What Will Break Gold's Currency Deadlock?

A strengthening U.S. dollar is again creating headwinds for gold.

Gold's fear component is strong enough to override this, however.

An overlooked momentum consideration also supports gold this spring.

Gold is once again finding itself in a tug-of-war among safety-conscious investors who favor the strong U.S. currency over the yellow metal. While many investors are flocking to the perceived safety of the dollar, gold is still attracting a fair share of the safe-haven crowd. The question is what will break this currency-related deadlock? In today's report, I'll make the case that gold's fear component, along with a key momentum consideration, will support the metal while it builds up strength for another rally later this spring.

In recent reports, we've discussed the supporting factors for a continued recovery in the gold market in the months ahead. Most of these considerations have been psychological in nature; specifically, the market's intensifying fears over the state of the global economy. The recent outperformance of the gold mining stocks vis-? -vis the gold price is another sign which suggests the metal's price outlook remains positive.

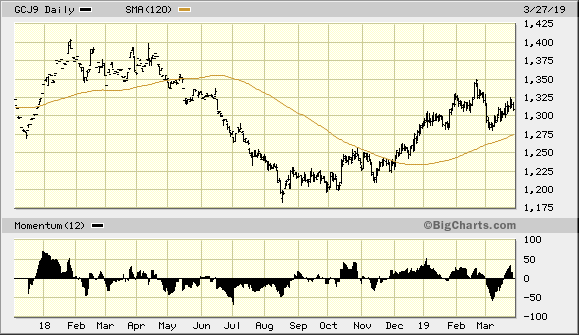

Now let's turn our attention to an important longer-term trend consideration for the gold price. Historically, the yellow metal has tended to perform well on an intermediate-term (3-9 month) basis whenever the gold price has closed decisively above the 120-day moving average. The 120-day MA encompasses the average performance of the gold price over an approximately half-year period. Whenever gold closes above this trend line and the 120-day MA turns up, it reflects a positive reversal of metal's price momentum. When dealing with any commodity, price momentum is an important consideration since commodities tend to be far more cyclical than equities. A positive shift in gold's intermediate-term momentum is one reason for expecting a buoyant gold price in the coming months.

Source: BigCharts

Conversely, when the gold price falls under the 120-day moving average, it's a sign that forward momentum in the metal's price has deteriorated enough to justify selling. Gold's previous 120-day MA sell signal occurred last May when the price dropped under the moving average (see above chart). From there, gold commenced a nearly 4-month plunge to below the $1,200 level before finally establishing a bottom last fall. As long as the April gold futures price shown above remains above its 120-day MA on a weekly closing basis, investors are justified in maintaining a bullish intermediate-term posture on the metal. While this doesn't guarantee gold will make further gains in the immediate term, its positive relationship to the 120-day MA suggests that there's enough buoyancy in the market to prevent a sell-off during the latest consolidation phase of the gold market.

Along with a breakout above the 120-day MA, there should ideally be improvement in gold's relative strength indicator versus equities. As can be seen in the following graph, relative strength for gold compared to the benchmark S&P 500 Index (SPX) could use some improvement. However, gold's relative strength is still in far better condition now than it was for much of 2018. As I've emphasized in past reports, investment fund managers typically look at the relative relationship between stocks and gold before deciding to make serious commitments to the metal. When gold's relative strength performance versus the SPX is strong, fund managers are far more likely to purchase bullion or bullion-backed ETFs.

Source: StockCharts

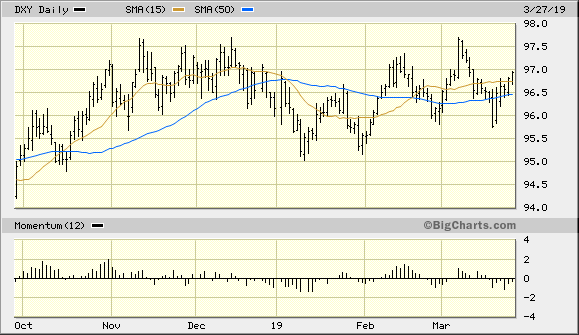

A strengthening U.S. dollar index (DXY) has also served as a headwind to gold's most recent rally attempt. As can be seen in the following graph, DXY is back above its 15-day and 50-day moving averages and it's nearing its yearly high. In view of the fixation of many participants on the 50-day MA, this is potentially bad news for the immediate-term (1-4 week) gold price outlook as a stronger dollar will undermine gold's currency component. Nonetheless, gold's "fear factor" should allow bullion prices to remain within the well-established trading range of the last three months.

Source: BigCharts

Let's briefly address gold's fear factor. What the commodity lacks in terms of a strong currency component it is more than making up for in terms of a strong safety component. That is, safe-haven gold demand has been on the upswing of late with the market's worries over a slowing eurozone economy. What's more, mounting concerns over the inversion in the U.S. Treasury yield curve has investors wondering if the U.S. economy is on the verge of recession. Both concerns are sufficiently strong enough to support gold's safety bid in the foreseeable future. As well, the continued uncertainty over the U.S.-China trade war should also increase gold's safe-haven demand.

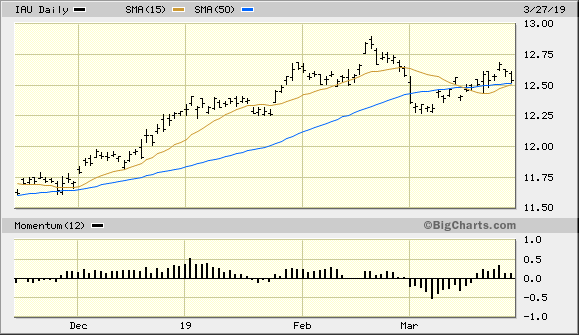

Turning to the gold ETF, after confirming an immediate-term buy signal, the iShares Gold Trust (IAU) is still in the bulls' hands despite the latest dollar-driven gold pullback. IAU closed above its nearest pivotal high of $12.56 on Mar. 20 to confirm the latest bottom and re-entry signal. I continue to recommend that traders who purchase IAU use a level slightly under $12.30 as the initial stop loss for this trade on an intraday basis. Although IAU remains above its key 15-day and 50-day trend lines as of mid-week, the ETF needs to shake off the latest attempt at a bear raid by closing out this week above its psychologically significant 50-day moving average.

Source: BigCharts

While a temporary strengthening of the U.S. dollar doesn't necessary mean gold prices will trend lower, it does create a strong headwind for gold prices in the near term. If the dollar continues to strengthen, it will increase the resistance against a further gold rally and may force the gold bulls to content themselves with a trading range while equities enjoy a relief rally. During the next several days, it will also be important to monitor gold's relative strength indicator versus the S&P 500 Index. As previously stated, an increase in gold's relative appeal compared to stocks would provide fund managers with more of an incentive to buy gold. This, in turn, would likely serve as a catalyst to gold's next rally which I anticipate later this spring.

So, despite dollar-related headwinds, the weight of evidence remains positive for the yellow metal's short-term and intermediate-term outlook. Gold ETF demand is rising, as shown by recent increases in holdings of the SPDR Gold Trust (GLD). Rallies in the major gold mining shares also suggest gold demand will further increase based on the sensitivity of bullion prices to mining share prices. Moreover, the latest increase in global economic fears, along with the U.S. Treasury yield curve inversion, supports a buoyant price for the yellow metal in the coming weeks. Investors are, therefore, still justified in maintaining a bullish intermediate-term outlook on the yellow metal.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts