-year chart, which shows the completed Cup and Handle pattern.

Larry is currently of the view that once gold breaks above the long-term yellow-colored upper channel rail shown on his latest 25-year chart above, it is likely to go into vertical meltup mode, which is in my view a very likely scenario given what is in store for most currencies.

Here is what Larry himself had to say about this chart:

"What I am seeing . . . and thinking what I am about to see . . . is very exciting. According to chart history . . . a breakout from a rounding cup and handle usually results in a dramatic parabolic upward move.

As you very carefully examine the attached 25-year chart of Gold that I have been working on for weeks... please notice what it is screaming at us. It seems (to me ) that it could explode upwards before the end of the 2024 year."

I concur with Larry's observations and would add that once gold succeeds in breaking above the steeper upper rail of the channel in force from the 2011 highs, it should indeed go into vertical melt-up mode, but this is likely to start as a steep but fairly orderly uptrend that accelerates in stages over time until it ends up in a wild speculative melee with the price going "limit up" successively or equivalent as much as market conditions and rules at the time permit.

Needless to say, the gains in all gold-related investments at this time should be spectacular.

With thanks to Larry for permission to use his charts.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.