What To Make Of Gold Stocks Now?

Barry Dawes of Martin Place Securities takes a look at the gold market and shares his thoughts on some gold stocks.

Barry Dawes of Martin Place Securities takes a look at the gold market and shares his thoughts on some gold stocks.

Gold stocks are at an important juncture. The 13-year downtrend is broken and being backtested. Gold stocks versus gold are still consolidating.

It is hard to tell where gold is going next. It's likely to be a C wave lower, but anything can happen in gold. The futures are showing so far two consecutive 'hammer' actions, which is quite positive.

Keep watching.

This is a big bull market in gold and gold stocks, but nothing much is clear. Earnings don't seem to matter, and assets even less.

Of course, the NST bid for DEG makes a lot of sense, especially for DEG shareholders, so it is an excellent route into NST and NST's dividend stream. Other M&A is likely to be at the smaller end of the market.

Do note the varying performances of gold stocks in North America and ASX.

It certainly is not a strong bull market pushing up all stocks, and valuations seem quite inconsistent. This, of course, means market participation by investors is still quite low. And that generally means it is early days in this bull market.

Hard to work this one out for gold just now.

The C wave on the 15-minute chart says down soon, and it could be sharp. If so, it should be short-lived.

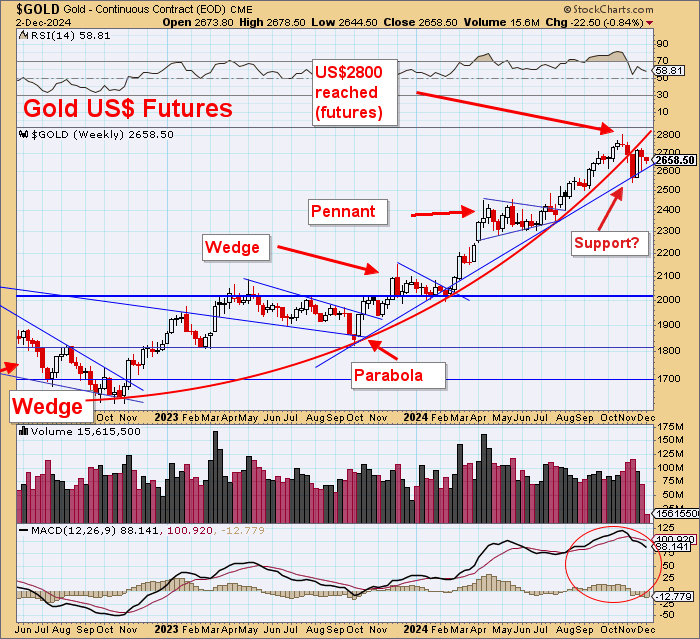

The weekly futures have broken their parabola, but they haven't broken down yet. Not quite the same story but be wary of futures contract month premium changes when trying to interpret prices, hence the use of the GLD ETF.

The 15-minute chart is below. Is a C wave coming or not?

Look at weekly futures. These two consecutive hammers are bullish.

Gold Stocks

The long-term should take precedence. This 13-year downtrend is very important.

It is being backtested, and this can be seen in the short term. 165 is major resistance still but 145 is excellent support and there is that 2011 downtrend that is also providing support.

Keep watching gold stocks versus gold.

It looks like it is heading lower for a few days, but it is still setting up like a major reversal. 20-year perspective 13-year downtrend is broken Being backtested

5-year perspective. 165 resistance holding back index. Backtesting on 2011 downtrend, holding uptrend.

The 18-month perspective shows good technical support.

XAU versus gold. Long consolidation and RHS being formed.

Note that the CDNX for junior stocks is creeping higher for the TSX-V.

And don't lose the bigger picture of a MAJOR trend reversal now completing with the RHS.

North American gold stocks are heading higher, but not with much consistency.

Newmont Corp. (NEM:NYSE) back into support.

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) is testing downtrend.

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has new highs, but uptrend is broken.

Kinross Gold Corp. (K:TSX; KGC:NYSE) has new highs, but uptrend is broken.

AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) is backtesting downtrend.

Gold Fields Ltd. (GFI:NYSE; GFI:JSE) is testing uptrend.

Northern Star Resources Ltd. (NST:ASX;NESRF:OTC) is in the U.S. market with new highs and backtesting uptrend.

Evolution Mining Ltd. (EVN:ASX; CAHPF:OTCMKTS) is in the U.S. market and has broken downtrend.

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) is testing uptrend.

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) is testing uptrend.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., Agnico Eagle Mines Ltd., and Franco-Nevada Corp.Barry Dawes: I, or members of my immediate household or family, own securities of: Northern Star Resources Ltd. and De Grey. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.