White Gold Corporation: Support Must Hold

White Gold Corporation is a newer name in the junior space, and holds the largest property portfolio in the White Gold District of the Yukon, with nearly 1.1 million acres.

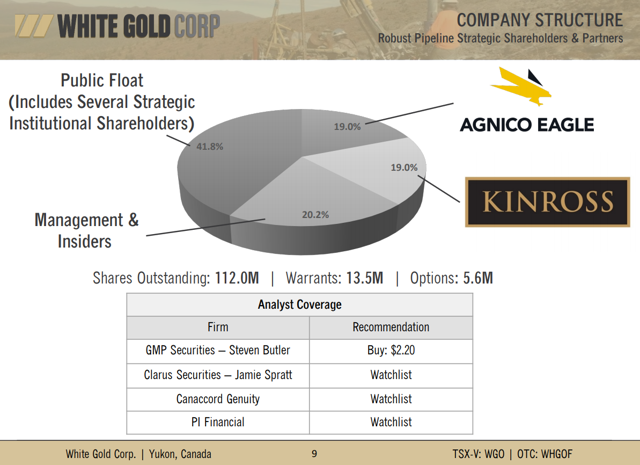

The company has a strong share structure with a good chunk of float held by Kinross Gold and Agnico Eagle.

While the drill bit has had a reasonable amount of success at the company's projects, the technical picture leaves a lot to be desired.

White Gold Corporation (OTC:WHGOF) is a newer name to the junior space, with the company having its IPO debut in late 2016. The catalyst was a letter agreement for all of Shawn Ryan and Wildwood Exploration's gold properties in the Canadian Yukon Territories. For those unfamiliar with Shawn Ryan, he was previously a wild mushroom picker in British Columbia, before returning to his roots of prospecting. When the gourmet mushroom market took a hit, he headed back to Dawson City in the Yukon in search of gold (GLD). His prospecting and extensive soil sampling in the area turned out to be extremely lucrative, with Ryan stumbling upon the White Gold deposit which was purchased for $140 million by Kinross Gold (KGC) in 2009. Ryan has a knack for sniffing out highly lucrative claims, and White Gold is hoping that they got some of his better claims in their 2016 purchase.

Thus far, it looks like their purchase is panning out. The company has delineated a resource of over 1.5 million ounces with over 65% in the indicated category, at an average grade of over 1.8 grams per tonne gold. Shawn Ryan is currently the Chief Technical Advisor for the company. While the projects seem to have a lot of promise, the technical picture leaves a lot to be desired. For this reason, while I do believe the name is one to keep on the radar, I see new buys as risky at current levels.

(Source: Uphere.ca)

White Gold Corporation has a tight share structure of just over 110 million shares, with nearly 60% of that share structure held by management/insiders and strategic investors, Kinross and Agnico Eagle (NYSE:AEM). This is exceptionally tight as far as things go in the junior group, and the company has been mindful of dilution with only two significant financings the past three years. One with GMP Securities and Clarus in 2017 for $10 million of flow-through shares at C$1.80, and the other bought deal financing in 2018 with Clarus, GMP Securities, Canaccord, and Sprott with flow-through shares at C$2.00, and common shares at C$1.50. The company's current enterprise value with 112 million shares outstanding after backing out their US$11 million in cash is roughly just shy of $80 million. This is a very reasonable enterprise value for a company with 1.5 million ounces of gold and several drill-ready targets across nearly 1.1 million acres of prospective land. The federal government's decision to go ahead on a $360M Yukon Resource Gateway Project emboldens the company's bullish thesis, with significant upgrades to over 650 kilometers of roads and bridge replacements planned going forward. The end date is currently slated for 2025. As of right now, the start-up is delayed, but there's little doubt that it will ultimately go forward, despite the lagged start-up thus far.

(Source: Company Presentation)

So let's take a look at the company's flagship deposits:

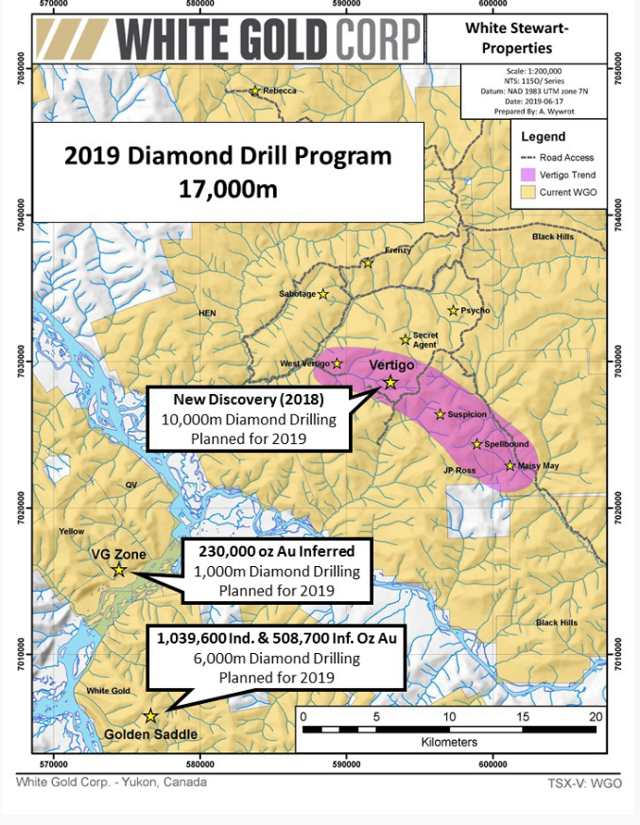

White Gold Corporation's Golden Saddle & Arc deposits were the first discovery in the White Gold District, and are located approximately 95 kilometers south of Dawson City, Yukon Territories. The current resource stands at just over 1.5 million ounces, with a high-grade core with the potential for a starter pit of 832,000 ounces at 3.0 grams per tonne gold. These are exceptional grades for a near-surface resource that is potentially amenable to open-pit mining. So far, the deposit traces a strike length of over 1,200 meters. The most recent highlight hole, WHTGS-19-D0198, hit 68 meters of 3.59 grams per tonne gold from only 70-meter depths. This hole is above the average grade of the deposit currently and was drilled into a minor gap in the block model.

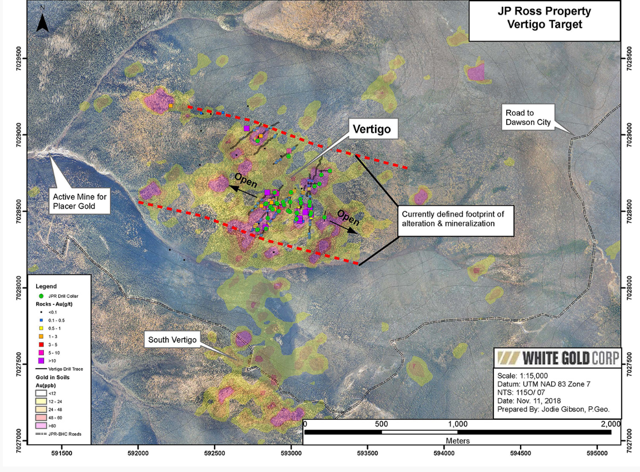

The company's second flagship deposit is Vertigo, which is part of the JP Ross Property. The Vertigo deposit is part of a larger, more than a 10-kilometer trend, with several different targets outlined. While the deposit does not have a resource outlined yet, initial drill results are encouraging, with the most substantial results reported last year. Drill hole JPRVER-RAB-18-014 intersected 24 meters of 23.44 grams per tonne gold, a very impressive hole over reasonable widths. White Gold followed up these results with JPRVER-RC-18-01, which intersected 9.14 meters of 9.19 grams per tonne gold. These results have delineated a mineralized zone of 2 kilometers by 650 meters, which remains open in most directions.

While it remains early to place much of a valuation on Vertigo given that they don't have a resource here yet, early drilling is certainly promising. The fact that sampling has outlined several other targets adjacent along trend in the more than 10-kilometer structure is also a very positive development. If the company continues to see drilling success and similar holes to the ones we saw in 2018, the company could have a substantial deposit here at Vertigo and its parallel targets.

(Source: Company News Release)

(Source: Company News Release)

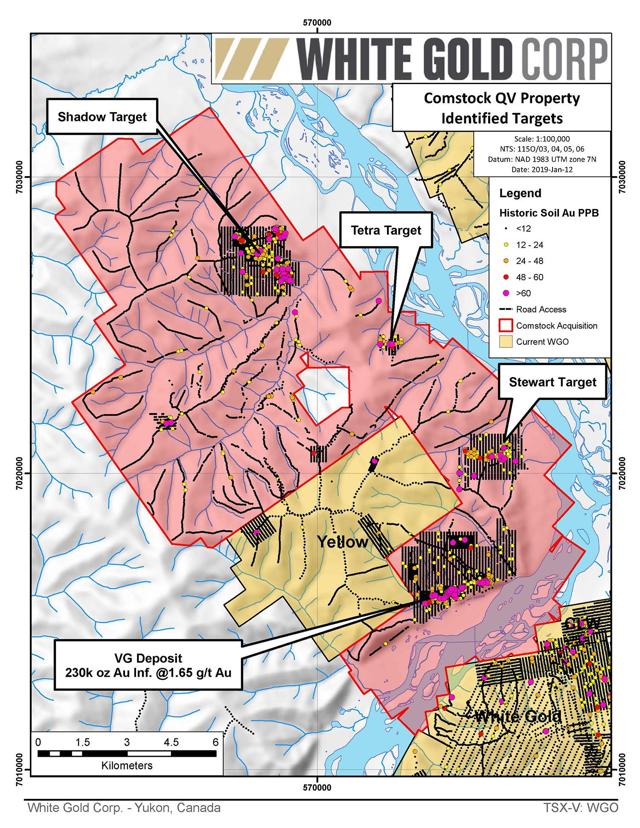

Elsewhere in White Gold Corporation's property portfolio, the majority of deposits are more in the greenfields stage and too early to speculate on. The company did recently acquire the QV Gold Project from Comstock Metals (OTCPK:CMMMF), which is 20 kilometers southwest of their Vertigo deposit. The project has an inferred resource of just over 200,000 ounces at 1.65 grams per tonne gold and comes with near 40,000 acres of land. White Gold Corporation paid a very modest $2.5 million for the property, with 30% of this in cash, and the remainder in shares of White Gold.

To summarize, White Gold certainly has an incredible property portfolio on their hands and can be compared to the Gold Standard Ventures (GSV) of the Yukon Territories. While it is too early to suggest the company has a world-class deposit on their hands, initial drilling is undoubtedly encouraging. The federal government's decision on the Yukon Resource Gateway Project adds some security to the investment thesis with the added infrastructure that should be in place by 2025. The risk is that the federal government or related parties do not decide to go ahead with the project as it's already quite delayed. I believe there's over a 70% chance they will go ahead with it, but there are never any guarantees. The North Klondike Highway portion of the project received funding just recently. The company certainly has a reasonably attractive valuation at near US$80 million given its land package and the current resource but remains entirely speculative. Generally, I prefer to wait for companies to establish a 2.5 million ounce resource with 75% of that in the measured & indicated categories before I can comfortably say the project is de-risked. The worse the jurisdiction, the higher the minimum resource I want to see.

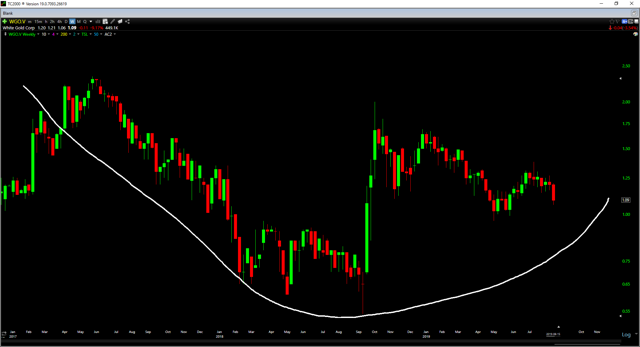

So why would we not look to invest in a company with such a promising property portfolio? The issue I see is the stock's significant underperformance with its peers. While other analysts may see buying low and cheap as an opportunity, I've found from experience that cheap tends to get cheaper, especially in the junior mining sector. The reason for this is that the industry is typically dominated by retail trading with a lack of funds in the sub $500 million space, and sentiment often rules the day medium-term. Rather than funds swooping in to buy when things get cheap on multi-billion dollar companies like Amazon (AMZN), Apple (AAPL) and others, the junior sector does not have this benefit. For this reason, I prefer to wait for concrete signs of a technical turnaround before jumping into new positions. Let's take a look at what would constitute a turnaround in the technicals below:

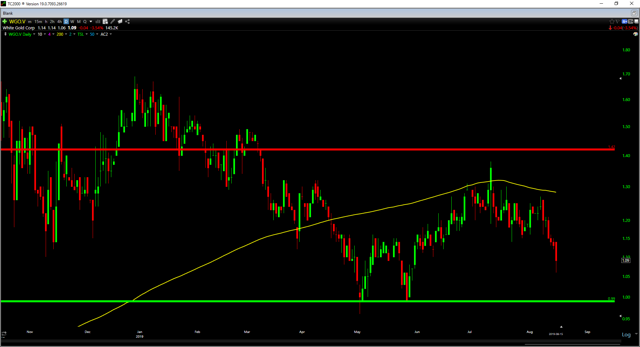

Looking at the below weekly chart, we can see that White Gold Corporation's stock seems to be trying to build out a large bowl type pattern. The support for this bowl pattern comes in around the C$0.90-$1.00 level, and this area is imperative to defend for the bulls. While this pattern often has bullish implications long term, it is the breakout from this bowl pattern that really gets the upside momentum going. Currently, it looks like we're at least a couple of months away from that occurring. It's important to note that this thesis is also predicated on the C$0.90 level holding.

Moving to a daily chart, we can see that the stock has a brick wall of resistance overhead near the C$1.42 level. Eager sellers are showing up immediately on each test of this level, and we would want to see a change of character to suggest the sellers are exhausted. A change of character would show up if the stock could put in a weekly close above C$1.45. In terms of supporting a bullish thesis, the bulls are not in control here at all, but at a minimum need to play defense at the C$0.99 level on a weekly close. If the stock were to break below C$0.99 on a weekly close and stay below there for more than two consecutive weeks, the stock would likely have some tough sledding ahead.

While the company is a very alluring speculative opportunity, the technical picture suggests that investors are best suited to be patient here. While investors will not catch the lows by being patient for a breakout over C$1.45 on a weekly close, they will de-risk the investment by not trying to trade long within a downtrend. As Gold Standard Ventures investors have likely learned, a great project does not always make an excellent investment. Instead, the key is playing defense in downtrends and being mindful of lethargic price action coupled with 3-month lows.

White Gold Corporation remains on my radar in my list of ninety junior miners I follow, but I don't see any reason to jump in the stock just yet. The key for the bulls is defending the C$0.99 level on a weekly going forward, and otherwise, the stock could see a tough back half of 2019 ahead for it. While the name is one to keep a close eye on, waiting for a clear uptrend seems like the wisest move here before getting involved on the long side.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts