What ECB's Tiering Means for Gold / Commodities / Gold & Silver 2019

In a key policy shift, the ECB has recentlyintroduced tiered system of interest rates. This news isn’t of interest only tothe banks keeping their reserves at the ECB. In today’s article, you’ll learnabout the new instrument of monetary policy, and find out what it implies forthe gold market.

In a key policy shift, the ECB has recentlyintroduced tiered system of interest rates. This news isn’t of interest only tothe banks keeping their reserves at the ECB. In today’s article, you’ll learnabout the new instrument of monetary policy, and find out what it implies forthe gold market.

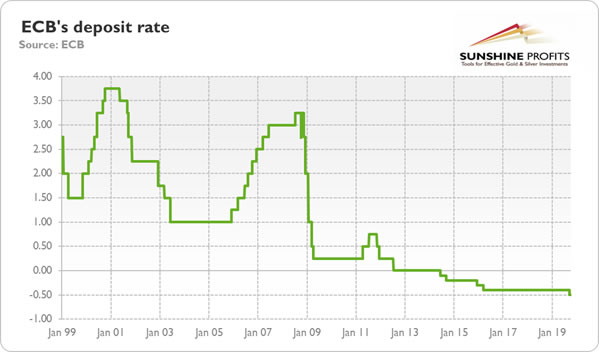

If you think that monetary policy in the UnitedStates is crazy, you are right. But in Europe, it is even stranger (and inJapan, it is really insane). As you probably remember, in September, the ECB introduced a package of measures to ease monetary policy further in the face ofsluggish economic growth and subdued inflation. In particular, the Governing Council resumed quantitative easing (the bank will be purchasing €20 billion of assetsmonthly), eased theconditions for TLTRO operations, strengthened the forward guidance strategy,and – the crème dela crème – cut the deposit rate by 10 basis points from -0.40 to -0.50percent, as the chart below shows. The ECB used, of course, all theseinstruments already in the past. What isreally new is the introduction of the tiering system. How does it work andwhat could be its consequences for the euro area economy and gold prices?

Chart 1: ECB’s deposit rate from January 1999 toOctober 2019.

In the ECB’s tiered system of interest rates, aportion of bank deposits, currently set at six times their mandatory reserves,is exempted from the negative deposit rate. In other words, reserves below a threshold bear zero interest, and only excess of reserves above thisthreshold is subject to negative interest. The idea is to limit the harmfuleffects of negative interest rates on banks’ profitability. This is why most ofthe central banks that implemented NIRP have some form of tiering system. Forexample, due to tiering, the percentage of reserves subject to negativeinterest rates in Japan is only about 5 percent.

Youmight ask now why, the heck, introduce negative interest rates in the first place and then implement neutralizingmeasures? That’s a great question, but not for us, but for a psychiatrist. But our guess is that the ECB used the NIRP to weaken the euro, as it is the only channel through which itsmonetary policy somehow still works,but the banks were fed up watching their bottom lines turn red, so the ECBtiered the interest rates. Now, everyone is happy.

Really?Not so fast! The tiered system is welcome, but its introduction came too late for a sector hurt by years of ultra-lowinterest rates. And the relief will be too small, as it would result inannual saving of only about €2-3billion euros for the entire euro zone banking system, around one third of thetotal costs of the NIRP that banks would have to bear without the tieredsystem.

Moreover, investors should remember that the euroarea banking sector is heterogeneous, so notall banks will gain to the same extent. As German and French banks have themost reserves, they suffered from the NIRP the most and they will feel now thegreatest relief. It means that the policy won’t make its hit to the maximum andthat there might be some side effects.

But what is perhaps the most important is that the implementation of tiering systemtightened the monetary conditions. The ECB cut deposit rates, but the moneymarket rates rose. Why? Quite simply. Tiering means that many reserves areexempted now from negative interest rates. They are subject to the zerointerest rate, and only a part of them bear interest rate at -0.50 percent.Hence, the banks’ weighted deposit rate at the ECB increased from around -0.37to -0.25 percent. It’s not clear how the tightened monetary conditions aresupposed to stimulate economic growth in the euro area. Higher interest rates should support the euro and also the yellow metalon the margin.

However, although the introduction of tieringprovides some relief for commercial banks’ profitability and increases theinter-bank interest rates, it extendsthe possible time of the NIRP in the euro area and expands the room for evenmore negative interest rates in the future. As banks are now partiallyshielded from the disastrous effects of the NIRP, the ECB could hesitate less before the next reduction of itspolicy rate or delay the normalization of its monetary policy.

The sluggish growth combined with lower yields should weaken the euro and gold pricesagainst the U.S. dollar in the medium term.However, given the ultra-dovish stance of the ECB and unwelcome upward pressureon the greenback, the Fed might be more inclined to follow suit and also adopta more accommodative stance. It could cut the federal funds rate as early as in October. Thus, if the ECB’s tieringtranslates ultimately into a more dovish Fed, it should affect gold prices positively.

If you enjoyed the above analysis, we invite you tocheck out our other services. We provide detailed fundamental analyses of thegold market in our monthly Gold Market Overview reports andwe provide daily Gold & Silver Trading Alerts with clearbuy and sell signals. If you’re not ready to subscribe yet and are not on ourgold mailing list yet, we urge you to sign up. It’s free and if you don’t likeit, you can easily unsubscribe. Sign uptoday!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.