Why Is VanGold Mining So Hot?

In this interview, Peter Epstein of Epstein Research talks with CEO James Anderson about why this company has potential beyond riding the rising tide of gold and silver prices.

In this interview, Peter Epstein of Epstein Research talks with CEO James Anderson about why this company has potential beyond riding the rising tide of gold and silver prices.

In every article/interview I've done on a gold or silver junior in the past three months, I've remarked, somewhat breathlessly, on how strong prices are. Yet, prices keep moving higher! Gold, at US$1,944/ounce (US$1,944/oz; an all-time high in U.S. dollars) is up +39% from its 52-week low of US$1,401/oz. Silver, at US$24.33/oz, is up 102% from its mid-March COVID-19 low!

VanGold Mining Corp. (VGLD:TSX.V) is a silver-gold story benefiting from this apparent precious metals bull market, but more importantly from the potential to generate two-years-plus of steady free cash flow starting in about 6-9 months. Monetizing historical stockpiles is as much as most readers may know about VanGold, but there's so much more to this story.

In a prior article I mentioned the possibility of CA$15 to CA$27 million (CA$27M) in total cash flow, over 24-30 months, from toll-milling surface and underground (u/g) stockpiles. At today's spot prices, my rough estimate increases to CA$23M-$35M. Anything above CA$15M would be a great outcome for a company with a market cap of CA$13.0M = US$9.7M. [Note: Market cap is before a recently announced private placement of 24.5M units at CA$0.155/unit.]

While free cash flow from harvesting stockpiles would greatly reduce the need for future equity raises, better still is the tremendous exploration and near-term production potential. High-grade ore in and around historical u/g workings is low-hanging fruit that could pay off for years to come.

Finally, there's a decent chance that the entire region's blockbuster vein, the Mother Vein, passes through VanGold's property at depth, with (possibly) very wide stopes and high grades. The company needs to drill to test that theory, so stay tuned. Please continue reading to find out what CEO James Anderson has been up to that has everyone so damn excited.

Peter Epstein: Please explain what VanGold learned from shipping and toll-milling 1,039 tonnes of ore from its surface stockpile of approximately 175,000 tonnes.

James Anderson: Many things really. Regarding gold and silver recoveries, some people thought our surface material, exposed to the elements for nearly 110 years, would not float in a floatation mill due to oxidation. We proved those folks wrong with +75% recoveries for gold (Au) and +60% for silver (Ag). We have ideas about how to get better Ag recoveries. For a first test through a mill, we are very happy with these results.

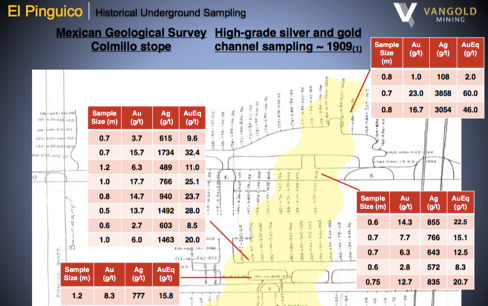

The head grade of 1.23 g/t Au Eq (Au equivalent) on 1,039 tonnes of surface material passed through the mill was almost exactly what we expected. That gives us confidence in our other grade assumptions especially for the u/g stockpile which we believe is about three times higher than the surface stockpile, roughly 3.6 g/t Au Eq. In 1959, the Mexican Geological Survey estimated a meaningfully higher grade. So, there might be some upside here.

Perhaps most important, we learned a great deal about the economics of sending material to a local mill. Actually knowing all the component costs of shipping and processing gives you great confidence to plan for the future. We ended up producing 18 ounces of gold and 930 ounces of silver, a small start, but an important first step along our journey.

PE: After your current capital raise, VanGold will have about $5M in cash. And, you hope to have significant monthly cash flow, for 24-30 months, targeted to start in 1H/2021. Why do you need so much cash?

JA: First, I want to thank our shareholders, many of whom are investing for a second or third time, for giving us money to pursue this exciting project. Re-entering and refurbishing the 110-year old mine will no doubt come with surprises, both good and bad.

We're now confident that we will have ample funds to deal with anything unexpected as we assess the bottom of the u/g stockpile and access the #7, or Sangria, adit level. Although delayed for 10 days due to COVID-19, that work is expected to start next week. Meanwhile, computer modeling of the deposit in anticipation of an underground drill program is ongoing.

PE: Regarding VanGold's two stockpiles, please explain the logistics of monetizing these assets?

JA: With regard to the surface stockpile, it could not be easier. A front-end loader will shovel material into 20-tonne trucks for delivery to a local mill. With regard to the u/g stockpile, there are several additional steps. First, we need to clear the bottom of the El Pinguico shaft and sample the bottom of the u/g stockpile.

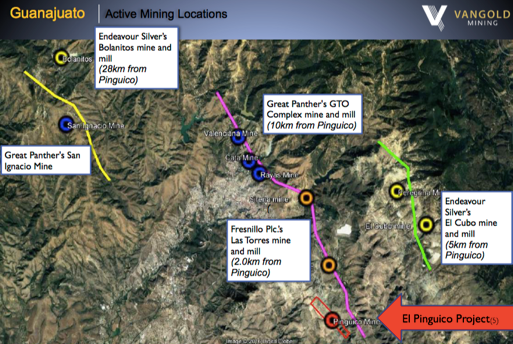

As established by VanGold's trenching (to NI 43-101 standards), the top of the stockpile grades about 3.6 g/t Au Eq. We plan to further establish and confirm that grade by sampling the bottom. We are carefully studying options to either refurbish the El Pinguico shaft, or the Sangria adit, to 21st-century safety standards, to bring the u/g material to surface. Finally let me emphasize this point we need to establish a medium-term contract with a mill to process our material.

We're optimistic on this front. I mean, we did successfully negotiate and fulfill a contact for 1,039 tonnes in May. There are four mills between 2 to 28 kilometers (28 km) from our property. We think we will be able to strike a deal with one of them. Still, until we sign a contract, that remains a risk factor.

PE: How soon before you might deliver a PEA/PFS [preliminary economic assessment or preliminary feasibility study]? Or, given that you've done trial mining and toll-milling on 1,039 tonnes of ore, do you need to spend the time and capital on these reports?

JA: That's a good question. Frankly, we hope to skip over much of the cult of report writing and simply transition from shipping our stockpiled material (over 24-30 months, targeted to start 1H/2021) into adding in higher grade, in-situ, newly mined material.

PE: El Pinguico is usually described as a silver-gold project. Do you know what the mix is between the two metals?

JA: Well, the u/g stockpile grades 1.66 g/t gold + 167 g/t silver, a 100 to 1 silver to gold ratio. If the stockpile is indicative of surrounding areas, which we believe it probably is, then for each ounce of gold, there's likely to be about 100 ounces of silver. In terms of in-situ metal value, at spot prices (US$1,944/oz gold and US$24.33/oz silver), 56% of the economics would come from silver, and 44% from gold.

PE: The u/g stockpile grades ~3.6 g/t gold equivalent. Yet, historical mining, drill records and u/g sampling indicate much higher grades. Why is the stockpile grade much lower?

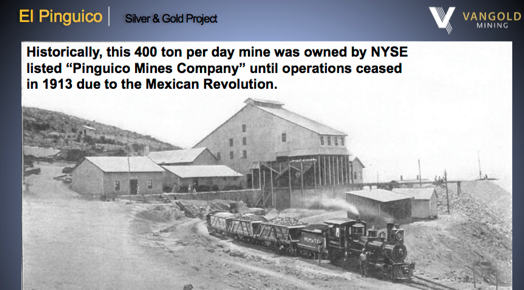

JA: In any u/g operation, mining consistent tonnage facilitates the smooth procession of the overall mine plan. Mining widths and grades vary, as does the time it takes to mine a specified amount of ore on any given day or week. Therefore, miners keep a running stockpile of lower-grade ore to supplement the high-grade material sent to the mill. We believe our u/g stockpile is just that, partially diluted high-grade ore that never made it out of the mine when operations ended in 1913.

PE: You've spoken about the possibility of the Mother Vein crossing your property. If it does, what might that mean for the scope of the project?

JA: We are nearly certain the Veta Madre, or 'Mother Vein,' crosses our property at depth. The structure is regional in size, having a surface expression over 25-30 km. Meanwhile, we know that Fresnillo Plc (FRES:LSE) mined the Veta Madre to within 250 meters of our property border.

What we don't know is how well mineralized the Veta Madre will be on our property, or whether the El Pinguico vein structures, which host all the high-grade silver and gold mined on our property 110 years ago, intersects with that larger structure. If there's a meaningful intersection, it will be an extraordinarily compelling drill target!

PE: Are there nearby properties or mining assets to consider acquiring or otherwise gaining control of?

JA: Yes, we certainly have some ideas about that, but I really can't say more at this time. There is an important balance for VanGold regarding staying focused on the work we have ahead at El Pinguico, and yet maintaining our eyes on the horizon too. We're keenly watching for new opportunities within the 450-year-old Guanajuato mining camp.

PE: The gold price has breached US$1,900/oz, and silver has doubled to US$24+/oz since mid-March! Sentiment for precious metal juniors is quite buoyant. What could go wrong?

JA: Sentiment could hardly be better right now. That usually marks at least an interim top for precious metals. We saw a modest pause last week in some of the sector's strongest performing juniors. Preparing for that inevitable pull back, and taking advantage of it when it does occur, is certainly one of VanGold Mining's top goals. That's one of the reasons why we're raising cash now, better safe than sorry.

PE: Thank you, James, I think we covered a lot of ground here. I will be watching VanGold for updates. I would wish you good luck on your capital raise, but I doubt you need it. Stay safe and healthy.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Epstein Research disclosures/disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about VanGold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of VanGold Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock and warrants in VanGold Mining, and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.