While Gold Moves With The Dollar, Leveraged ETN Products Offer Short-Term Opportunities

A great trading market in 2017, and so far in 2018, and the equities are more volatile than the bullion.

Leveraged ETN products are intraday trading products.

NUGT and JNUG for the rallies.

DUST and JDST for the dips.

Use the profits to load up on bullion.

Gold and the dollar have been like frick and frack over recent months as the prices of the currency and the metal have been moving in opposite directions on almost a tick-for-tick basis. The dollar is the world's reserve currency and the benchmark pricing mechanism for most commodities. Gold is a hybrid as it is perhaps the oldest means of exchange in the world while being a metal and commodity product. Gold's role in the financial system is not only a historical fact but a current event. Central banks around the globe hold 20% of the yellow metal ever mined in the history of the world as a foreign exchange reserve asset.

Gold is an asset that many investors hold for safety. However, it can be a volatile market instrument that tends to trade higher or lower for weeks at a time making it a candidate for nimble traders with their fingers on the pulse of the market.

A great trading market in 2018 and so far in 2018 and the equities are more volatile than the bullion

Trading, rather than investing, has been the optimal approach to the gold market so far in 2018.

Source: CQG

As the daily chart of April COMEX gold futures highlights, the yellow metal has already experienced two rallies and two selloffs since the start of this year. April gold closed 2017 at $1309.90 per ounce, and it rallied by $60.60 or 4.6% until reaching a high on January 25. A correction took the price $61.50 lower by February 8 and then gold turned around and rallied by $55.40 by February 16. Since that lower high, gold had dropped to lows of $1303.60 on March 1, a decline of $60.80 and was trading at around the $1320 level on March 5.

The price action in gold mining shares has mirrored the path of the yellow metal.

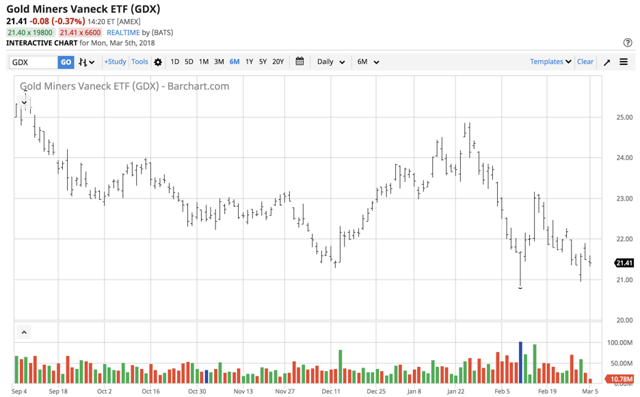

Source: Barchart

GDX closed 2017 at $23.24 per share and rallied to a high of $24.86 on January 24, a rise of 7%. It then declined to lows of $20.84 on February 9, which was over 16% lower and the rise to a high of $23.15 on February took the mining shares over 11% higher. The move in the gold mining shares magnified the price moves in gold on a percentage basis.

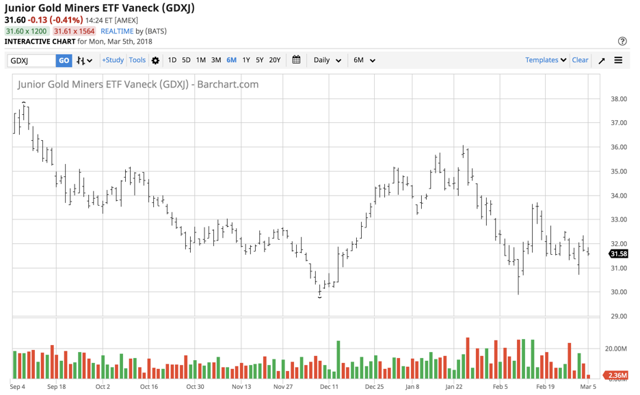

Source: Barchart

The move in the junior gold miner index, GDXJ, tends to be even more volatile than the GDX over time.

Over the first two months and one week of 2018, gold has been volatile, and the mining indices have been fertile ground to trade the range in the yellow metal as they often display greater price variance than the metal.

Leveraged ETN products are intraday trading products

Leveraged instruments are not appropriate for investment purposes for medium- or long-term market views, but they can be excellent trading sardines.

Leveraged ETN products carry a different set of risks when compared to instruments that seek to replicate price action in an underlying asset on a one-to-one basis. They are debt securities that depend on the credit of the issuers. An ETN is a liability of the company or financial institution that issues the security and buyers take the risk of performance by that particular company. When it comes to leverage, issuers use futures, swaps, and options to turbocharge performance. Therefore, time value can eat away at the products if a move does not occur quickly. A bullish or bearish double or triple-leveraged ETN that owns call or put options has the risk of theta, or time decay, which eats away at the value of the product in stable or slow-moving markets, even if the price goes in the direction that the buyer anticipates. Therefore, one can lose significant capital during periods in a short-time if they do not get immediate market moves in the direction that the product purports to replicate.

Meanwhile, for short-term traders who take intraday or in some cases overnight positions, the leveraged ETN products serve to optimize trading results when technical and fundamental analysis leads to a sharp move higher or lower in a short period.

NUGT and JNUG for the rallies

Since gold mining shares tend to provide market participants with a higher degree of volatility, the triple leveraged ETN products turbocharge those results.

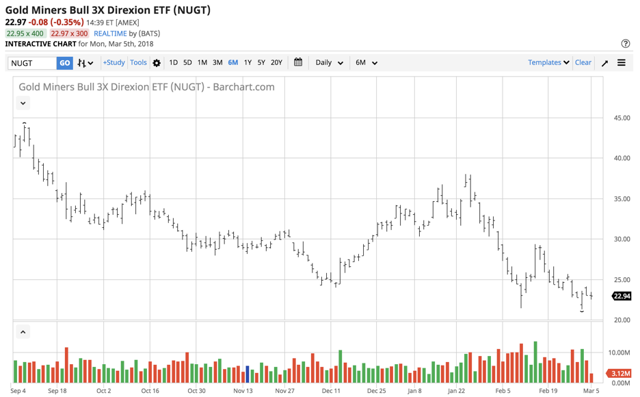

Source: Barchart

NUGT is the three times leveraged bullish gold miner ETN product. As the chart shows, NUGT moved from $31.70 at the end of 2017 to a high of $36.96 on January 24, a rise of 16.6%. The decline to $21.40 on February 9 was a drop of 42%. NUGT is not for the faint of heart, but it is an excellent tool for those day trading in the gold market.

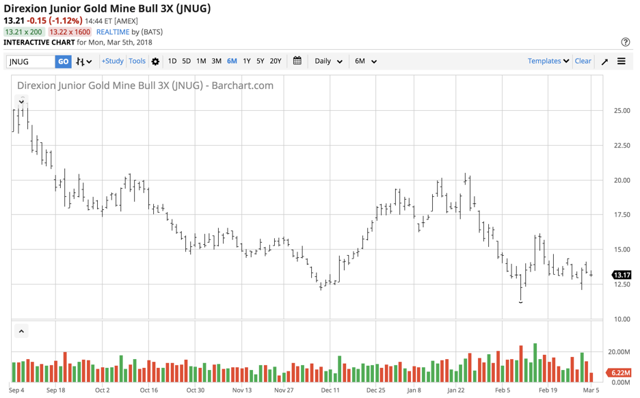

Source: Barchart

JNUG is the triple leveraged junior gold miner ETN for those who want maximum leverage in the gold market. This ETN moved from $17.76 at the end of 2017 to highs of $20.50 on January 24, an increase of 15%, less than the NUGT ETN during the period as the larger miners outperformed the juniors over the period. However, the drop to $11.34 on February 9 amounted to 45% of the value of the instrument. As you can see, the triple leveraged ETN's magnify the results in the gold market on the upside, but they can be highly painful on the downside. These products take an escalator to the upside, but an elevator shaft to the downside.

DUST and JDST for the dips

NUGT and JNUG meet the demand for action seekers on the upside in the gold market when it comes to mining shares, and each offers excellent liquidity. NUGT trades an average of 6.8 million shares each day, while JNUG trades more than 12.3 million on an average session.

To respond to the demand from gold bears, there are triple leveraged bearish instruments on the gold mining shares.

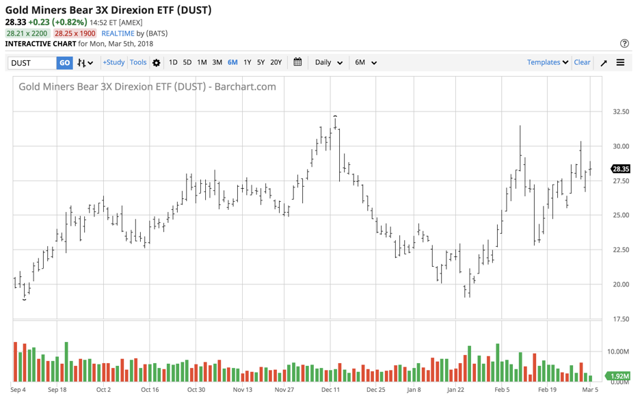

Source: Barchart

Dust lost 12.4% of its value from the final trading day of 2017 through January 25 as gold moved to the upside. However, as gold fell, DUST appreciated by over 50% from low to high between January 25 and February 9.

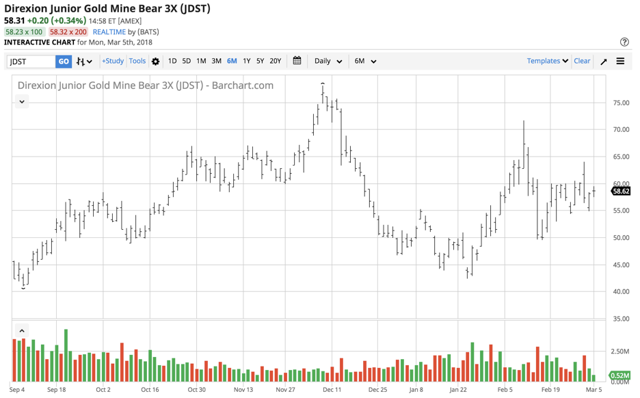

Source: Barchart

JDST lost 17.5% from the year of last year until January 24, but it exploded in value by over 69% between the time gold made its high and when it found a bottom on February 9. DUST trades an average of 5.4 million shares each day and JDST an average of 1.47 million.

Use the profits to load up on bullion

As a trader, I love to use these instruments for intraday trading purposes. However, I rarely if ever hold them overnight and have never kept a position for longer than one week as the theta risk outweighs the market risk, in my opinion.

My strategy over the years has been the same when it comes to these instruments. I am a gold bull in the long-term and am always looking to add to my physical holdings. I tend to use my profits from trading the triple leveraged gold mining ETN products selecting direction based on my analysis of the path of least resistance for the yellow metal to buy gold bars and coins.

Gold continues to move higher and lower with the dollar on a daily basis these days and short-term trends have created profitable opportunities for trading the triple leveraged ETN mining products on a daily basis. DUSY and JDST can magnify results, but keep in mind that magnification causes a wild roller coaster ride with these products.

The Hecht Commodity Report is a must-read...

I believe we're on the verge of a commodities super cycle. Do you know how to profit from it? I do, and I can help you navigate the turbulent commodities markets to make the most of the trends behind the trade. The Hecht Commodity Report on Marketplace provides subscribers with my weekly outlook, top picks, and bullish, bearish or neutral calls on over 30 individual commodities markets, including U.S. futures. I also make timely recommendations for risk positions in ETF and ETN markets and commodity equities and related options. There's also an active live chat, where I reply quickly to questions. If you want to build wealth with commodities, the Hecht Commodity Report is required reading.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.