Why I'm Increasing My Position In Gold

Gold is robust and sometimes anti-fragile making it a great addition to any portfolio especially with an uncertain future.

Expanding debt in the corporate and government sector eludes to an uncertain future.

Owning tangible gold is the best method for hedging.

I have increased my position in gold because I feel uncertainty about the future has increased. Gold has long been a commodity that is robust and even anti-fragile at times. Anti-fragile is a concept popularized by Nassim Taleb. Anti-fragile means that something benefits from volatility. This is different than robust, which would be an asset that is very resilient to economic shocks. Gold is unchanged and sometimes benefits from economic shocks. This makes gold a great diversification option. This article will cover the following topics.

1. Why gold is robust and sometimes anti-fragile.

2. Why uncertainty has increased making gold an attractive investment.

3. Various ways to invest in gold and what I currently hold.

Gold is Sometimes Anti-Fragile and Always Robust:

You don't have to look far for evidence about how gold increases in price in times of uncertainty. It's a very popular investing theory.

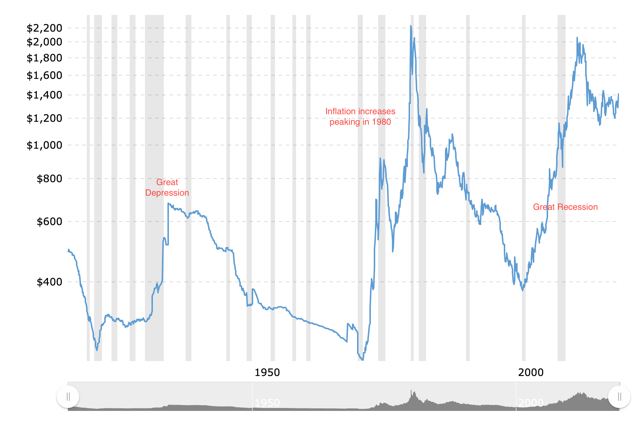

Source: Macro Trends

Source: Macro Trends

I labeled key events on this chart. Shaded regions are recessions. It is very clear how gold benefits from uncertainty. Gold doesn't increase for every negative event, but it has for certain ones.

From 1970 to 1980 gold went up by over 8x or 800%. This specific time period is when inflation went crazy, reaching almost 14%. Paul Volcker fixed inflation in 1980. He raised interest rates stamping out inflation and inducing a recession. Gold's price increased in huge amounts as inflation went up, and then decreased once Volcker brought a sense of relief. Below is a more focused graph on different events and how different investments reacted.

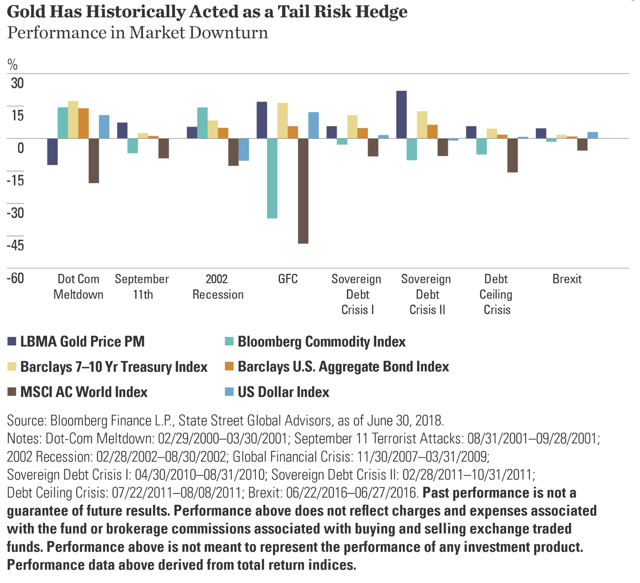

Source: SPDR Blog

Source: SPDR Blog

Gold rarely performs poorly in an economic shock making it extremely robust. Recently gold has outperformed most parts of the market.

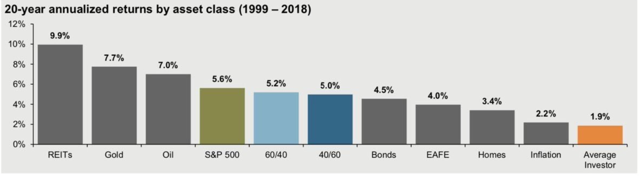

Source: JP Morgan

Now this is no guarantee that this outperformance will continue. I would also like to emphasize I am not purchasing gold for speculative price increases. I think that it is a necessary hedge in uncertain times.

Uncertainty in Today's World:

Uncertainty for me starts with rising debt around the world and especially in the US.

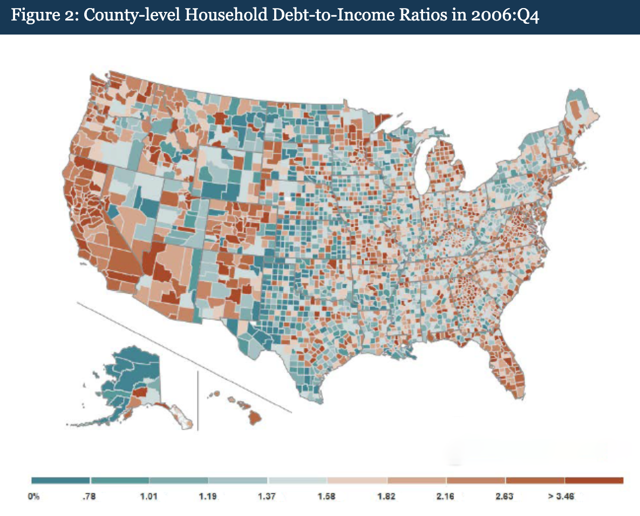

The Great Recession during 2008 is also referred to as the Global Debt Crisis. Consumer debt was high by any measure. Rampant subprime mortgage lending along with fraud certainly didn't make things better, but it is not what caused the extent of the financial fallout. The real problem can be seen in the following image.

Source: Federal Reserve

In late 2006, debt to income ratios were massive, especially on the coast. Here is an example. Let's say my debt to income ratio is 3.0. This means that my debt payments & monthly expenses are three times larger than my income. That is not sustainable by any calculation.

After the economy collapsed the government stepped in to mitigate the damages. Some debt disappeared or was forgiven, but a lot of it transferred. The government conducted massive bailouts and provided a variety of stimulus to prop up the economy. Consumer debt decreased and in its place government debt increased.

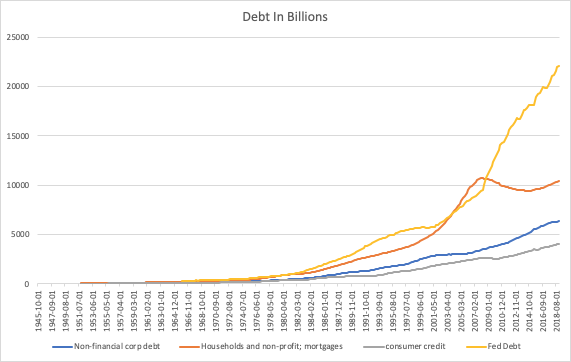

Source: Federal Reserve

The graph above shows how mortgage debt decreased (orange line) as well as consumer credit (grey line). Federal debt in response sky rocketed (yellow line).

The government also lowered interest rates drastically. Corporations could now get "free" money, or money at extremely low interest rates. Corporations used the opportunity to pile on debt for low costs and conduct massive share buyback programs (blue line). This is what partly fueled the recent stock bull market.

Going forward one would expect the government to pay off its debt once the economy recovers. This would allow for less of government expenditure to go to interest. Also, it would allow the government to have less debt once the next recession comes around. The US government is not being prudent or conservative. In fact, it is doing quite the opposite. It is increasing debt.

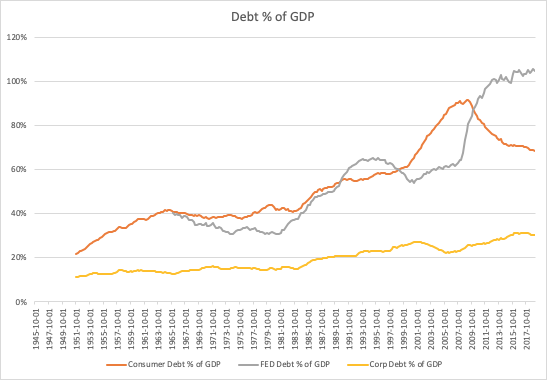

Source: Federal Reserve

For this graph I combined consumer credit and household mortgage debt under consumer debt (orange line). You can see Federal debt increase dramatically relative to GDP (grey line). After the recession it has continued to increase even relative to GDP.

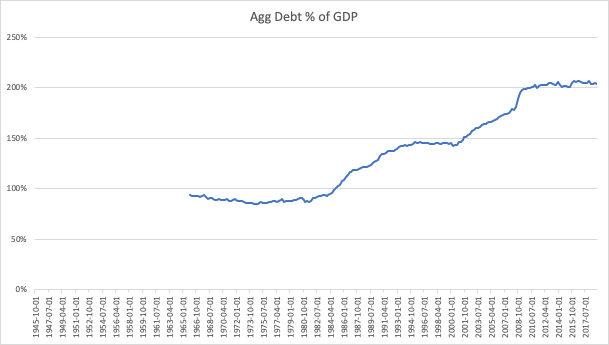

Source: Federal Reserve

Here is all the debt combined as a % of GDP. Notice that the Great Recession resulted in an overall uptick of about 25%. This is because debt was transferred from the consumer to the government, but it didn't decrease overall. Now that we're in a stable economic environment you'd assume the debt would decrease (at least Federally), but government debt and corporate debt has grown enough to outpace the decrease in consumer debt. We are at all-time highs.

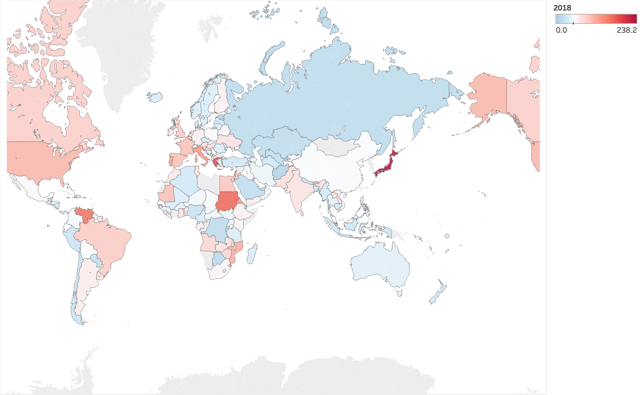

Debt is on the rise relative to GDP around the globe.

Source: IMF

This data was collected from the IMF for 2018. The color white is set at the median which is 51%. Japan is the highest at 238.2%

Here is where the US stacks up in a box and whisker.

Souce: IMF

The US is relatively high, but not quite an outlier like Japan. The overall trend is worrisome.

Overall global debt is outpacing global GDP growth. The average government debt to GDP in the world was 47.9% in 2012. In 2018 it was 57.6%.

I can't see anything getting better anytime soon. Tax revenue is flat and government spending is increasing. The deficit is soaring.

One key thing to note here is that GDP can grow through debt. The government, consumption, and even investments can grow through debt. The more GDP grows through debt in the present the more future GDP will be restricted. If the country borrows to grow income today, it will be paying off that interest in the future. As seen above the growth of debt has been keeping pace with GDP. Not a great sign of future growth.

This is not a guarantee that the economy will collapse. But in the age of "Too Big to Fail" and government debt already high, gold seems like a good addition to any portfolio.

If I'm wrong not much money is lost and I possibly even make money if gold continues to outperform. If I'm right then the downside of not having gold in a portfolio is massive. The expected value of is in favor of gold.

Various Ways to Invest in Gold:

1. Own tangible gold

2. Own an ETF that tracks gold

3. Futures contracts

4. Gold mining companies

5. Gold streaming companies

For the purpose of my investment thesis I am working towards purchasing tangible gold. A speculative investment in gold would lend itself better to the other options. Tangible gold is the best option as a hedge because it doesn't have unassociated risks such as counter-party risk. Counter-party risk is the risk associated with related parties in an investment. Here is an outline why I am not choosing the other options.

Gold ETFs:

Gold ETFs rely on a custodian, a major financial institution, to store their gold for them. If the financial system undergoes a major hit and is impaired, the price of the gold ETF could be negatively impacted. The following article outlines this problem (Forbes Olivier Garret).

Future Contracts:

A future contract on an open exchange has virtually no counter-party risk. I am personally not pursuing this option because I don't want the added problem of choosing various expiration dates and worrying about time decay. On another note gold futures tend to have a pretty high capital commitment.

Gold Mining Companies:

Individual companies have plenty of risk that has nothing to do with the price of gold. Even if you were to purchase many gold companies to manage the risk of the individual, you would still have lots of risks not associated with the price of gold.

Gold Streaming Companies:

Gold streaming companies provide gold mining operations with financing with the promise of the gold mine selling gold to them at a discounted price. This is essentially a gold call option. This has counter-party risk as well in the form of the gold mining operation.

How to Invest in Tangible Gold:

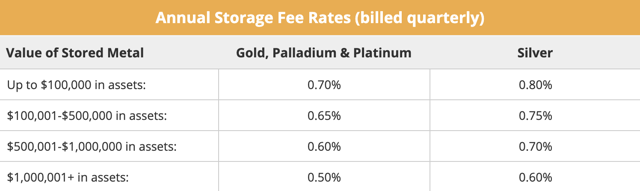

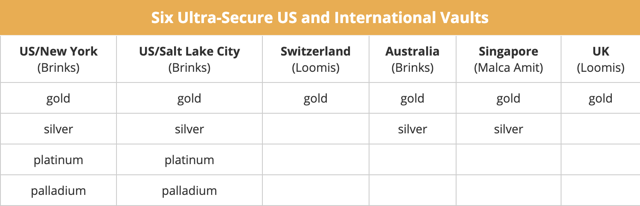

I currently own (GLD), but I am working on purchasing tangible gold through Hard Assets Alliance. Once I have established my account I will transfer my assets over and liquidate my holdings in GLD. Hard Assets Alliance allows you to purchase a variety of precious metals of which they store for you in vaults around the world. There is no minimum purchase price, and the costs are comparatively low to ETFs.

Source: Hard Assets Alliance Prices

Source: Hard Assets Alliance Prices

You actually directly own these assets which eliminates counter-party risk. These assets are insured at full replacement value rather than at a dollar amount. What this means if the banking system blows up you a guaranteed your gold rather than in US dollars. Furthermore, the metals are stored in highly secured vaults which is more beneficial than storing it in a safe at home.

Source: Hard Assets Alliance Security

Source: Hard Assets Alliance Security

You can also get your metals delivered to your home if you so choose. The deliveries are completely insured.

Please let me know if you have any questions or dissenting opinions. Any feedback is greatly appreciated.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Kiefer Tuck and get email alerts