White Rock Minerals (ASX: WRM): Advancing their zinc VMS Red Mountain project in Alaska and Mt Carrington Gold Silver Project in Australia, Interview with Matthew Gill, Managing Director and CEO. Booth 1003 VRIC

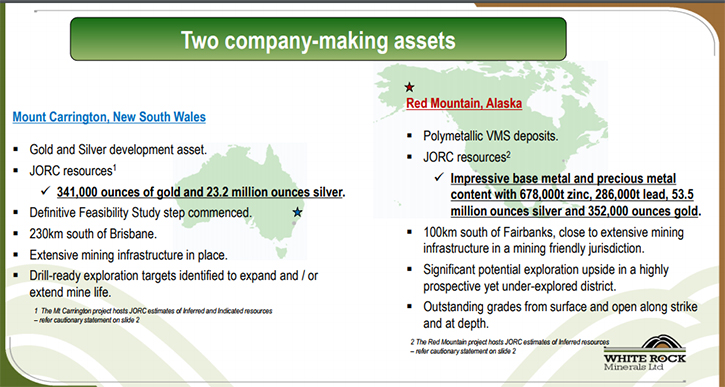

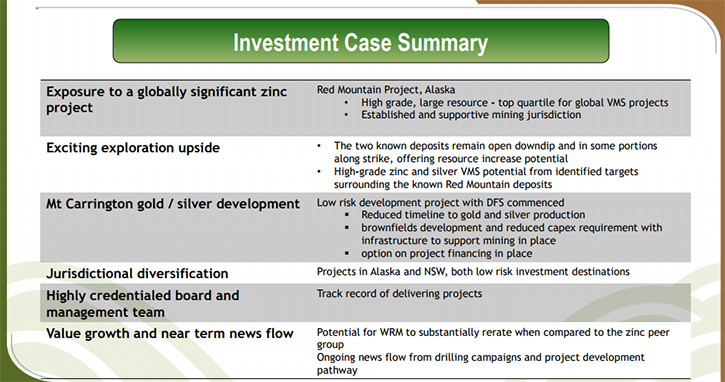

White Rock Minerals (ASX: WRM) is an Australian minerals exploration and development company, with projects located in central Alaska and eastern Australia. Their main focus in 2018 will be in Alaska at their globally-significant, advanced zinc-silver-gold VMS Red Mountain project in Alaska, with high grade zinc and silver in two deposits already discovered.We learned from Matthew Gill, Managing Director and CEO of White Rock Minerals, they are ready to proceed with a comprehensive exploration campaign in Alaska in 2018.White Rock's Australian asset is the Mt Carrington gold-silver project in northern NSW. In Australia, the results of the pre-feasibility study for the gold stage of Mt. Carrington were released, highlighting a maiden JORC 2012 Reserve of 160 thousand ounces of gold with solid cash flow and positive financial metrics. Mr. Gill believes that with exposure to gold, silver and zinc in two safe mining jurisdictions of Australia and North America, White Rock Minerals is a diversified company with a huge potential for value-add.Dr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matt Gill for White Rock Minerals (ASX:WRM). Could you give our readers/investors an overview of your company, your focus and current activities?Mr. Matthew Gill: Sure, Al. In the last few months, since we spoke, we have focused on two major areas. Before Christmas, we released to the market our intentions for an exploration program in the 2018 season for our zinc VMS project in Alaska. I'll come back to explain more about that important announcement to let the readers, shareholders and investors know what we intend to do on the ground with that great project that we only acquired last year. Then, after Christmas, we released the findings of our pre-feasibility study (PFS) for the gold first stage of our Mount Carrington gold and silver project in New South Wales. This is very similar to the Canadian NI 43-101 reporting format. That PFS was actually the culmination of a year's work. Those are the two main things we've done in the last month or so.  Dr. Allen Alper:What are the major findings from your pre-feasibility study?Mr. Matthew Gill: As you know, our Mt Carrington project in New South Wales, here in Australia, is a gold and silver project. It has about eight million ounces of silver in the JORC Indicated category with more in the Inferred category also, but we have initially focused on the 300-odd thousand ounces of gold that are available. As a result of this first stage of the PFS, we were able to declare a maiden ore reserve of about three and a half million tonnes holding about 160 thousand ounces of gold. It describes an initial four and a half year mine life, before we even start mining the silver. We were able to increase the throughput to a million tonnes per annum and increase the gold production rate 30% to about 35 thousand ounces per annum. We actually mine about 60% more ounces than the original scoping study. This is a really good outcome and has financial metrics that will generate in excess of 36 million dollars Australian in free cash. That's using a U.S. gold price of $1,275 dollars an ounce, and as you would know it's actually currently better than that. Those are the key findings.

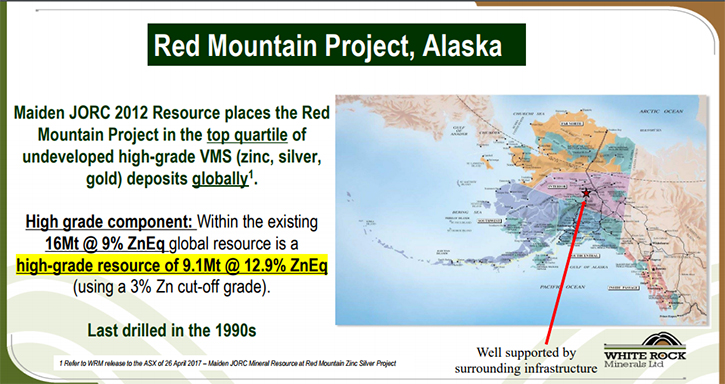

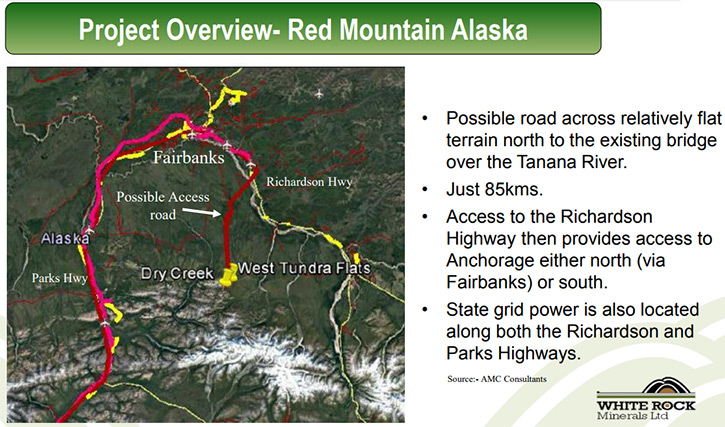

Dr. Allen Alper:What are the major findings from your pre-feasibility study?Mr. Matthew Gill: As you know, our Mt Carrington project in New South Wales, here in Australia, is a gold and silver project. It has about eight million ounces of silver in the JORC Indicated category with more in the Inferred category also, but we have initially focused on the 300-odd thousand ounces of gold that are available. As a result of this first stage of the PFS, we were able to declare a maiden ore reserve of about three and a half million tonnes holding about 160 thousand ounces of gold. It describes an initial four and a half year mine life, before we even start mining the silver. We were able to increase the throughput to a million tonnes per annum and increase the gold production rate 30% to about 35 thousand ounces per annum. We actually mine about 60% more ounces than the original scoping study. This is a really good outcome and has financial metrics that will generate in excess of 36 million dollars Australian in free cash. That's using a U.S. gold price of $1,275 dollars an ounce, and as you would know it's actually currently better than that. Those are the key findings. Dr. Allen Alper:That's excellent. Could you update our readers on the Red Mountain project?Mr. Matthew Gill: That's probably, in some ways, the more exciting project. We only acquired this project in 2016. It's a volcanogenic massive sulfide project, a VMS, rich in zinc and silver, as well as lead and gold - a true polymetallic VMS system. As you would appreciate, zinc has certainly been a very high-performing commodity over the last year or so. We expanded our exploration claims footprint 10 fold last year, on this project, to have a strategic landholding now in this region. We released a maiden JORC 2012 Resource last year that immediately placed this project in the top quartile of undeveloped zinc projects in the world. The huge upside is that the two known deposits are still open at depth and along strike in places, and we have identified another 30 similar targets, but which haven't had any modern day exploration or any drilling since the 1990s. We announced our proposed exploration strategy there for this year, which includes about 6,000 meters of drilling in and around the two known deposits, and also on some of the more distant identified targets. Those identified targets will be the subject of a comprehensive on-ground electromagnetic survey as well as some geo-chemistry. It's going to be a comprehensive regional exploration and detailed drilling program we're planning for Alaska this year.

Dr. Allen Alper:That's excellent. Could you update our readers on the Red Mountain project?Mr. Matthew Gill: That's probably, in some ways, the more exciting project. We only acquired this project in 2016. It's a volcanogenic massive sulfide project, a VMS, rich in zinc and silver, as well as lead and gold - a true polymetallic VMS system. As you would appreciate, zinc has certainly been a very high-performing commodity over the last year or so. We expanded our exploration claims footprint 10 fold last year, on this project, to have a strategic landholding now in this region. We released a maiden JORC 2012 Resource last year that immediately placed this project in the top quartile of undeveloped zinc projects in the world. The huge upside is that the two known deposits are still open at depth and along strike in places, and we have identified another 30 similar targets, but which haven't had any modern day exploration or any drilling since the 1990s. We announced our proposed exploration strategy there for this year, which includes about 6,000 meters of drilling in and around the two known deposits, and also on some of the more distant identified targets. Those identified targets will be the subject of a comprehensive on-ground electromagnetic survey as well as some geo-chemistry. It's going to be a comprehensive regional exploration and detailed drilling program we're planning for Alaska this year.

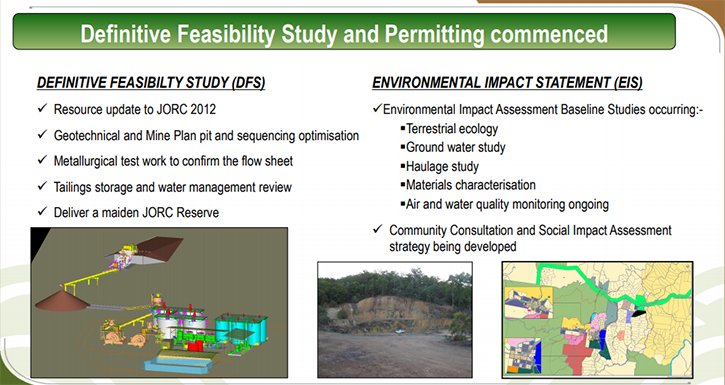

Dr. Allen Alper:That sounds excellent! Could you update our readers on your objectives for 2018 on both projects?Mr. Matthew Gill: With Mount Carrington we intend to continue with the key environmental impact statement studies, and consider the next step, technically, which is normally a definitive feasibility study, so a DFS. They are the two next major steps for our New South Wales gold and silver project at Mount Carrington. For Red Mountain in Alaska, our plan is to get on the ground with this comprehensive exploration program during the 2018 field season, including on-ground geo-physics, geo-chemistry and drilling. Our objective, by the end of this calendar year, is to have added to the existing zinc resources at Red Mountain, which is very possible because both known deposits are open along strike and down dip, also, to have drilled some of the high-priority other targets, and hopefully make some discoveries there. That's our objective for Red Mountain for this year.Dr. Allen Alper:That sounds very good. Could you update our readers on yourself, your board and management team?Mr. Matthew Gill: I am of course a bit biased, but I believe we have a first class and deeply experienced Board, with over 170 years of experience in the mining industry. I'm a mining engineer. I've worked in Australia and overseas in PNG and Bolivia and Ghana and Myanmar, from operational through to managing director roles and everything in between. There are four other board members. Our chairman is a mining engineer, with over 40 years of experience. He's currently chairman of another ASX-listed company. Another member of our board is a mining engineer, on the board of another ASX company and with many years of experience in the project development space and M&A, and, in fact, a fourth member of our board is also a mining engineer - he was previously MD of Newcrest and Orica. We all bring different experiences, whether it's business development or corporate, or M and A, or operational. The fifth member of our board is a finance individual who has worked for Morgan Stanley, Credit Suisse and Standard Chartered in the mining metals space. He too is on another ASX company board. It is fairly unusual to have four mining engineers out of five on a board, but it shows that we're about building a business and growing the company, that's our objective. Normally, a mining engineer has a fairly good, broad exposure, everything from exploration, geology through mining, through processing, through project development, but also, importantly, corporately, with capital markets, mergers and acquisitions, and stakeholder engagement, with its shareholders, communities and at the government level also. I find ours is a great board with deep experience that I actually learn from as well. On the executive side there is myself, as not just the managing director, but the CEO. I have a very confident, capable exploration manager in Rohan Worland, who's worked in Australia and overseas, including Nevada. He and I, basically, are managing and directing White Rock's activities, including our work plan for Alaska.

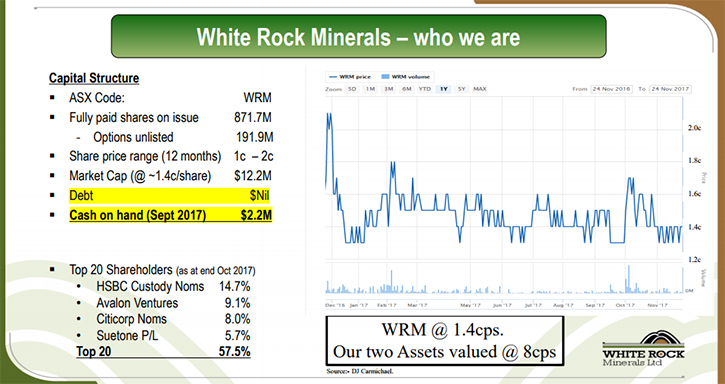

Dr. Allen Alper:That sounds excellent! Could you update our readers on your objectives for 2018 on both projects?Mr. Matthew Gill: With Mount Carrington we intend to continue with the key environmental impact statement studies, and consider the next step, technically, which is normally a definitive feasibility study, so a DFS. They are the two next major steps for our New South Wales gold and silver project at Mount Carrington. For Red Mountain in Alaska, our plan is to get on the ground with this comprehensive exploration program during the 2018 field season, including on-ground geo-physics, geo-chemistry and drilling. Our objective, by the end of this calendar year, is to have added to the existing zinc resources at Red Mountain, which is very possible because both known deposits are open along strike and down dip, also, to have drilled some of the high-priority other targets, and hopefully make some discoveries there. That's our objective for Red Mountain for this year.Dr. Allen Alper:That sounds very good. Could you update our readers on yourself, your board and management team?Mr. Matthew Gill: I am of course a bit biased, but I believe we have a first class and deeply experienced Board, with over 170 years of experience in the mining industry. I'm a mining engineer. I've worked in Australia and overseas in PNG and Bolivia and Ghana and Myanmar, from operational through to managing director roles and everything in between. There are four other board members. Our chairman is a mining engineer, with over 40 years of experience. He's currently chairman of another ASX-listed company. Another member of our board is a mining engineer, on the board of another ASX company and with many years of experience in the project development space and M&A, and, in fact, a fourth member of our board is also a mining engineer - he was previously MD of Newcrest and Orica. We all bring different experiences, whether it's business development or corporate, or M and A, or operational. The fifth member of our board is a finance individual who has worked for Morgan Stanley, Credit Suisse and Standard Chartered in the mining metals space. He too is on another ASX company board. It is fairly unusual to have four mining engineers out of five on a board, but it shows that we're about building a business and growing the company, that's our objective. Normally, a mining engineer has a fairly good, broad exposure, everything from exploration, geology through mining, through processing, through project development, but also, importantly, corporately, with capital markets, mergers and acquisitions, and stakeholder engagement, with its shareholders, communities and at the government level also. I find ours is a great board with deep experience that I actually learn from as well. On the executive side there is myself, as not just the managing director, but the CEO. I have a very confident, capable exploration manager in Rohan Worland, who's worked in Australia and overseas, including Nevada. He and I, basically, are managing and directing White Rock's activities, including our work plan for Alaska.  On that particular point, Rohan and I will be in Vancouver later this month for the Vancouver Resource Investment conference and the AME Roundup conference as part of our preparatory work for our field season in Alaska, and meeting contractors and consultants, but also to meet and establish relationships and contacts, as we get to know how to work and operate in Alaska. I'm, actually on a workshop with the Alaskan state government at the Vancouver conference, so that's coming up in the next week. If any of your readers/investors are going to those conferences around the 22nd of January, by all means they should look us up. We have a booth at the Vancouver Resource conference (#1003), and I'll be about if people want to have a chat.Dr. Allen Alper:That sounds great. That's excellent. Could you update our readers/investors on your share and capital structure?Mr. Matthew Gill: Sure. As of the end of September 2017 we had about two million dollars in the bank. We have no debt. We have a market cap of around 12 million dollars Australian. We're terribly under-valued when you look at our in-ground assets, both at Mount Carrington with the gold and silver, but also in Alaska with its endowment of zinc, silver, lead and gold. We have about 900 million shares on issue, and a share price of about 1.3 cents. I understand that our capital structure is a bit unusual, I know, for some North American readers, but it's quite common in Australia.

On that particular point, Rohan and I will be in Vancouver later this month for the Vancouver Resource Investment conference and the AME Roundup conference as part of our preparatory work for our field season in Alaska, and meeting contractors and consultants, but also to meet and establish relationships and contacts, as we get to know how to work and operate in Alaska. I'm, actually on a workshop with the Alaskan state government at the Vancouver conference, so that's coming up in the next week. If any of your readers/investors are going to those conferences around the 22nd of January, by all means they should look us up. We have a booth at the Vancouver Resource conference (#1003), and I'll be about if people want to have a chat.Dr. Allen Alper:That sounds great. That's excellent. Could you update our readers/investors on your share and capital structure?Mr. Matthew Gill: Sure. As of the end of September 2017 we had about two million dollars in the bank. We have no debt. We have a market cap of around 12 million dollars Australian. We're terribly under-valued when you look at our in-ground assets, both at Mount Carrington with the gold and silver, but also in Alaska with its endowment of zinc, silver, lead and gold. We have about 900 million shares on issue, and a share price of about 1.3 cents. I understand that our capital structure is a bit unusual, I know, for some North American readers, but it's quite common in Australia. Dr. Allen Alper:Sounds like there'll be a lot of opportunity for share price appreciation. Mr. Matthew Gill: That's exactly the plan, yes. Dr. Allen Alper:Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?Mr. Matthew Gill: I would suggest to an investor that they should have a broad spread in any investment portfolio. White Rock covers both precious metals in gold and silver in two very solid, safe jurisdictional domains in Australia and North America. We also have exposure to zinc, still one of the best-performing base metals. From a commodities point of view, being exposed to gold, silver and zinc isa good investment proposition I would have thought. We are diversified in two very good jurisdictions, important because of sovereign risk in other parts of the world. The opportunity I feel is significant for an investor, in particular from our plans for Red Mountain given that we're about to go exploring, where there hasn't been any drilling since the 1990s, and there should be significant news flow from our activities there. There is huge potential for value-add that the market is yet to recognize because we haven't started any work on the ground as yet. That is all about to change. The reader can have a look at our website to see the prospectivity that we believe is there and the reason we're focusing on that this year.

Dr. Allen Alper:Sounds like there'll be a lot of opportunity for share price appreciation. Mr. Matthew Gill: That's exactly the plan, yes. Dr. Allen Alper:Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?Mr. Matthew Gill: I would suggest to an investor that they should have a broad spread in any investment portfolio. White Rock covers both precious metals in gold and silver in two very solid, safe jurisdictional domains in Australia and North America. We also have exposure to zinc, still one of the best-performing base metals. From a commodities point of view, being exposed to gold, silver and zinc isa good investment proposition I would have thought. We are diversified in two very good jurisdictions, important because of sovereign risk in other parts of the world. The opportunity I feel is significant for an investor, in particular from our plans for Red Mountain given that we're about to go exploring, where there hasn't been any drilling since the 1990s, and there should be significant news flow from our activities there. There is huge potential for value-add that the market is yet to recognize because we haven't started any work on the ground as yet. That is all about to change. The reader can have a look at our website to see the prospectivity that we believe is there and the reason we're focusing on that this year. Dr. Allen Alper:That sounds very good. Is there anything else you would like to add?Mr. Matthew Gill: That covers the short-term, the medium-term and our objectives pretty well.Dr. Allen Alper:That's great. http://www.whiterockminerals.com.auMatthew Gill or Shane Turner Phone: 03 5331 4644 email info@whiterockminerals.com.au

Dr. Allen Alper:That sounds very good. Is there anything else you would like to add?Mr. Matthew Gill: That covers the short-term, the medium-term and our objectives pretty well.Dr. Allen Alper:That's great. http://www.whiterockminerals.com.auMatthew Gill or Shane Turner Phone: 03 5331 4644 email info@whiterockminerals.com.au