When Will the Turnaround in Gold Likely Come? Implications for Silver? / Commodities / Gold & Silver 2019

Inyesterday’s analysis, we emphasized that even though a big decline in gold isalready underway, it’s likely that it won’t be a straight move down and therewill be periodic corrections. Moreover, we provided price targets from whichthe bounce could start. Based on the circumstances, it might even be a tradablemove. In today’s analysis, we’re going to show you that there are signals suggesting that theturnaround might start relatively soon – during this month.

Inyesterday’s analysis, we emphasized that even though a big decline in gold isalready underway, it’s likely that it won’t be a straight move down and therewill be periodic corrections. Moreover, we provided price targets from whichthe bounce could start. Based on the circumstances, it might even be a tradablemove. In today’s analysis, we’re going to show you that there are signals suggesting that theturnaround might start relatively soon – during this month.

Butfirst, let’s take a look at the most recent price changes.

Yesterday’sMoves in PMs

The most importantthing that happened on the gold market is the breakdown below the $1,500 leveland below the neck level of the head-and-shoulders pattern. Earlier, bothlevels prevented gold from declining further and now this is no longer thecase. Gold can slide.

Thehead and shoulders pattern suggests a move to at least $1,425 as that’s thesize of the head of the pattern. There are other factors that need to beconsidered as well. The Fibonacci retracements provide useful targets as well.The first one is relatively close, at about $1,450, the second is at about$1,416, which is relatively close to the above-mentioned $1425 level, and thethird is at about $1,381.

Theprevious highs and lows also play a part. There are quite a few such extremesthat formed in June and July, but they are more or less in tune with theFibonacci retracements, so they don’t add much to the above.

Takingboth: the head-and-shoulders and the Fibonacci retracements into account, itseems that gold is more likely to bounce from about $1,420 than from otherprice levels. The $1,381 level might be the something that generates a reboundas well but it’s not as likely as the $1,420 level. At least not based on theabove chart.

Basedon the long-term gold and silver charts that we featured in yesterday’s Gold& Silver Trading Alert, we have indicationsthat gold might bounce from about $1,420, and from the $1,360 – 1,380 area. Thiscoincides very well with the above-mentioned price levels.

Themost important take-away, though, is that gold is not likely bottoming rightnow. Sure, it moved higher yesterday, but it didn’t rally back above the necklevel of the head-and-shoulderspattern,which means that yesterday’s rally was just a verification of the breakdown –nothing more. Consequently, it didn’t change the bearish implications of thelatter, and the short-term outlook remains bearish.

Pleasenote that while gold moved visibly higher on a day-to-day basis, gold minersdidn’t. The HUIIndex ended the session just 0.5% higher. This underperformance shows that thebreakdown below the head and shoulders pattern was not accidental and that it’slikely to slide further.

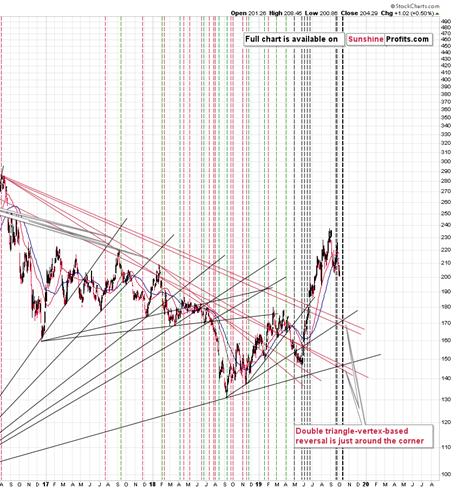

Inthe opening paragraph of today’s analysis, we wrote that there are signs thatwe’ll see a corrective upswing in the following weeks. Both signs come fromapplying the triangle-vertex-basedreversal technique. Let’s take a look at them.

Triangles,Trend and Reversals

Bothsilver and the HUI Index are very close to the point in time where two (silver)or four (HUI) previous resistance and support lines cross. These moments tendto mark important reversals for a given market. Of course, this is not alwaysthe case, but it is the case often enough to make this tradingtechnique useful, especially if it’s confirmed by more than one vertex. There are threevertexes (two in case of the HUI Index and one in silver) that point to anearby reversal. And by nearby, we mean the middle of the month.

Theentire precious metals sector is likely to correct more or less at the sametime, so this implies also a correction in gold.

Doesit mean that the gold, silver, and miners’ decline is about to be over?Absolutely not. Gold probably has hundreds of dollars to go before the bottomis in, similarly to how it declined in the second part of the 90s or in late80s. This does, however, mean that we might see a short-term turnaround aftergold, silver, and mining stocks decline some more.

Thismonth’s seasonalitychart for silver confirms the bearish indications.

Silverand Q4 Seasonality

Youcan read more detailed seasonal silver analysis overhere,but the long story short is that the declines are likely to take place in the 3weeks of the month, in particular at the very beginning of the month. Anystrength is likely to be seen closer to the end of the month, and perhaps inearly November.

Allthe above paints a quite coherent short-term picture: the precious metalssector declines shortly, but starts a corrective upswing from lower pricelevels close to the middle of the month.

Beforesummarizing, we would like to briefly reply to a boomerang question that wejust received. “Boomerang” because it comes back every couple of weeks ormonths. The question is why is comparing the current price moves to arelatively distant past (like the mid-90s) useful, if the fundamental situationis different (e.g. interest rates, sovereign debt levels).

Surely,the fundamental situation differs. Not only interest rates, debt levels, butgeopolitics in general. The presidents and prime ministers come and go, themonetary authorities change, and the world is developing in a non-linear way ingeneral. However, fear and greed have been and will always be present and aslong as the capital markets are available, their participants will makedecisions based not only on logical fundamental factors, but also based on theemotional determinants. No geopolitical situation will make any free market(let’s not debate the goldmanipulation and silvermanipulation theories here – they are definitely free to a major extent and at the same timeno market is completely free as long as the interest rates are artificiallyset) price move up or down in a straight line continuously. People will alwaysget ahead of themselves with their optimism and greed and then they will getahead of themselves with their pessimism and desperation and hate toward aparticular sector. And that’s what makes bull markets and bear markets unfoldin specific ways – where there are periodic corrections and where there aremedium-term downtrends that are opposite of the very long-term uptrends.

TheWestern world’s debt is ballooning, interest rates are ridiculously low andthere are massive trade tensions. Monetary officials are determined tostimulate the economy even though it doesn’t really want to respond to thestimuli in the way that it used to. And it’s all very positive for gold… In thelong run.

Andin the long run, we don’t expect gold to decline as low as it declined afterthe mid-90s top. As a reminder, gold bottomed several years later very close to$250. No, we don’t expect anything like that. The fundamentals definitelyjustify much higher gold prices. Will gold’s upcoming bottom be twice as highas the one that we saw about 20 years ago? Or three times as high? Or more?Please note that by saying that a medium-term slide is very likely, we are nottelling anyone that gold should get back to its value from 20 years ago.

However,based on the way gold performed after parabolic upswings (when greed was at itsextreme), it tends to perform relatively similarly. For instance, both the 1980and 2011 price spikes were followed by very sharp declines. There are numerousother ways in which we can detect what kind of situation is similar to what wesee right now and when more of them point to the same outcome, the latterbecomes likely. There are numerous reasons for gold to decline right now, eventhough it’s likely to rally in the long run. The massive breakout in the USDIndex is one of the most important factors, but there are also many others. Thefact that gold was the only part of the precious metals sector that reallyrallied this year serves as a perfect confirmation. Gold stocks should berallying strongly in the early part of the bull market, just like they did inthe early 2000s. The opposite has been happening in the previous months. Why?Because gold, silver, and mining stocks haven’t fallen enough and need todecline some more before the investors enter the fear, desperation and hatestage. That’s when true bottoms are formed, not when people continue to expecthigher gold prices (which was the case based on the surveys conducted in thelate 2015).

Summingup, the big decline in the precious metals sector appears to be finallyunderway. While there will be periodic corrections, it seems that we will seethem only after gold, silver and mining stocks decline some more – possiblyclose to the middle of October. In today’s analysis, we updated ourshort-term downside targets based on the latest information as the recentdecline is not as sharp as the 2011 one, so the technique that predicted the2011 correction might not apply here.

Today'sarticle is a small sample of what our subscribers enjoy on a daily basis. Forinstance today, we’ve covered the price target analysis for silver and miningstocks – just as richly as you have seen it done for gold. We’ve also includeda helpful summary of the gold move’s determinants at play. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. On top, you’ll also get 7 days of instant email notifications the momenta new Signal is posted, bringing our Day Trading Signals at your fingertips. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.