Why a Biden Win will Keep Metals Prices Rocking / Commodities / Metals & Mining

Joe Biden’s performancein Thursday night’s presidential debate was solid. The former vice presidentwas combative against Donald Trump and frequently had the billionaire USPresident on the defensive. Post-debate analysis centered around the questionof whether Trump, who is behind in the polls, did enough to convince votersthat taking a chance on Biden would not be in their best interests. Theconsensus was he had not.

At AOTH we want toknow what is coming for the world economy, and just as importantly, what is instore for the metals we are invested in. If Biden wins the election, I amextremely bullish on industrial metals and precious metals, in particular gold,silver, copper, zinc, and nickel sulfides.

Why?

The Democrats winningthe White House and both Houses of Congress would throw markets into a tizzy,causing investors to clamber for safe havens. Gold is the world’s oldest flightto safety and the logical response to market fear.

Installing a Democratin the White House would also be good for gold (and silver) because of Biden’spropensity to add to the debt.

If you think the $27trillion national debt is too high now, it will go even higher under a Bidenadministration. In an earlierarticle we showed the close relationshipbetween debt-to-GDP ratios and gold. The lower the GDP and the higher the debt,the better it is for gold.

As wehave suggested, one way to spring theUnited States from the coronavirus trap is a massive infrastructure spendingprogram, on the scale of President Roosevelt’s “New Deal”.

A globalinfrastructure spending push would mean a lot more energy metals will need tobe mined, including lithium, nickel, cobalt and manganese for EV batteries;copper for electric vehicle wiring and renewable energy projects; silver forsolar panels; and rare earths for permanent magnets that go into EV motors andwind turbines.

According to InsideClimate News, Biden has signaled he will embrace central concepts of the “NewGreen Deal” - a program first espoused by New York Senator, and Democraticwing-nut, imo, AlexandriaOcasio-Cortez - including spending $1.7trillion over 10 years to achieve 100% clean energy and net-zero emissions by2050.

(“AOC” will reportedlyserve on a panel helping Biden to developclimate policy.)

Dubbed “CleanEnergy Revolution”, the plan calls forinstallation of 500,000 electric vehicle charging stations by 2030, and wouldprovide $400 billion for R&D in clean technology.

Copper

Copper’s widespread usein construction wiring & piping, and electrical transmission lines, make ita key metal for civil infrastructure renewal. A report by Roskillforecasts total copper consumption will exceed 43 million tonnes by 2035,driven by population and GDP growth, urbanization and electricity demand.

The global 5G buildoutand the continued movement towards electric vehicles - including cars, trucks,vans, construction equipment and trains - are two big copper demand drivers.

Even though 5G iswireless, its deployment involves a lot more fiber and copper cable to connectequipment.

Electric vehicles andassociated charging infrastructure may contribute between 3.1 and 4 milliontonnes of net growth by 2035, according to Roskill. EVs contain about fourtimes as much copper as regular vehicles. With each charging station usingabout 2 kg of copper, that’s 42 million tonnes, or double the current amount ofcopper mined in one year.

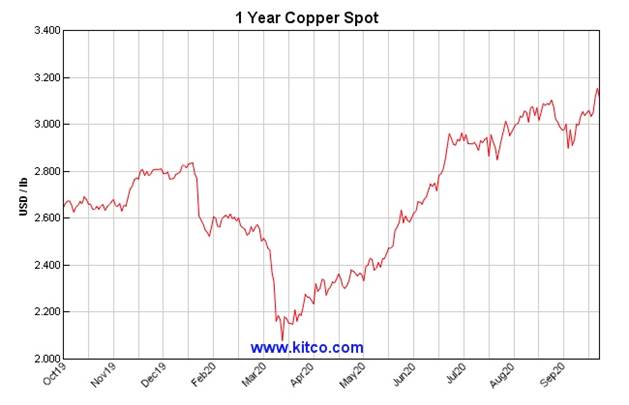

Copper approached a twoand a half year high this week on the strength of continued demand from China,which consumes about half of the industrial metal used in construction,communications, transportation and energy transmission.

The most activelytraded copper futures rose to nearly $3.20 a pound on Wednesday, the highestsince June 2018. From four-year lows in March, when the reality of covid-19shook metals markets, copper prices have gained about 60%, despite slackindustrial demand in Europe, the United States and Canada, and a recent rise incopper warehouse inventories.

Indeed, the mostpessimistic forecasts of copper demand, and pricing, during the worst pandemicin 102 years have failed to come to pass. The easiest explanation is China. Itsmanufacturing sector back on track, the country’s copper imports rose sharplyover the past four months; in September, China imported 62% more copper thanthe same month in 2019.

The Chinese economybecame the first major world economy to return to its pre-virus growthtrajectory, when it posted positive numbers in the second quarter. Recentfigures from China’s National Bureau of Statistics indicate that third-quarterGDP growth is up 4.9% from a year ago. Between April and June, Q2, the bureaureported a 3.2% rise.

According to the WorldBank and the OECD, the Chinese economy in 2020 will grow 2% - the only G20country to show positive economic output this year. Beijing has managed tolargely contain the virus in recent months after the pandemic shut down itseconomy in February and March. Commerce and travel have been allowed to resume,which is driving economic growth and fueling demand for copper and otherindustrial metals, like aluminum and nickel, whose prices are also climbing.

There are other factorsat play, including covid-19 related restrictions imposed on the copper miningindustry in top producers Chile, Peru and Mexico, along with speculativeinterest in the metal due to a weaker dollar.

Copper output from theworld’s top 10 producers declined 3.7% during the second quarter, due tovirus-related lockdowns in Chile, Peru and Mexico.

According toGlobalData, total output during the three-month period decreased from 2.7million tonnes to 2.6Mt. Total annual mined copper production is around 20million tonnes.

Another supply squeezeis likely in Zambia, where copper mines have halted $2 billion worth of plannedexpansions, due to a dispute over a royalty tax introduced last year.

Copper traders are alsogrowing more bullish on the prospect of a Joe Biden victory in the upcoming USpresidential election. Obama’s VP has put forth a $2 trillion climate plan thatincludes upgrading the electrical grid and building more electric vehiclecharging stations.

China

As mentioned, Chinabuys around 50% of the world’s copper. The country also now accounts for morethan half of demand for nickel, steel and aluminum.

But as we pointed outin a previousarticle, there is something off in China’scopper usage figures. The country’s importation of 3.55 million tonnes ofrefined copper during the first nine months of this year – already more thanwas consumed by China in 2019 – implies a 16% increase in copper consumption.

But JP Morgan, whichtracks China’s copper usage, is only expecting a 0.5% increase in real copperconsumption. According to the influential bank, viaReuters, the numbers are “strongly hintingthat some invisible stocks have been accumulated”, maybe as much as 900,000tonnes...

Therehas also been, as [the bank’s executive director Natasha Kaneva] pointed out,“a lot of talk about the State Reserves Bureau” (SRB) buying copper...”

TheSRB remains a known unknown in the copper market.

Butthe key take-away from all the speculation is that everyone agrees there is anongoing mass transfer of excess stock to statistically hidden inventories inmainland China.

In other words, Chinais stockpiling copper. The question is, why? The prevailing narrative is thatChina wants to be the world’s manufacturing hub, and will draw in billions oftonnes of metal – not just copper but iron ore, zinc, aluminum, nickel, etc. -through its Belt and Road Initiative (BRI). China wants to reclaim its positionas the world’s most powerful empire and is doing what it needs to do to bringCentral Asian countries, and those further afield, into its trading orbit.

As mentioned, Chinais also planning large investment in renewable energy, which will demand evenmore copper, silver, and battery metals to store the electricity.

There may, however,be darker underlying motives. China has stirred up the world’s resourcemarkets, by acquiring or partnering with foreign mining companies. For example,grabbing stakes in lithium mines in Australia and Chile, iron ore and coppermines in Africa, nickel projects in Indonesia, and oilsands mines in Canada.

Obviously, we can’tsay for sure, given China’s opaque statistics, but we suggest a good chunk ofthe raw materials are going into bulking up the Chinese Military, in particularits navy patrolling the South China Sea.

China’s problem is itis not a maritime nation, meaning that most of its supplies have to come vialand bridges. For this reason, China needs to have firm control over itsborders, and cannot risk a naval blockade in the South China Sea.

China’s clashes withIndia this year over their disputed border in the Himalayas is an example ofChina’s determination to carve out it’s own sphere of influence much likeGeorge Orwell described in his seminal novel, ‘1984’.

China began buildingup its Military in the mid-1990s, with the goal of keeping its enemies at bayin the waters off the Chinese coast. Claiming territory and building islands inthe South China Sea was a way of creating a wide buffer zone to defend primarilyagainst the United States, which sees itself as the defender of internationallaw. The US has important strategic interests in the region, with majormilitary bases in Japan, the Philippines and South Korea.

The region is also acritical shipping lane - roughly half a billion people live within 100 miles ofthe South China Sea coastline and shipping volumes have skyrocketed - and hostsa wealth of fisheries, oil and gas. According to the World Bank, the SouthChina Sea holds proven oil reserves of at least 7 billion barrels and 900trillion cubic feet of natural gas.

Long seen to beinferior to the powerful US Navy, including the Japan-based 7th Fleet, in justover two decades the People’s Liberation Army has amassed one of the largestnavies in the world. According to an in-depth Reuters feature on the Chinese Military buildup,

Chinanow rules the waves in what it calls the San Hai, or “Three Seas”: the SouthChina Sea, East China Sea and Yellow Sea. In these waters, the United Statesand its allies avoid provoking the Chinese navy.

Thisincreased Chinese firepower at sea - complemented by a missile force that insome areas now outclasses America’s - has changed the game in the Pacific. Theexpanding naval force is central to President Xi Jinping’s bold bid to makeChina the preeminent military power in the region. In raw numbers, the PLA navynow has the world’s biggest fleet.

China has acted toaggressively rein in regions with desires for self-determination, ie. Hong Kongand Taiwan.

Under Obama, the UScould not prevent China from annexing 80% of the South China Sea, defendfreedom of navigation through the $5-trillion annual maritime trade corridor,or stop China-backed North Korea from conducting nuclear tests.

Ongoing maneuvers inthe South China Sea show that Beijingis willing to flex its muscles ina region it sees as strategically and economically important - even if it meansgoing up against the almighty US Navy, mandated to safeguard internationalshipping lanes and to defend its ally, Taiwan, considered by China to be arenegade province that snatched traditional Chinese territory and must beunited with the motherland.

China can’t afford tohave Taiwan sitting there armed to the teeth by the US and eventually the PLAwill take them out; in my opinion (I am not alone)an invasion will happen before July 2021, when the Chinese Communist Partymarks its 100th anniversary.

Congressional leadersare currently deliberating a $3.6 billion bill to counter Chinese aggression inthe Pacific, accordingto Defense News.

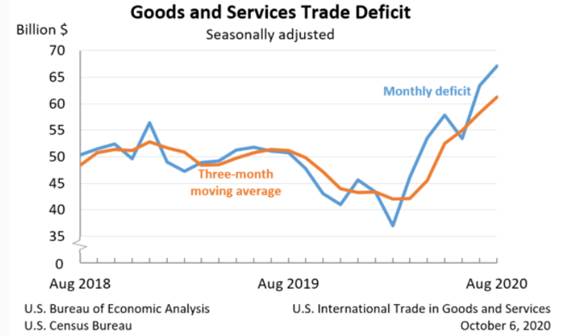

Of course, China andthe US have been butting heads, economically, for the past 2.5 years. TheUS-China trade war has resulted in hundreds of billions worth of tariffslevied, attempts to counter Chinese barriers to entry, and sanctions againstChinese individuals and companies. China has even threatened to restrict itsexports of rare earth elements, in what would be a repeat of Beijing’s tradeaction in 2010 that resulted in rare earth oxide prices going ballistic.

I wouldn’t besurprised to see China eventually cut North America off from all the metals itcurrently has a monopoly over. The Chinese have lockedup the rare earths market and they are theprimary player in a number of critical mineral markets including cobalt,graphite, manganese and vanadium.

Fortunately the USgovernment has finally come around to understanding this could and probablywill happen and is taking steps to prepare.

The Trumpadministration recognized this when the president issuedan executive order in December 2017,instructing his government to devise “a strategy to reduce the Nation’sreliance on critical minerals” that are largely imported. Last week Trumpsigned another executive order declaring US reliance on importing theseminerals from adversaries like China a national emergency.

If China were tosuddenly refuse sale of any of the 20 metals the US deems critical to theeconomy or defense of the nation, such as manganese needed to make steel, orrare earths used by the Military, the US economy and its defense capabilitieswould be in serious trouble.

Notyour father’s recovery

China’s dominance inthe manufacture of personal protective equipment (PPE) and ventilators, hasalso raised alarm bells in Washington, amid widespread shortages of ventilatorsand PPE in US hospitals treating patients stricken with coronavirus.

Insufficientpreparation for the pandemic is one of the main reasons the United States leadsthe world in the number of cases and fatalities from covid-19. The Trumpadministration’s highly criticized response to it may be what prevents themercurial president from winning a second mandate. It is obviously the mainblockage preventing the US economy from growing. Until the pandemic is beaten –and I mean beaten in the way that China has pummeled it – there will be notraditional recovery, like in previous recessions.

A lot has to happen.First the government must do everything it can to get people back to work.While there is optimism regarding unemployment – the number of weekly joblessfell to 767,000, the lowest since March – there are still tens of millions notworking. Economists therefore expect the pace of recovery to be slow.

A recent survey publishedby NPR found that a majority of low-incomeminority households had their savings wiped out, compared to white householdsand others with incomes over $100,000, which managed to escape financialcalamity. The recent expiration of $600 weekly stimulus checks, affecting tensof millions of Americans, has exacerbated the situation.

And it does not seemlike help will be coming until after the election. The $2.2 trillion stimuluspackage agreed to by Trump and Nancy Pelosi was chopped down by SenateRepublicans to a half a billion. That lesser package was recently rejected bySenate Democrats.

Globally there is norecovery either.

Countries thatinitially recovered from the pandemic, by lifting lockdowns, are now facing along period of modest expansion, meaning it will likely take many months, ifnot years, for the global economy to bounce back to pre-pandemic levels.

For example, economistspredict it will take until 2022 for the British economy, which suffered theworst decline among rich countries during the second quarter, to recuperate. Italso won’t be until 2022 that the US economy recovers, economists say.

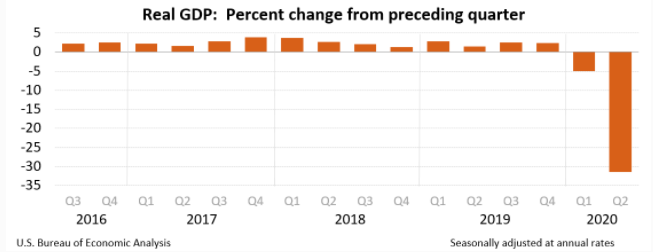

US real GDP

In the eurozone,industrial sentiment has collapsed. The global economy contracted for a secondstraight quarter in Q3. Across the Group of 20 leading economies, the 3.4%decline in output during the first quarter, was the largest since records beganin 1998, while the steep second-quarter drop was without precedent since theend of World War Two.

Another depressing factconcerns the success rate of vaccines. Hundreds of companies are going balls tothe wall trying to develop a covid-19 vaccine, but we know from previouscoronaviruses (like SARS, MERS) that vaccines don’t work very well with thistype of virus.

The challenges mostcountries are facing right now are daunting. Not only do they need to have aplan for recovering from covid-19, the supply chains that have been interruptedor broken by the virus have to be repaired, so that the essentials, ie., food/medicine/ fresh water, can get to those in need.

In a previousarticle wereported on how the coronavirus is exacerbating inequality and global hunger.

The World FoodProgram’s recent ‘Global Report on Food Crises 2020’ highlights 55 countrieswhere 135 million people are facing crisis-level food insecurity, and that wasbefore covid-19. Adding the pandemic to their problems accessing food andproper nutrition, creates an “excruciating trade-off between saving lives orlivelihoods or, in a worst-case scenario, saving people from the coronavirus tohave them die from hunger.”

The report suggeststhat shutting down businesses and locking people in their homes to protect themfrom the virus, is expected to exacerbate poverty and hunger, thereby killingmore people than the virus itself.

But there is more thatneeds to be done. A lot more. On top of the covid crisis there is a climatecrisis, and for lack of a better term, a “technology” crisis. Governments mustmake funding available for 5G networks so that businesses are not left behindas the world moves more into digitization and automation which require robustInternet and cellular infrastructure.

The fossil-fueled basedtransportation system needs to be electrified, and the switch has to be madefrom oil, gas and coal-powered power plants to those which run on solar, windand thorium produced nuclear energy. If we have any hope of cleaning up theplanet, before the point of no return, a massive decarbonization needs to takeplace.

In a recent report,commodities consultant Wood Mackenzie said an investment of over $1 trillionwill be needed in key energy transition metals over the next 15 years just tomeet the growing demands of decarbonization.

“One can argue aboutboth the pace and scale of the energy transition but the criticality of metalsto its realization is without question,” says Julian Kettle, Wood Mackenzie’svice chairman of metals and mining. “Put simply, the energy transition startsand ends with metals. If you want to generate, transmit or store low/no-carbonenergy you need aluminum, cobalt, copper, nickel and lithium.”

Strange how WoodMackenzie forgot about silver, without which there will be no energytransition.

The solar powerindustry currently accounts for 13% of silver’s industrial demand.

More and more silverwill be demanded for its use in solar photovoltaic cells, as countries move furthertowards adopting renewable energy sources. Around 20 grams of silver arerequired to build a solar panel. The Silver Institute predicts 100gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would morethan double the world’s 2017 capacity of 398GW.

For now though, theimmediate need is obviously rescuing economies that have been crushed by thepandemic.

In an earlierarticle wesaid what the global economy really needs, in this low-growth, spending-stalledenvironment , is a push - something big that will attract huge amounts ofinvestment, and workers. Wehave suggested thiscould be a massive infrastructure spending program, on the scale of PresidentRoosevelt’s “New Deal”.

The New Deal provided atemplate for focused government spending programs that target largeinfrastructure projects. Among its programs that helped the United States torecover from the Great Depression were the Tennessee Valley Authority, whichbuilt hydroelectric projects in the hard-hit Tennessee Valley region, and theWorks Progress Administration, a jobs program that employed 8.5 million peoplefrom 1935 to 1943.

In an earlierarticle wesuggested how a “Debt Jubilee” retiring the world’s $246 trillion debt burden,combined with a massive infrastructure building program, could kickstart theglobal economy flat-lined by the coronavirus.

Governments, relievedof their crushing debts, would be free to offer generous social programswithout having to hike taxes. They could also finally dedicate the vast sums oftax dollars required to address global warming, and the trillions of dollars-worthof investment needed to close the global infrastructure gap. That means makingfunds available for worn-out highways, bridges, airports, sewage systems, newmoney for subway systems, buses, new recreation centers, etc.

Released from the thumbscrews of debt, consumers, businesses and governments are free to spend andborrow, at rock-bottom interest rates. It's practically free money, and best ofall, it comes with no strings. Over a short period of time, the world economystarts growing again.

The world faces a globalinfrastructure deficit of $94 trillion.To close the gap, annual infrastructure spending would need to rise by 0.5%,according to a report from the G-20-backed Global Infrastructure Hub.

The Federation ofCanadian Municipalities says Canada needs to spend $2 billion a year, to meetcurrent infrastructure needs.

According to theAmerican Society of Civil Engineers, from 2013 to 2017 (when its lastInfrastructure Report Card came out), there has been no improvement in bridges,roads, drinking water, energy, aviation and dams. Estimates are it will take$4.6 trillion by 2025 to bring US infrastructure up to an acceptable standard.

Bidenand metals

During the presidentialdebate on Thursday, Joe Biden indicated if he becomes president, there will bea major shift away from fossil fuels to clean energy – wind and solar. In aprelude to what a future US-China relationship might look like, the Democraticnominee’s clean energy plan appears to be tracking China’s.

Last month, ChinesePresident Xi Jinping pledged to make his country carbon neutral by 2060,raising expectations that the China’s next Five Year Plan, starting in 2021,will heavily feature renewable energy projects. Bloomberg reports that Chinamay accelerate its goal of making 20% of primary energy use from non-fossilfuels by 2025, instead of 2030, meaning a major increase in wind and solarinstallations.

Key to Biden’s $1.3trillion infrastructure improvement plan, is a $50 billion investment inrepairs to roads and bridges; $10 billion for transit construction in poorareas of the country; a doubling of BUILD and INFRA grants, and more fundingfor the US Army Corps of Engineers.

The plan also includesinvestments in high-speed rail, public transit, bicycling, school construction,expansion of rural broadband, and replacement of pipes and other waterinfrastructure.

There are two thingsthat are practically certain if Biden wins the White House and the Democratstake back the House and clinch a majority in the Senate. The first is anavalanche of new spending without limits, as put forward by proponents of ModernMonetary Theory. The second is a huge investment inclean energy projects, similar to Obama’s 2009 plan to electrifythe transportation system, of which Biden was asignificant architect as vice president. As reported by CNBC,

Biden aims to push as much as $1.7 trillion over 10years into a plan to boost renewable powerand speed introduction of electric vehicles,through tax credits, boosted research and development into technologiesincluding large-scale battery power storage and carbon capture andminimization, and modernizing infrastructure, including the nation’selectricity grid and a nationwide network of public charging stations for EVs.

The Biden campaign has reportedlytold US miners it supports boosting production of metals used to make EVS, solar panels and other materials crucial to his climate plan.He also supports bipartisan efforts to build a domestic supply chain forlithium, copper, rare earths and other strategic materials the US currentlyimports from China and other countries.

MMT

Biden, despite claimsto be otherwise, is a socialist. He believes strongly in the power of the stateto tax and spend, and will face overwhelming pressure from the left wing of theDemocratic Party – supporters of hard-left progressives like Elizabeth Warrenand Bernie Sanders – to toe the party line. A long wish list waits to befilled, with little to no consequence to the already out of control $27 billionnational debt, courtesy of Modern Monetary Theory, or MMT.

Modern MonetaryTheory is a new way of approaching the US federal budget that is bothunconventional and absurd. It posits that rather than obsessing about how largethe debt has grown and the ongoing annual deficits that fuel debt, we shouldfocus on spending, specifically, how the government can target certain spendingprograms that will cause minimal inflation. Fiscal policy on steroids is,according to its proponents, to be the new engine of US growth and prosperity.

Government istherefore given a free pass on spending, because the only thing that we have toworry about with the national debt is inflation. Curb inflation and the debtcan keep growing, with no consequences. This is because the US government cannever run out of money. It just keeps printing money, because dollars are alwaysin demand (with the dollar being the reserve currency, and commodities aretraded in dollars).

One of MMT’s mainproponents is Stephanie Kelton, an economics professor who advised BernieSanders’ 2016 presidential campaign. Among the statements she makes in a videoexplaining MMT, Kelton says “The US dollaris a simple public monopoly. In other words, the United States currency comesfrom the United States government.” That means the federal government doesn’tneed to “come up with the money” in order to be able to spend. It just printsmoney and spends it.

Modern MonetaryTheory and the ideas of the Democratic Party’s far left fit like hand and glove.Pleas for universal medical coverage, free college tuition and a minimum $15per hour wage can all be paid for by setting the money presses free.

Among MMT’s criticsis Stephen King (not that Stephen King) who disparages the theory in arecent FinancialTimes column:

Still,imagine for a moment that governments embrace MMT. Imagine too, as MMTproponents suggest, that control of the printing press is taken away fromunelected central bankers and given to “accountable” elected fiscalrepresentatives. Would we be any better off? Far from it. Giving electedrepresentatives the keys to the printing press is the equivalent of giving agambling addict the keys to the casino. For many politicians, the primaryobjective is to remain in power. As such, they will too often be incentivisedto pursue instant gratification at the expense of longer-term stability.

Moreimportantly, inflation and taxes are, in many ways, simply two sides of thesame coin. Those governments without access to tax revenues can instead “debasethe coinage”. Supporters of MMT claim this will never happen, yet historysuggests otherwise: after all, it has been a tried and tested policy of kingsand queens over hundreds of years. Too often, those with access to the printingpress are prepared to take undue risks in the hope that “this time it’sdifferent”.

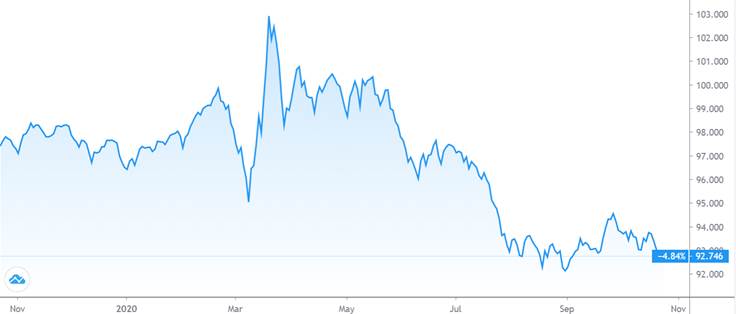

Sinkingdollar

It doesn’t take a greatdeal of economics knowledge to see that MMT would decimate the value of the USdollar, which has lost a significant amount of value since hitting multi-yearhighs in March.

The dollar andcommodities move in opposite directions, because when the dollar falls, thoseusing other currencies get a better exchange when they swap their money for USdollars, thereby boosting demand for said commodities.

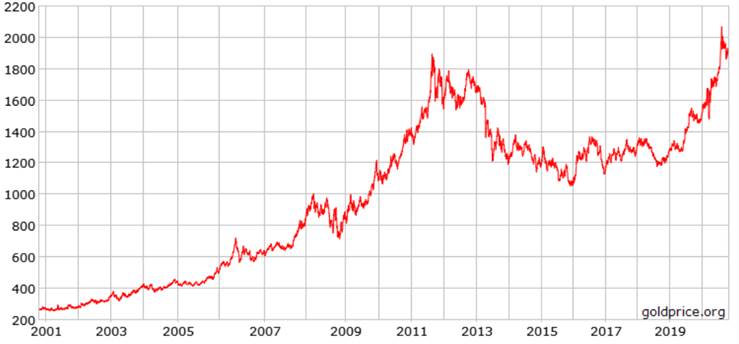

For example, when thedollar slumped between 1998 and 2008, gold prices nearly tripled, reaching$1,000 an ounce in early 2008. A falling dollar due to MMT will be goodfor gold, and all metal prices.

US$

GoldUS $ ounce

Gold prices will alsobe strengthened by a slew of other factors, including covid-19, inflationexpectations on the back of (seemingly) unlimited monetary stimulus, lowinterest rates worldwide, and geopolitical concerns especially US-Chinatensions overtrade and the South China Sea.

Even if Biden’s doesn’tfully embrace MMT we expect stimulus spending on steroids especially if he getsa Democratic mandate from both the Senate and the House. The flood gates ofcoronavirus relief will be opened, with billions spent on mandatory masks,stricter social distancing protocols, increased and sustained relief forindividuals, businesses, food banks, day cares etc. As long as interest ratesremain low, and they are expected to until at least 2023, expect many trillionsof dollars to fly out of the Treasury, with little to no consideration of theconsequences.

Structuralmetals deficits

At this point I hopeyou are beginning to see the formulation of a bull case for precious, cleanenergy and industrial metals. On top of surging demand for copper, silver, zincand nickel, from heavily green infrastructure programs designed to lift saggingeconomies out of the pandemic, we have current and emerging structural deficitsfor a number of metals, that will keep prices buoyant for the foreseeablefuture.

The only reason wehaven’t seen metal prices spike higher, is that demand for them has come off abit due to the pandemic. When demand is restored, the supply-demand imbalancewill be striking.

According to theInternational Copper Study Group (ICSG), the refined copper market is likely toregister a deficit this year of 52,000 tonnes – against a 280,000t surplus thegroup forecast this time last year. The reason as mentioned at the top is anunexpected push for copper imports from China, which has pretty much recoveredfrom the pandemic; and the fact that global copper production has been upendedby the coronavirus. The ICSG predicts global copper mine production will fall1.5% this year, the second consecutive year of lower output.

Longer-term, coppersupply is almost certain to be squeezed.

As wehave reported, without new capitalinvestments, Commodities Research Unit (CRU) predicts mine production will dropfrom the current 20 million tonnes to below 12Mt by 2034, leading to a supplyshortfall of more than 15Mt. Over 200 copper mines are expected to run out ofore before 2035, with not enough new mines in the pipeline to take their place.

Despite new zinc minesopening in Australia and Cuba, zinc supply has failed to keep up withconsumption. Some very large zinc mines have been depleted and shut down inrecent years, with not enough new mine supply to compensate. Like copper, zinchas benefited from strong Chinese metals demand. While prices fell 17.3% duringthe first quarter owing to pandemic-related uncertainty, prices have sincerecovered, with three-month zinc averaging $2,121 per tonne over the firsteight months of the year.

Teslahas expressed concern overwhether there will be enough high-purity “Class 1” nickel needed forelectric-vehicle batteries.

According to BloombergNEF,demand for Class 1 nickel is expected to out-run supply within five years,fueled by rising consumption by lithium-ion electric vehicle battery suppliers.Nickel’s inroads are due mainly to an industry shift towards “NMC 811”batteries which require eight times the other metals in the battery.(first-version NMC 111 batteries have one part each nickel, cobalt andmanganese).

But a lot of nickelwill still need to be mined for stainless steel and other uses. The nickelindustry’s dilemma is therefore how to keep the traditional market intact, byproducing enough nickel pig iron (NPI) and ferronickel from laterites tosatisfy existing stainless steel customers, in particular China, while at thesame time mining enough nickel sulfides to surf the coming wave of EV batterydemand?

Among a wave ofcovid-19 shutdowns this summer, some of the biggest producing silver mines inthe world were shut down, although some production has come back online. TheSilver Institute is predicting a 13%decline in silver production from Latin America this year -equivalent to 67 million fewer ounces - with global supply set to fall 7.2%.

Given supply and demandfactors (including robust industrial and investment demand for the preciousmetal), Capital Economics estimates the silver market will remain in a smalldeficit, right through to 2022.

Commoditiesbull

We aren’t the only oneswith a sanguine view of commodities going forward.

Goldman Sachs contends, viaZero Hedge, that A weaker U.S.dollar, rising inflation risks and demand driven by additional fiscal andmonetary stimulus from major central banks will spur a bull market forcommodities in 2021, Goldman's chief commodity strategist Jeffrey Currie saidon Thursday, also predicting that "all commodity markets are in, or movingtoward, a deficit with inventories drawing in all but cocoa, coffee and ironore."

The bank, whichnotes that markets are increasingly concerned about the return of inflation,forecast a return of 28% over a 12-month period on the S&P/Goldman SachsCommodity Index (GSCI), with a 17.9% return for precious metals, 42.6% for energy,5.5% for industrial metals and a negative return of 0.8% for agriculture.

Focusing on Gold,Currie said that expansionary fiscal and monetary policies in developed marketeconomies continue to drive interest rates lower and create demand for hedgingthe tail risks of inflation, lifting demand for precious metals. As a result,Goldman forecasts gold prices at an average of $1,836 per ounce in 2020 and$2,300 per ounce in 2021, and expects silver prices to be at around $22 perounce in 2020 and $30 per ounce next year.

Conclusion

History does notrepeat itself, but it does rhyme. If Joe Biden is elected president inNovember, it’s going to be like Christmas morning for industrial, clean energyand precious metal focused junior resource companies.

Of course, we don’tknow for sure what a Biden presidency will look like for mining, but we can usehistory as a guide. While vice president under Obama, Biden presided over a massivetransportation electrification plan. Ahead of the Herd was there, in 2009, andwe nailed it when we called lithium a huge investment opportunity.

Biden is a tax andspend Democrat, a socialist who believes in MMT and is going to flip the switchon massive coronavirus stimulus money, along with hundreds of billions,trillions, more for clean energy/ renewables and electrification of the UStransportation system which is still heavily skewed toward regular vehicles.

The added stimuluswill be great for gold and silver (though horrendous for the debt) and theclean energy/ infrastructure investments will be bullish for industrial metalssilver, copper, zinc and nickel sulfides – the latter better suited for thefastest growing segment of the nickel market - EV batteries.

The Biden campaignhas already said it supports mining for minerals that support his climate plan,and efforts to build a domestic supply chainfor lithium, copper, rare earths and other strategic materials the US currentlyimports from China and other countries. That’s great news for US mining.

The only problem? Weare facing structural deficits for several of these metals. Without a major push,and fat exploration budgets, to develop new deposits, all the majors will bescrambling for every kind of deposit, to replace reserves.

Copper miners willbecome gold miners, gold mining companies will covet copper-gold deposits, zincminers will become silver miners, and vice versa.

We live in a finiteresource world. Structural supply deficits in many of our soon to be muchneeded ‘recovery’ metals were already in evidence before covid-19. Globaldemand for these metals is going to accelerate.

Junior resourcecompanies, not majors, own the worlds future mines and juniors are the onesmost adept at finding these future mines. They already own, and find more of,what the world’s larger mining companies need to replace reserves and growtheir asset base. The mad dash for resources is coming.

In our opinion therehas perhaps never been a better time to be a junior owning a gold, silver,copper, zinc or nickel sulfide deposit, with decent grades in a safejurisdiction.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.