Why I Am Holding Gold And Silver To Supplement My REIT Portfolio

REITs and precious metals are two of the most opportunistic investments today.

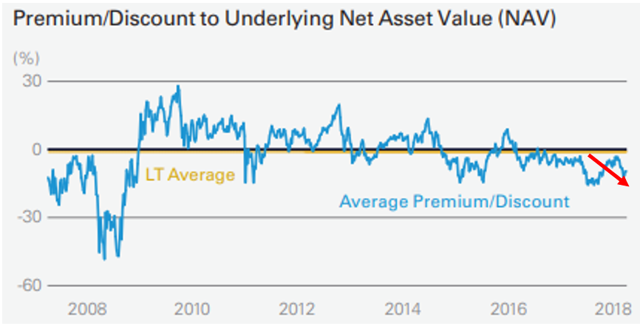

REITs combine all the benefits of real estate as the best long-term investment asset class with numerous other advantages, including passivity, liquidity, and a current discount to NAV.

Precious metals are very undervalued relative to long-term ratios and have numerous potential catalysts in today's uncertain geopolitical and economic environment.

By pairing the two, we can get the best of both worlds: lucrative, resilient cash flow from real estate and countercyclical resilience and uncorrelated portfolio diversification with precious metals.

We sleep well at night knowing that our two favorite asset classes have thousands of years of history backing their long-term investment thesis.

(This article was produced with Samuel Smith, co-author of High Yield Landlord)

There are many ways to build long-term wealth, the most popular being real estate, stocks, and bonds. However, with the current stock market nearing a record bullish run-up from its 2008-2009 lows, valuations are beginning to look quite stretched. Traditional metrics for gauging the relative attractiveness of equity valuations place the market into significantly overvalued territory. Furthermore, continued historically low interest rates and rising inflation make bonds appear unattractive. Real estate, as an inflation-resistant real asset, remains the most attractive of these three, but still looks rather pricey as prices have surged here as well over the past decade. Where, then, can we find value in today's marketplace? Is putting cash in a 2% CD a good alternative when inflation is pacing well ahead of that rate, effectively guaranteeing a loss of purchasing power?

Two often-overlooked alternative investments that are very resistant to inflation and look particularly attractive right now can be found in Real Estate Investment Trusts (REITs) and precious metals such as gold and silver. In fact, not only do these investments look attractive individually, their lack of correlation makes them even more attractive taken as a pair.

Why REITs?

We have written at length why real estate is quite possibly the best long-term investment one can make. This is due to the fact that it is limited (the amount of land on planet earth is finite and only certain portions of earth are suitable for various types of real estate), necessary (real estate is absolutely needed for the survival and prosperity of the human race and cannot be replaced), and flexible (many buildings can serve multiple purposes with only a little or even no changes needed to the land or the structure and even when significant redevelopment is needed, it can still often be done in a profitable manner over the long run) - giving it remarkable durability and stability in value. As a result of these traits, real estate has produced the best long-term, risk-adjusted results of any asset class.

However, there are a few risks and roadblocks to investing in real estate relative to other asset classes. First and foremost are the "Triple Ts" of landlording: Toilets, tenants, and trash. As we pointed out in a recent article on rental investing, when you invest in rentals it's anything but a passive investment. It can, in fact, be quite time-consuming, stressful, and risky. Tasks often include conducting extensive due diligence on the property and region, negotiate financing, finding good quality tenants, arranging for legal work, monitoring tenants and collecting rent, and maintaining the property. Additionally, there is a very likely risk of the property experiencing vacancies for considerable periods of time, turning it into a massive liability rather than an asset. An additional risk with investing in real estate today is that valuations are looking pretty stretched in many sectors and geographies after a solid decade of global growth and record low interest rates. As a result, cash flow and long-term appreciation potential on purchases made today may be below historical averages.

This is where REITs come into play (and is where we specialize in making even the research and selection process entirely passive at High Yield Landlord). In addition to the fact that they are truly passive investments (and numerous other qualitative reasons we discuss here), we think REITs are a particularly undervalued and underappreciated investment right now due to the simple fact that they are largely trading below the net asset value of their underlying properties. That might seem incredible given their numerous qualitative advantages over individual landlording, but the data is undeniable:

An additional benefit of investing in REITs is that they yield quite stable cash flow in the form of dividends through all market cycles, making them easier to hold during market downturns than traditional stocks. At High Yield Landlord, we spend hours researching the REIT market in order to target the highest quality REITs that also are being offered for sale by Mr. Market at low valuations, further enhancing our margin of safety and cash flow yield. As a result, we are able to achieve superior dividend yields at sustainable dividend payout ratios, thereby giving us attractive current income (enabling us to capitalize on short-term volatility by averaging down on top opportunities) and superior total returns over time. Some of our top ideas at present that reflect our broad diversification include Brookfield Property REIT (BPR), Spirit Realty Capital (SRC), and UMH Properties (UMH).

Why Precious Metals?

Backed by millennia as the premier form of money and a stable store of wealth, gold and silver have - to borrow a term from Warren Buffett - perhaps the ultimate "moat" protecting their intrinsic value over the long term, and have proven to be an ideal safe-haven asset during times of economic and/or geopolitical uncertainty.

Here are five reasons why gold and silver look particularly appealing right now:

1. Declining Gold Discoveries

The drop in gold prices off of the highs seen earlier this decade has made it less economical to mine gold, resulting in both fewer mines as well shorter mine lifespans. This will inevitably lead to less gold production and possibly a supply crunch that would boost prices.

2. China and India

Asian giants India and China have been accumulating large amounts of the precious metal - driving up global demand as well as laying the groundwork for future challenges to the dollar as the world's reserve currency. Indian households traditionally invest a large portion of their savings in the precious metal and also love gold jewelry. As their nation's wealth increases, so does their aggregate demand for gold. Geopolitical and economic uncertainty in China is driving their heavy demand for the metal: namely, the falling yuan and growing trade friction with major trading partners such as the United States. If the current trade war prolongs and begins taking a heavy toll on the economy, a further flight to safety might be in order.

3. US Fiscal and Monetary Policy

The US Federal Reserve's low interest rate policies have propped up an otherwise weak economy in the wake of the financial crisis while also facilitating record government budget deficits. As US national, state, corporate, household, and student debts continue to soar to new highs, the central bank will feel continued pressure to keep rates low even as inflation continues rising, likely leading to continued negative real rates (interest rate minus inflation rate). Economic history shows that negative real rates are a very bullish indicator for gold and silver.

In fact, Fed Chairman Jerome Powell acknowledged recently that inflation could head up to 2.5% without the Fed feeling the need to take extra countermeasures. The Core PCE Price Index is currently hovering around 2% year over year, which, while above expectations and revealing an accelerating inflationary trend, still has plenty of room to run before meeting the Fed's target ceiling.

4. Geopolitics

With the ongoing tensions between the US and international rivals Russia, Iran, Syria, China, and North Korea, there are plenty of factors that could potentially combine to significantly disrupt the global economy at any time. The US could eventually play a more aggressive military role in Syria, thereby putting it into direct confrontation with Russia. Its sanctions on Iran could very likely lead to a major war in the Middle East, its trade wars with China, Canada, and Europe could eventually lead to global economic recession or even an actual war, and its recently renewed relations with North Korea have hit a bump and could turn further south at any moment. History has proven that precious metals are second to none when it comes to safe-haven assets in uncertain times.

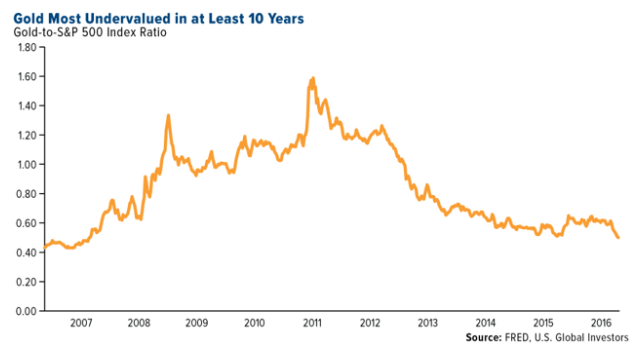

5. Gold and Silver are at a Decade-Low Versus the Stock Market

As the chart below indicates, the price of gold versus the value of the S&P 500 Index is around a 10-year low. This indicates that, particularly given the aforementioned tailwinds, gold is an especially attractive investment right now relative to other available options.

Furthermore, even as its relative price has declined significantly, equity valuations (based on the Schiller P/E ratio) have reached their second highest levels in modern history:

Investor Takeaway

While these fundamentals imply that precious metals are undervalued, as recent history has shown us, the market can behave irrationally for considerable periods of time. While there are no guarantees of near-term profits in silver and gold, and in fact there very well may be further losses on the way, we can be certain that, given excessive government spending and continued artificially low interest rates, the US dollar will continue to lose purchasing power over the long term and will likely, therefore, lose value relative to real assets such as precious metals.

A primary criticism advanced against investing in precious metals is that they lack the ability to generate cash flow, in stark contrast to real estate, bonds, and stocks. Therefore, while they may be a great way to preserve wealth, they do not actually create any. This is an excellent point and should serve to temper the impulse to over-allocate to gold and silver.

However, what critics of the precious metals fail to consider in their analysis is that: (1) our fiat monetary system (with its accompanying centrally-planned interest rates and money supply) creates enormous pricing distortion and mal-investment within the economy, creating a boom-bust cycle which leads to massive destruction of wealth (such as was last witnessed in 2008-2009), impacting virtually every sector of the economy, including the future cash flows and financial stability of businesses and real property. This then negatively impacts stock, corporate bond, and real estate values; (2) as a non-cash flowing real asset alternative to these other investments, with thousands of years of economic history as a substance of value, these economic crises often leave precious metals unaffected and, in fact, when governments respond like they did in 2009 with massive quantitative easing, this inflationary activity drives up precious metal prices significantly; (3) given the first two factors, REITs and gold are largely uncorrelated to one another, with the Vanguard Real Estate ETF (VNQ) and the popular gold ETF SPDR Gold Trust (GLD) having a mere 0.08 correlation over the past decade.

Taking those factors into consideration, it is our view that it is generally a good idea to maintain some exposure to precious metals through entire market cycles, and in particular right now. Famous investor and hedge fund manager Ray Dalio has contrived what he terms an "All Weather Portfolio" that is supposed to generate optimal risk-adjusted returns through all market cycles by obtaining and rebalancing to maintain an optimal asset allocation, including a healthy allotment to gold.

In addition to the "All Weather" strategy, here are some recommended ways to gain exposure to precious metals, including a few that even generate cash flow:

Lease your metals for industry use for payment in that same metal at Monetary Metals. This method, while still in its infancy, can potentially generate superior real yields over the long term given that metals are historically hedged against inflation. Invest in ETFs (such as the iShares Silver (SLV) and GLD ETFs) that are backed by the actual metals. While this method is easy and highly liquid, the downside is that you have to pay an annual fund management fee. A great way to offset this fee while generating monthly cash flow on your investment is to sell monthly options against the SLV and GLD ETFs (either covered calls or cash-secured puts). This effectively caps the short-term upside of your holdings, but in exchange you get a sizable amount of cash flow from your monthly options premium. If you choose to pursue this strategy, I highly recommend reading up on how options work and then using the free stock and options trading platform Robinhood to eliminate costly trading fees. Hold traditional bullion bars and coins. American Eagles are the most widely respected and trusted investment vehicles, but as a result they sell at a significant premium to spot prices. You can purchase other government minted coins as well as bullion bars or rounds for cheaper prices, but they may not be as liquid or fetch as attractive of a selling price. Regardless of which form of bullion you prefer, I would recommend purchasing with a rewards credit card on sites that sell bullion at a competitive rate and don't charge a premium for using credit cards (eBay (NASDAQ:EBAY) is great for this). This can effectively enable you to purchase metals at prices near to or below spot. Additionally, it is important to purchase from highly respected and trustworthy sources. Make sure you purchase from a well-reviewed precious metals dealer, especially one with operations outside of eBay. Finally, and most importantly, safely storing your metals is essential. Ideally, use a safety deposit box at a nearby bank. While these can sometimes come at a costly storage fee, other times you can get complimentary service if you hold additional accounts with that bank (I use Chase for example, which gives me a free safety deposit box as a benefit for banking with them). Invest in precious metals miners via stocks, ETFs, and/or mutual funds. This is by far the most risky and volatile method for gaining exposure to precious metals. However, it does generate cash flow without the capped upside of selling options while still providing easy liquidity. Unless you are willing to do significant due diligence and ride out periods of enormous volatility, it is best to invest in mining ETFs/mutual funds if you choose to go this route.Due to their limited cash flowing capabilities and relatively muted long-term returns, precious metals certainly should not dominate your portfolio. However, given their unique, unparalleled, and irreplaceable place in economic history and relatively attractive current valuations, a prudent investor should consider exposing their investment portfolio to this sector. Additionally, since we invest heavily in high yielding REITs, we are not reliant on our precious metals for cash flow. Instead, we invest to achieve a healthy balance between two largely uncorrelated asset classes that should, over the long term, combine strong inflation-adjusted returns with portfolio stability and high cash flow.

Note: We are currently sharing the full list of our highest-conviction investment ideas with "High Yield Landlord" members along with a report entitled "Our Favorite Picks for 2019."

If you liked this report, please scroll up and click "Follow" next to my name to not miss future articles.

High Yield Landlord recently became the #1 ranked service in real estate on Seeking Alpha. To ensure that the quality of our service remains at its highest, we will increase memberships rates and then soon after, close memberships completely. Subscribe now and secure yourself one of our last discounted spots.

If you are looking to expand your real estate investments in 2019, take action now and find out why over 200 investors follow the "High Yield Landlord" approach to real estate investing. For more information click here.

Disclosure: I am/we are long BPR; SRC; UMH; GLD; SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Jussi Askola and get email alerts