Why Investors Need To Be Cautious In Gold

Gold has jumped to its highest levels in six years.

This jump has been led by investors adding to ETF gold holdings and speculative interest.

The latest COT report shows a large rise in speculators, which is a contrarian warning sign.

With the latest jobs report and tariff easing, there are plenty of headwinds to gold.

The one precious metal that is attractive currently is platinum.

Gold has had an extraordinary run as it has broken the $1400 level, to the highest it's been in six years - since the 2013 "Gold Crash". The rise has been attributed to a combination of factors including expected lowering interest rates, trade tensions, and expected USD weakness.

While we are gold bulls, we urge investors caution as in the near-term gold is poised for some weakness as investors are over-exposed. ETF holdings have risen significantly over the past three weeks, but what we want to focus on is the latest Commitment of Traders (COT) report which showed a large rise in Speculative longs to some of the highest levels in years.

This does not necessarily signal a short-term top, but it certainly should raise caution for gold bulls as more speculative investors become bullish. But before that let's quickly explain the COT report.

About the COT Report

The COT report is issued by the CFTC every Friday, to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued it has already missed a large amount of trading activity.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them) so we won't claim to be the exports on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

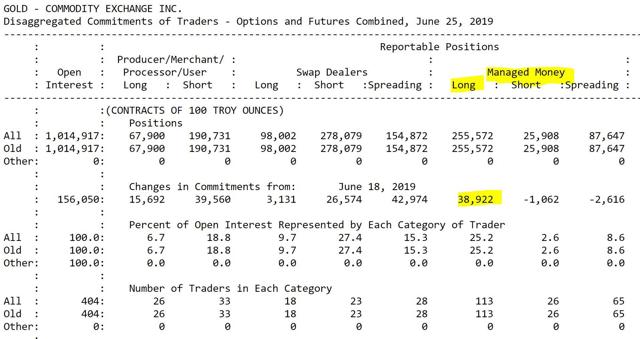

This week's COT Report showed a large rise in speculative positions as longs added over 38,000 contracts.

Source: CFTC

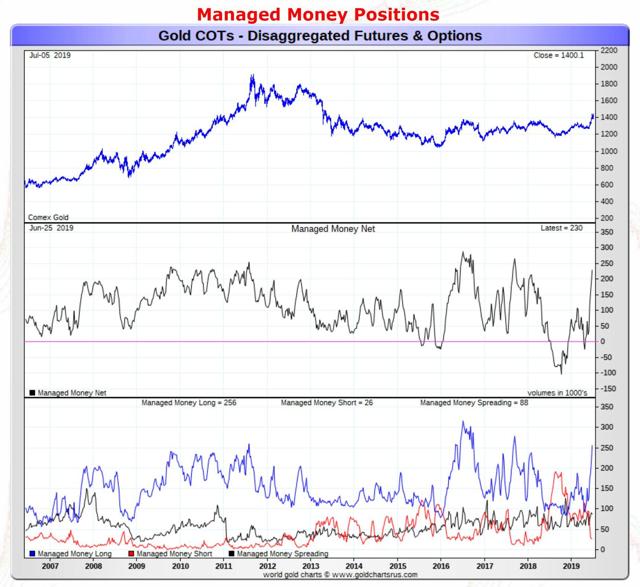

Chartwise, speculative positions are now almost net 225,000 contracts long gold - a far cry from the net-short position we saw earlier in the year.

Source: GoldChartsRus

As can be seen in the chart above, the Managed Money (think Speculators) positions have jumped to the highest levels in two years - and they have done it extremely quickly.

Conclusion

From a contrarian perspective, this is worrisome, and we're even more concerned because some of the risk factors that have moved gold higher are already baked in, but there's a possibility that they don't come to fruition. Two of the largest that come to mind are the trade tariffs that the POTUS was threatening China/Canada/Mexico with and the easing of the Federal Reserve. It seems that for now the tariffs are on hold (are we waiting for the US 2020 election cycle?) and based on Fridays jobs report, the expectations for more than a 25 basis point cut have been dramatically cut.

Extreme positioning by speculators and a diminishing of major risk factors make for some major headwinds for gold in the short-term. We actually think that the July 2nd announcement by the POTUS on his new Federal Reserve nominees was the day to sell as we posted on our official Twitter account:

Thus we think it's time for gold bulls to lighten up their PM leverage and lighten their positions in miners and the ETFs (SPDR Gold Trust ETF (NYSEARCA:GLD), iShares Silver Trust (SLV), Sprott Physical Silver Trust (PSLV), and ETFS Physical Swiss Gold Trust ETF, etc.).

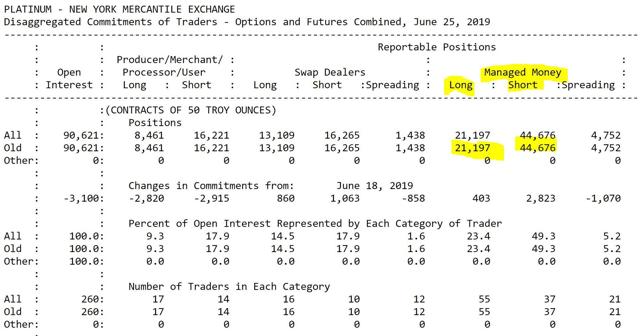

One exception to the PM call is platinum - we feel there is both fundamental and speculative reasons to own it. On the short-term speculative side, it's the only PM that showed a net short position which was particularly large - over 23,000 contracts short.

Source: CFTC

As a precious metal with a historical positive relationship with gold, we feel that platinum has the ability to rise if gold rises and if precious metals decline in the short-term (as we expect), platinum has little downside with such a large short position. This would make an asymmetric trade, and investors wishing to take advantage of this trade may want to consider purchasing the Aberdeen Standard Physical Platinum Shares ETF (PPLT) or the Sprott Physical Platinum and Palladium Trust (SPPP).

We expect good things for gold moving forward, but at this point, it's time for gold bulls to take some profits and wait for a better re-entry.

Disclosure: I am/we are long SIVR, PPLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Hebba Investments and get email alerts