Why Gold is Upand Why$1550 is Still The Target.

Why is Gold Up is the wrong question. We should be asking: Why isn't Gold higher? The answer to that question will likely come when the Fed decides to hike or not hike next week. And how Gold reacts. If you believe like us that what the Fed does is mattering less and less, than a hike will be a dip to buy.

Gold is becoming focused more and more on the longer term problems enveloping us domestically and globally. The Fed is dying as the preeminent influence on Gold pricing. What is more, they must lag behind real rates in whatever monetary policy they implement going forward or risk deflationary collapse as is now happening in our states. Debase globally or die domestically would be Emperor Diocletion's advice we'd bet!

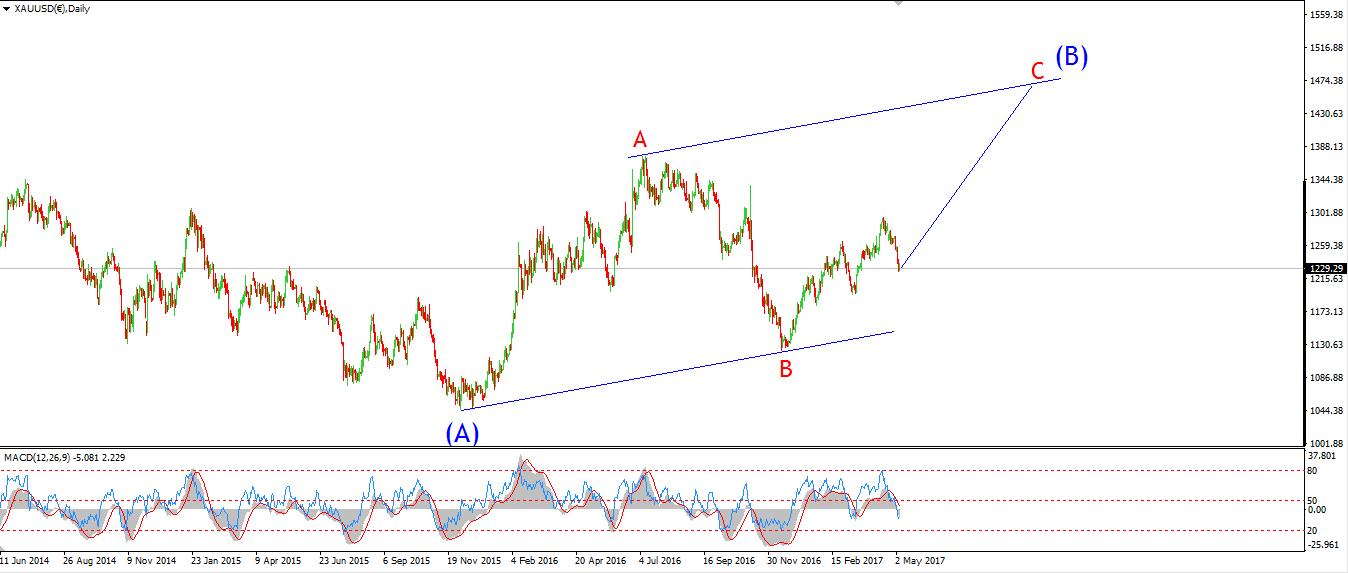

This is our opinion. It is based on observation, facts, and empirical evidence. So take it for what it is worth. We think Gold is looking at $1550 up top. We are not married to that. We handicap odds and likelihoods. We see Gold as increasingly immune from the Fed's charms. It is cutting the chord from domestic monetary manipulations. The middle east, China, and Russia are helping that happen.

YOU should be holding physical metal in a 5 to 10% range of your assets. YOU should pray it goes down. This should be irrelevant of your real estate holdings. Real estate will not protect you in inflation this time. And it will be a disaster in a deflationary collapse.

It seems to us that Gold is now predicting and discounting future concerns on longer time horizon. Things like jobs numbers and rate hikes are becoming catalysts for short term moves. But the secular Gold drift is higher as more uncertainty is born daily. It is starting to seem like globalism is unraveling all over in seemingly separate events that are ultimately linked to an unsustainable ideology that is now poorly adapting to current events.

Deflation begets printing. Deflation makes Gold a tall pygmy. Inflation makes Gold a giant. Either way, while it may underperform stocks kept alive on life support, Gold will hold its value and increase due to reality meeting fantasy. Venezuela has the best performing stock market this year and a share of stock still wont get you a loaf of bread. But Gold will.

Ourstock market iseither discounting inflation adn will ultimately underperform it when inflation comes. Or it isdestined t ocrash in adeflationary death from zombie banks becoming zombie states and ultimately a zombie Federal Gov't.

Diocletion got it right. Time to debase faster. We must outrun economic slowdowns by keeping real rates underwater.

From the Road. Apologize for formatting. We are travelling to several states looking for economic clues. Some are included in this story. We think the insights gleaned are fascinating as they relate to IL and CT.

First: Gold Now

Full Charts HERE

Next: Technicals- $1550 is the Target

From the recent post by Enda Glynn: What Goes Up...

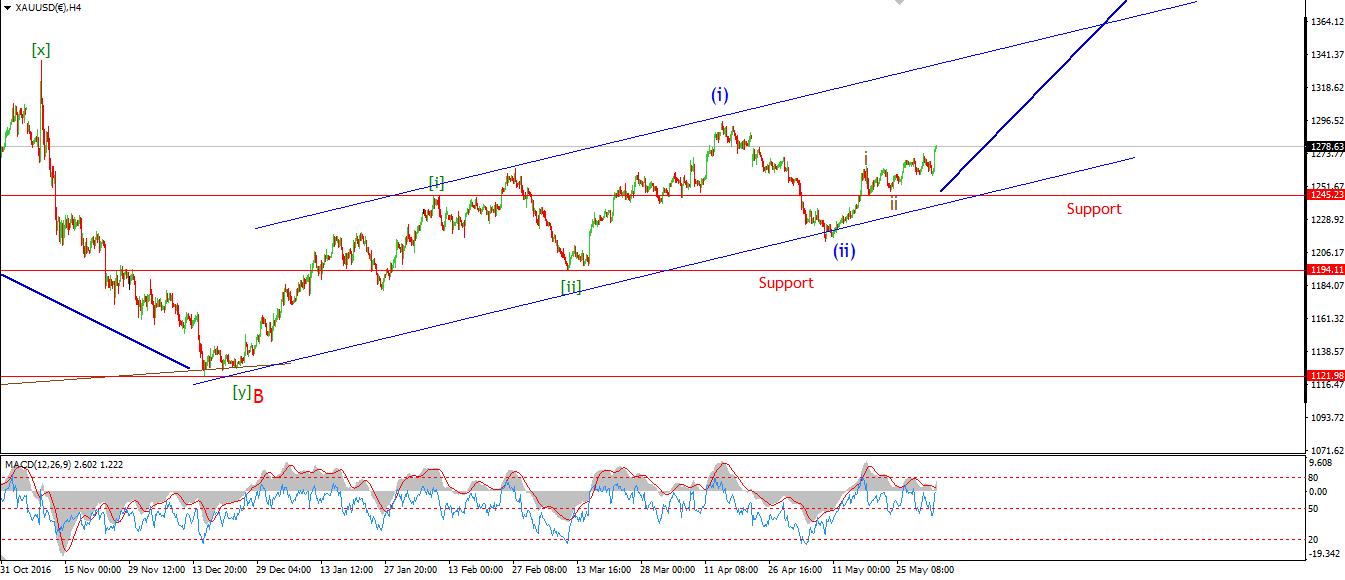

The current wave count calls for a large move higher in wave (iii) blue, One which should easily break into the $1400 area without much hassle. With that in mind, watch for the price to find support at the lower line of the trend channel. The price should experience only shallow corrections from now on.

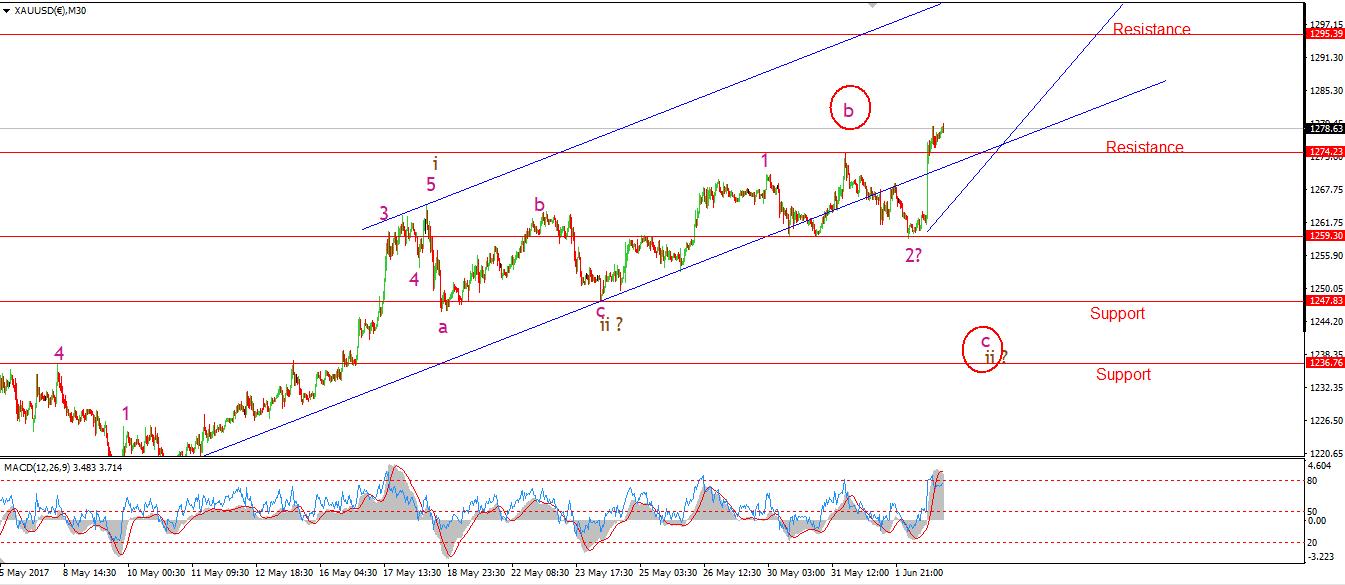

30 min

4 Hours

Daily

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: ISM Non-Manufacturing PMI, Factory Orders m/m.

GOLD reached a low of 1258.98 today, a slight break of support at 1259.30. So wave '2' pink was confirmed as a complex expanded flat correction. Where the internal structure traces out a 3,3,3 wave pattern.

Since todays low the price rocketed higher, up $20 dollars to the high. This is likely the start of wave '3' pink that I have been anticipating. The next significant resistance lies at 1295.39, the high of the previous wave (1) blue.

The current wave count calls for a large move higher in wave (iii) blue, One which should easily break into the $1400 area without much hassle. With that in mind, watch for the price to find support at the lower line of the trend channel. The price should experience only shallow corrections from now on.

Read More By Enda at Bullwaves.org

Contributors to The Rally in Brief

Domestic Economics

Contributions from Zerhedge's article titled "Schizophrenic" JOLTS Report Reveals Record Job Openings As Hiring Crashes

The jobs revision of May downward was a massive surprise to many. This can be viewed as the catalyst of the most recent rally. New Jobs were revised downward to only 138k jobs in May. From what we see is now only a total of 120k jobs added in the last 3 months. This is in a rate hike environment?

The JOLTS report can be described as Bipolar in the least and schizophrenic at worst. To us it is a telegraph that someone is either wrong or fudging numbers. More revisions will be coming. What do we mean specifically?

One one hand we see new job openings up by a huge number of 300k to all time highs of 6MM. Yet on the other hand we see new hires plunge to 250k putting us in the same level we were 3 years ago. There is no organic growth.

Jobs are nowhere for years

Taken together we must acknowledge this contradiction: Either the new jobs available number is too high, or the new hires is too low. We think the worst here.

Either jobs available number is too high and will be lowered, the new jobs available will never be filled and pulled off the market in time, or if to believe the beige book that the number of qualified applicants is too low for the jobs available. We are going with the first and second explanations for now. That is the new jobs available is too high and there is no intention to fill many of those jobs. Why so cynical? Here is why.

The "Quits" rate is down significantly. That is our tie breaker. As a reminder, Americans only quit their jobs when they are confident they can find a better paying job elsewhere, and in January we saw the number of quits rising to the highest level in 16 years. Here, after a modest rebound in March, when an additional 102K Americans quit their jobs, following a 150K drop in February, the number once again dropped substantially and in April declined to 3.027 million, down 111K to the lowest since last August.

UBS notes:

Gold is extending its recovery, creeping closer towards our target of $1300, supportedby recent developments across the macro space. The pullback in US real rates and the dollar have clearly been keypositive influences for gold prices of late. Gold's strength is in the face of equitieshovering at all-time highs. The disappointment around the US employment report forMay triggered the move towards the latest highs in gold - although our US economistsdo not think this derails the Fed from hiking rates next week, it does introduce a bitmore uncertainty around Fed expectations later this year.

To our point: if the market is still largely discounting a fed hike next week, why is Gold rallying? We would opine:

BECAUSE GOLD EITHER DOESN'T CARE DOMESTICALLY AND IS PREOCCUPIED WITH BIGGER GLOBAL FISHGOLD IS NOW DISCOUNTING THE FACT THAT ANY HIKE NEXT WEEK WILL BE UNDONE SOON THEREAFTERTHERE WILL BE NO HIKEIt Gets Worse - States are Bankrupt and in Denial

CT, IL are basically bankrupt. Our sources and our ground observations convey to us that cutbacks at state legal, public services, and pensions, are all being implemented behind the scenes. To quote one IL source:

Based on the failed budget, I would be surprised if i can get any of my cases before the state court in 4 months. I've seen this before in the 70's and it is not pretty.

We looked and are already seeing cases kicked down the line due to lack of judge availability. This is what happens.

From another city source in Stamford:

Expect services like street cleaning and other public things to be cut back very soon as blown budgets have forced "leaders' to cut what they can as soon as they can.

From Soren K. Group 'boots on the ground':

Skokie IL is building a Target and giving this wastoid business abatements and incentives to come here. Retail is so dead i nits current format that Target needs to include groceries and a CVS in the building to get people to come. It is a sham. The source was a school board director who worked part time at an Apple store to make ends meet. And he had the audacity to pitch the Target as a godsend to Skokie!

More info from SKG:

Postal employees are now being refused OT even after their ranks are diminished and they are short -staffed to get the mail out. The solution? New hirees at a fraction of the pay are coming in to do the extra work. We are witnessing the lowered expectations of millenials happy to get a part time job delivering mail now. Welcome to lowered expectations.

As Bon Scott laughingly said before:

Puerto Rico is the Petri dish of U.S. state defaultIllinois defaults - then declares bankruptcyCT declares bankruptcy - then defaultsNJ sells rights for Florida Vacation ad billboards to be placed at the Jersey shore - then defaults

The solution? More printing of money to bail out states is next. While a default is deflationary, a printing of money is debasing the USD. Antigoldilocks is here.

Deflationary events like defaults and cutbacks resulting in Zombie States that struggle to service debt while their residents just suffer. Inflationary events like money printing will grow soon in a race to stop deflation. Money velocity will slow even while that same supply grows. And perversely, stocks will be buoyed.

But Gold is now sensing longer term issues and is reacting accordingly. Rate hike? So what. Real rates must decrease to keep the stock market floating.

There is no recovery. And as perverse as it sounds that is why bonds will rally even more. Safety, NO. Liquidity, YES. Bonds are telling you that defaults are coming, and that those defaults will create less GDP growth. And that triage is likely when states default .Those that do not default will become zombies under the weight of debt service. If rates go up, there will be more defaults. Finally, lower credit means less loans to states already underwater. Tax revenues evaporate and money stops moving. Zombies.

Global Macro:

In addition to uncertainty and polarization that terror brings to elections, we are seeing the meltdown of globalist ideology as it comes face to face with reality.

The current crisis is in Qatar and the possibility that they will de-peg from the USD. This means simply that money is fleeing Qatar in droves now. People are demanding their USD and then getting out of Dodge. The Opec cartel is in jeopardy, and with it more Middle East instability can follow.

Gold is nearing $1300 this morning - its highest since the election. WTI Crude has sunk back to a $47 handle, ignoring dollar weakness as the Qatarstrophe raises more doubts about OPEC coordination.

Contributions from Zerohedge's article Qatarstrophe Sends Gold Near Post-Election Highs As Crude Tests 2017 Lows

Good Luck

Read more by Soren K.Group