Why Caution Is Required As Never Before And The Case For Investing In Gold

Elevated stock market valuations, reduced liquidity support by central banks and increased risk of recession are not a good mix for equity investors.

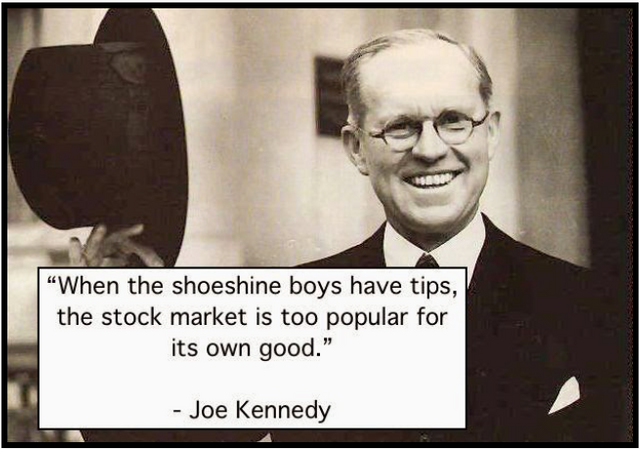

Retail investors are entering the market at an increasing rate, while some of the best fund managers are doing exactly the opposite.

Pension funds might pose one of the biggest systemic risks to the financial system.

Counter-intuitive to the riskier environment we are all faced with, gold has fallen out of favor with investors.

Source: steemit.com

The expensive and risky stock market

Stock Market Valuations

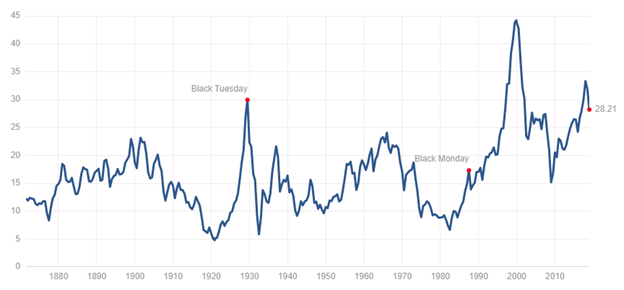

This should come as no surprise to anyone. The stock market valuations have become extremely high as a result of the ongoing excessive market liquidity and financial repression.

Despite the healthy correction over the last months of 2018, Shiller P/E ratio is still at one of its highest levels in history.

Source: multpl.com

Of course valuations should be reviewed within the context of interest rates as they act as gravity within the financial markets - inflating valuations when they are low and vice versa.

Over the long-term the 10-year U.S. bond yields and the Shiller P/E ratio have been in an inverse relationship as liquidity provided by low interest rates is flowing into the equity market and vice versa. As it can be seen below, from 1960s to 1980s bond yields in the U.S. have been steadily going up, while Shiller P/E ratio collapsed to one of its lowest points ever.

If we ignore the two bumps in the Shiller P/E ratio caused by the dot com bubble of 2000 and the financial crisis in 2008, we could easily observe the opposite trend to the one from 1960s-1980s period.

Source: macrotrends.net

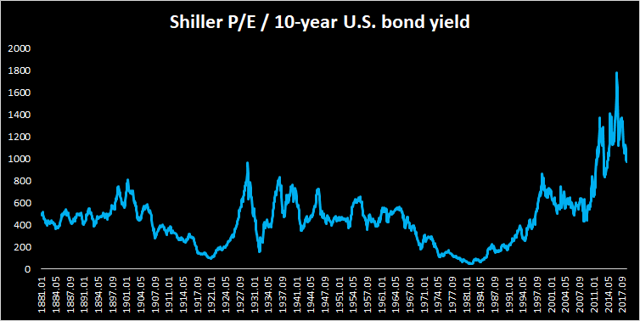

As a matter of fact, Shiller P/E to 10-year bond yield ratio is at its highest levels historically, meaning that even after controlling for the low interest rates stock market valuations are still at historical highs.

Source: Author's calculations based on data from Yale University Department of Economics

Liquidity being drawn out

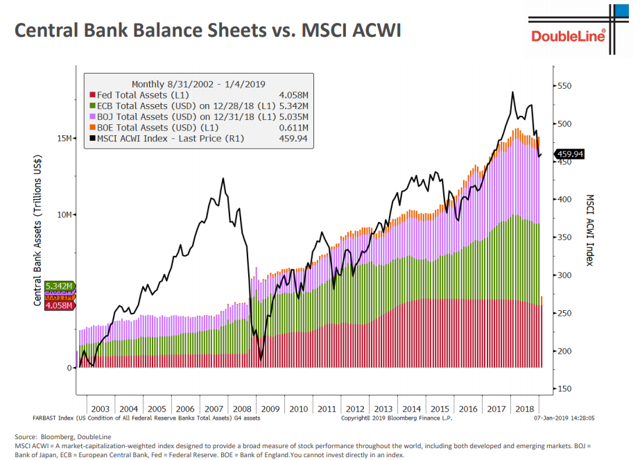

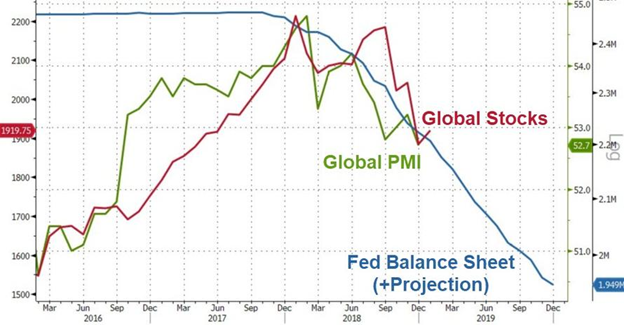

Liquidity provided by Central Banks around the world played a key role in inflating equity prices around the world.

Source: Doubleline.com

And here's just another look at the same story.

Source: zerohedge.com

As one of the most renowned investors, Stanley Druckenmiller recently said:

Everything for me has never been about earnings, never been about politics, it's always about liquidity.

So as central banks move to normalize interest rates and draw liquidity out, stock market valuations would likely experience more downward pressure.

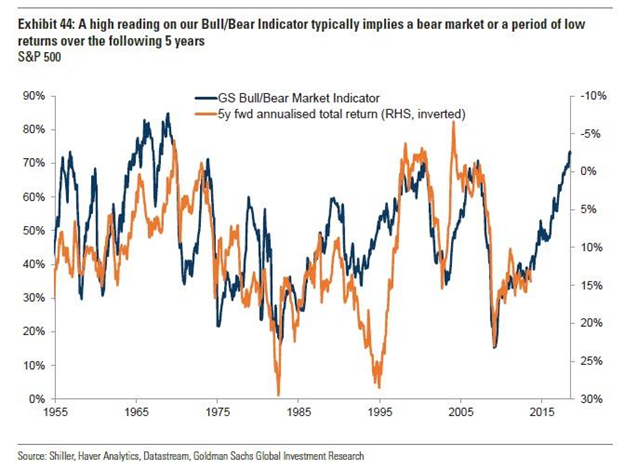

Even Goldman Sachs Bull/Bear indicator has been flashing red flags recently.

Source: zerohedge.com

Looming risk of recession

Although it's very hard and perhaps even pointless to try to predict recessions, the probability of seeing one has increased considerably.

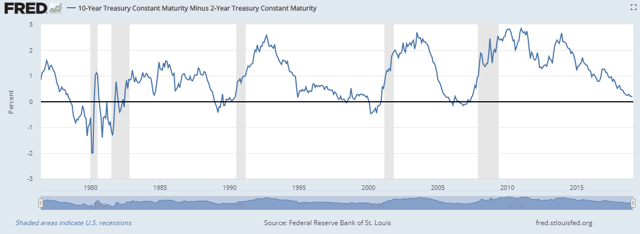

1) Yield Curve which has been a good indicator of future recessions is approaching negative territory

Source: Federal Reserve Economic Data

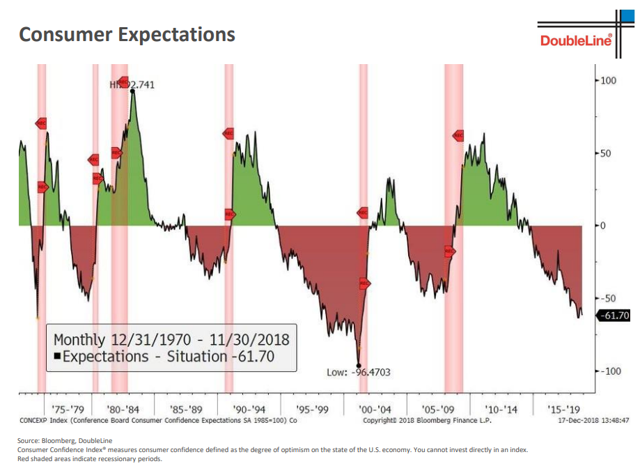

2) Consumer Expectations are also signaling a possible recession.

Source: Doubleline.com

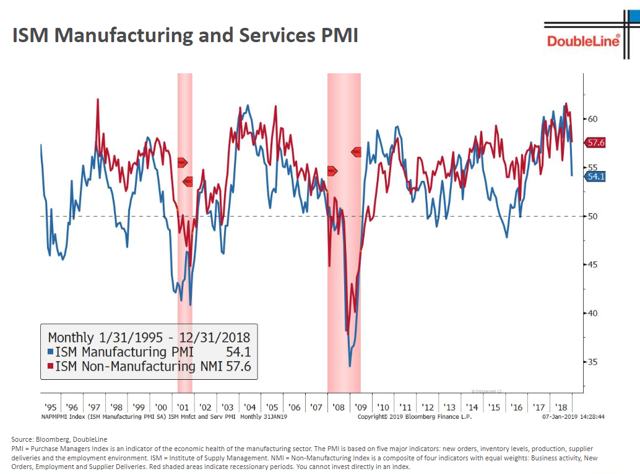

3) ISM Index declined significantly over the past months.

Source: Doubleline.com

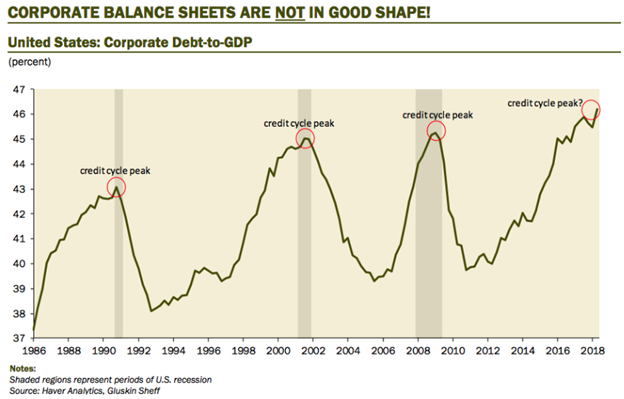

4) The level of corporate indebtedness is also flashing red lights.

Source: Haver Analytics

So in a nutshell, the probability that we are currently in the end of the 10-year long bull market has increased significantly as:

stock market valuations are extremely high even after controlling for the level of interest rates; liquidity is being drawn out of the market; probability of a near-term recession has increased significantly.Retail Investors vs. Seasoned Veterans

After having some time to soberly absorb all that information above, one would expect that investors' exposure to stocks should be lower as the risks of the financial system have increased.

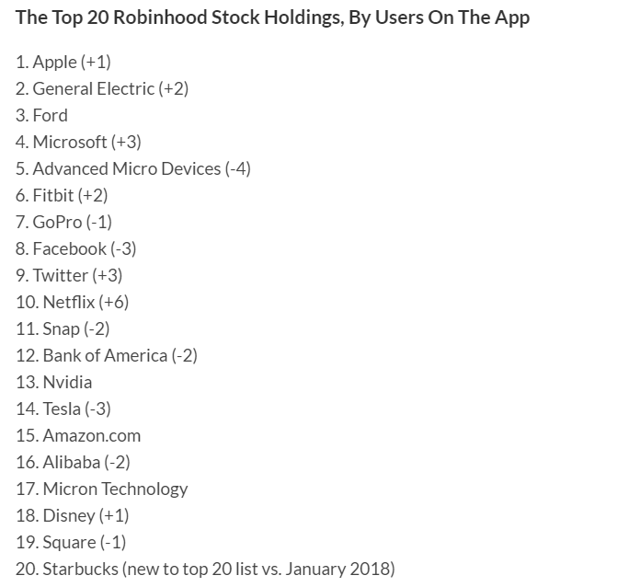

Well just as it happens the proliferation of ETFs and investment platforms such as Robinhood has made it significantly easier for retail investors to pull the trigger and put most of their savings into the stock market.

Exciting and fast growing FAANG and semiconductors stocks have been an absolute hit among Millennials while classic value investing has taken the back seat over the past few years.

Source: investors.com

Not only that, but stock-market oriented youtube channels seem to have exploded in numbers recently. Just by typing "buying stocks February 2019", one can be amazed how many people are recommending the stocks they are buying by solely talking about the growth opportunities and forward P/E ratios. Not only that, but some of these channels have accumulated hundreds of thousands of followers over the course of 2 years.

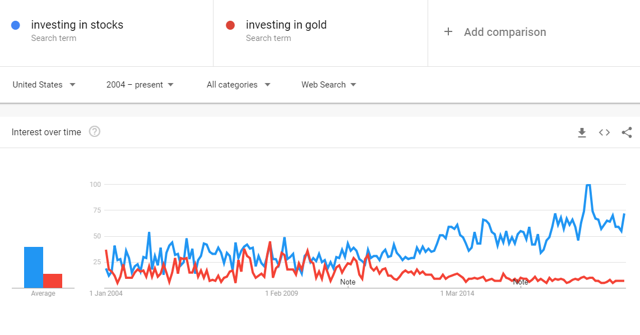

Google searches for "investing in stocks" has reached one of its highest levels recently, contrary to the "investing in gold" which is actually at the lowest levels since 2004.

Source: Google Trends

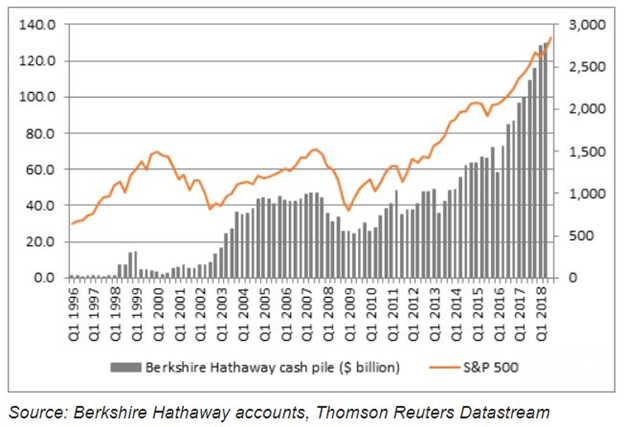

At the same time some of most renowned fund managers have been reducing their exposure to equities.

Warren Buffet's Berkshire Hathaway for example now holds a record amount of cash.

Source: marketwatch.com

Jeremy Grantham's Grantham, Mayo, VAN Otterloo & Company has also been trimming down its exposure to equities. Even macro oriented fund managers such as Jim Rogers and Stanley Druckenmiller have been sounding the alarm of late.

Even though it's absolutely great that more and more retail investors are finding way to invest in the market and learn how to manage their own savings, it is alarming that we see this divergence between one of the best fund managers out there and the average retail investor.

Pension Funds - the ticking time bomb

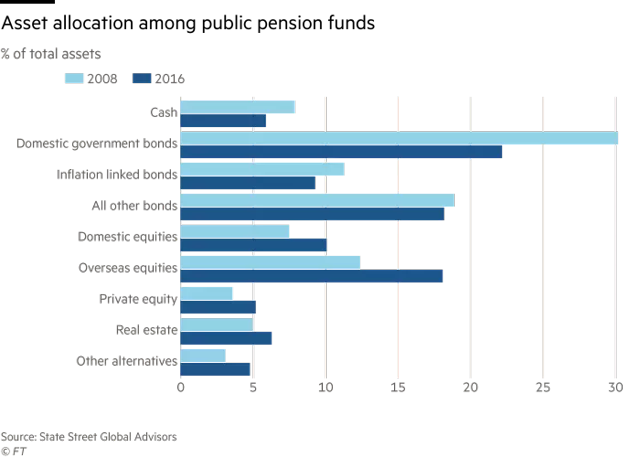

Alongside retail investors, Pension Funds have also loaded up heavily into the equity market.

In search for higher yields, Pension Funds have been forced to increase their exposure to equities in recent years.

Source: Financial Times

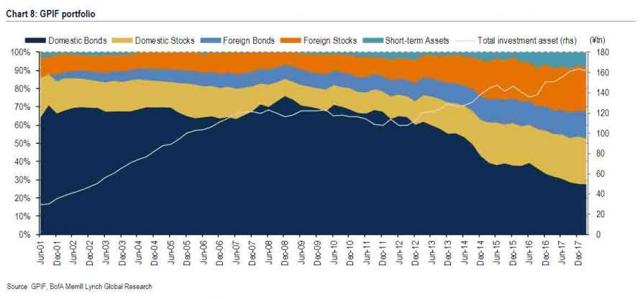

The world's largest pension fund - Japan's Government Pension Investment Fund has actually increased its target allocation to domestic and international equities to a combined share of 50%.

Within the historical context this shift seems quite radical and a potential source of systemic risk.

Source: zerohedge.com

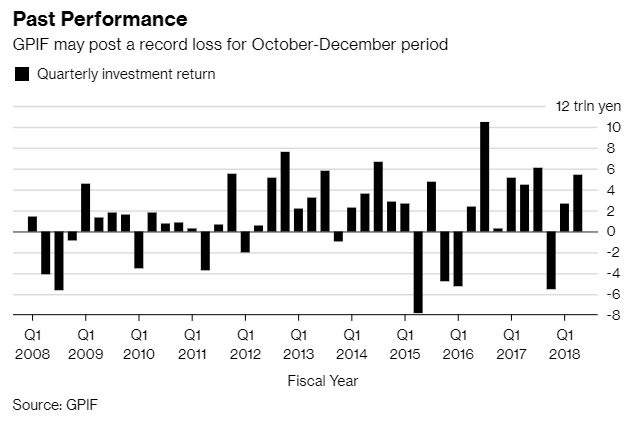

Not surprisingly perhaps, the relatively minor correction we experienced this December was actually a significant hit for the world's largest pension fund.

With a relatively good historical performance as seen below, the fund is estimated to have lost around 14 trillion yen over the last quarter of 2018.

Now I wonder what would happen to GPIF and the rest of the already yield starved pension funds should we see a more significant pullback in equity markets.

As of late Raoul Pal and Stanley Druckenmiller have also been sounding the alarm of a potential upcoming retirement crisis.

Why investing in gold makes sense

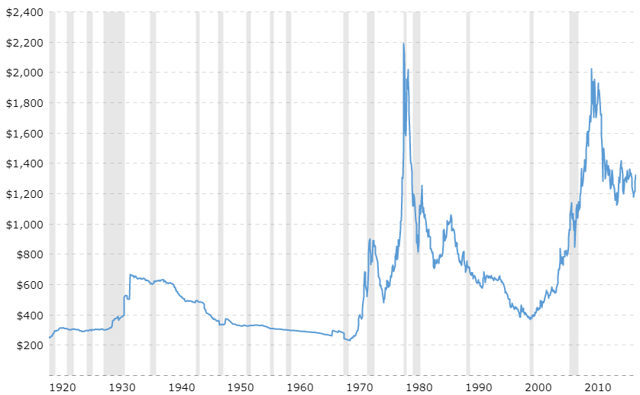

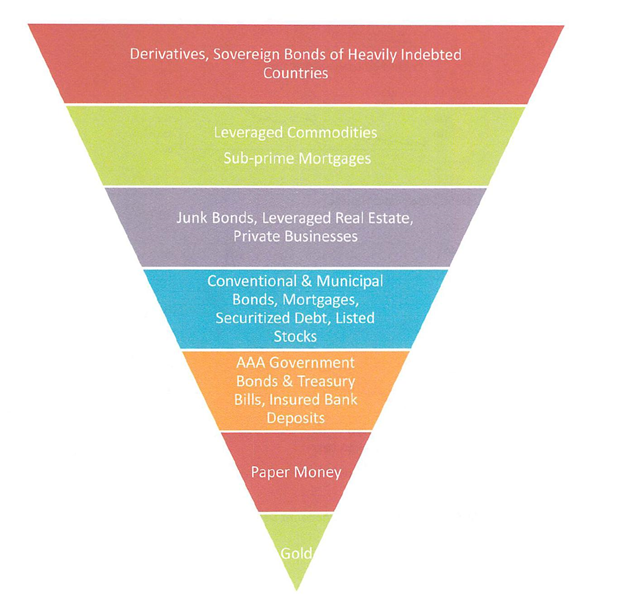

Gold is considered as one of the best means to store value over the long-term. The precious metal also has good diversification properties at a time when the long-lasting bull markets in equities and fixed income seem to be coming to an end.

While financial repression by central banks has created inflation in most financial instruments, gold has fallen out of favor. This, however, could change quickly as central banks start to unwind their balance sheets.

Soruce: Kitco News

Despite the risky stock market valuations, decreasing liquidity, higher probability of a recession in the U.S. and the systemic risk posed by the pension funds, there are two other reasons why I see gold as an attractive investment right now.

Interest rates not really a threat to gold prices

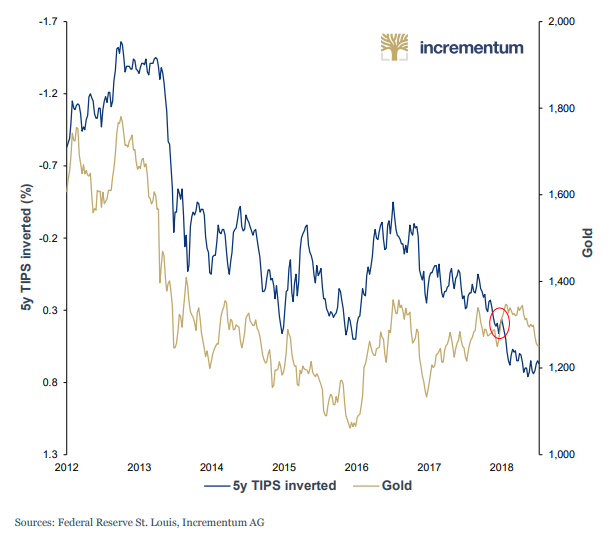

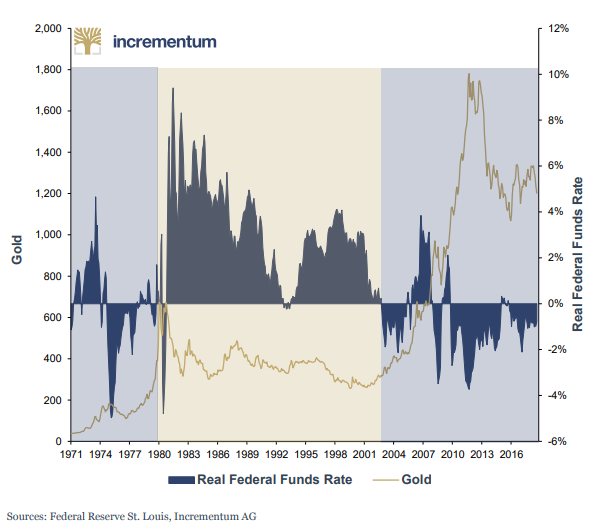

There has been plenty of evidence and research to suggest that the main driver behind the price of gold is real interest rates. The logic behind this statement is very simple and fits easily into everyone's minds: gold is a non-interest bearing instrument so as real interest rates go up, interest bearing instruments become more attractive to investors and they tend to dump gold for other securities.

Although I agree that inverse relationship exists during certain periods, I tend disagree with the statement that this is always the case. The main problem I have with the statement above is that there are two main characteristics of a financial instrument - return and risk.

Therefore, the same way as we can make a statement that demand for gold would decrease as interest rates go up, we can make a case that demand for gold should go up as overall market risk increases.

It is perhaps not that surprising that due to risk being taken out of the market by central banks over the past 10-years we have observed a very strong inverse relationship between gold and real interest rates. This correlation, however, seems to have broken down exactly at a time when the Fed started reducing its balance sheet and thus introduced the "risk" component back to the markets.

Source: In Gold We Trust

If we extend the observed period all the way to the beginning of 1970s when Breton Woods system ended, it is much harder to make the case that the inverse relationship between gold and real interest rates is permanent.

Source: In Gold We Trust

Finally, even if one believes that the inverse relationship would continue for the foreseeable future, there is a huge problem with global indebtedness both in the public and private sectors which leads many to believe that a significant increase in interest rates is impossible without bringing significant systemic risks with it.

Discrepancy between the price of gold and the stock market

Finally, as a result of the long bull market in equities, gold seems to have fallen out of favor.

The S&P 500 to Gold ratio currently stands at x2.04. There have been two more periods when it was that high and both of them were followed by periods of significant increase in gold prices.

Source: macrotrends.net

Source: macrotrends.net

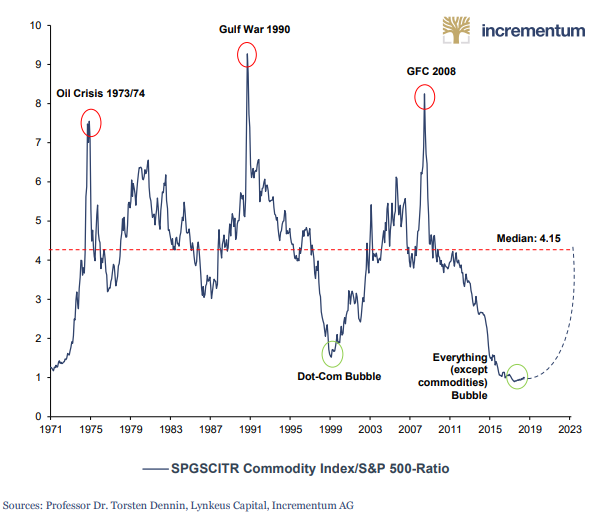

Relative valuation of commodities to S&P 500 is also at its lowest levels since 1971, which also underlines the discrepancy between valuations of financial and real assets.

Source: In Gold We Trust

Conclusion

All time high valuations coupled with the reversal of central banks' policy to provide liquidity at any cost has increased the risk of major pullback in the stock market. The risk of a recession in the U.S. has also increased over the past few months, while retail investors are flocking to the stock market. On top of that yield-starved Pension Funds around the world have significantly increased their equity holdings thus posing additional risk to the financial system.

As gloomy as all that sounds, trying to perfectly time the market remains cause perduta. Nevertheless, as probabilities of a significant market pullback increase, lowering overall exposure to equities and increasing that of low risk assets such as cash and gold seems like a prudent decision for long-term investors. The case for holding gold as part of a long-term diversified portfolio has also become more favorable as the precious metal has fallen out of favor with investors and the gap between the price of gold and the stock market has widened to one of the highest levels in history.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Follow Vladimir Dimitrov, CFA and get email alerts