Why now might be a good time to buy gold and gold juniors / Commodities / Gold and Silver 2021

Gold has been taking a beating in recent weeks, the sell-off prompted by rising bond yields which are taking the shine off the yellow metal. Higher interest rates diminish the argument for owning gold, which offers no yield.

On Wednesday, Feb. 24, spot gold dropped to $1,784.60 an ounce, just shy of $1,783.10 reached on Feb. 21, its lowest since July, 2020. The gold price climbed $342, or 22% last year, on pandemic fears, a low dollar and moribund bond yields, which for most of the year ran under 1%.

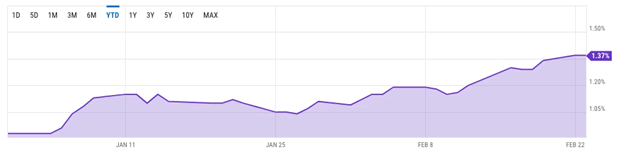

Gold has been pressured by higher yields on US Treasuries, most significantly the benchmark 10-year note, which is closing in on 1.4% (currently 1.37%), an increase of 44 basis points since the start of the year. The last time the 10-year was this high, was in February 2020, just before the start of the pandemic.

Kitco reported on Wednesday that a booming US housing market, fueled by low mortgage rates, is driving bond yields higher, after the Commerce Department showed new home sales rising 4.3%. The seasonally adjusted 923,000 units sold in January trounced consensus forecasts calling for 853,000 units to sell.

3 day Spot Gold. Source: Kitco

US 10-year Treasury yield, year to date. Source: YCharts

As the old trading adage goes, the time to buy is when there’s blood in the streets. While gold has taken a much greater hammering in previous years (2013, anyone?), a $100 loss, YTD, is definitely a dip.

Why are we bullish on gold now, and aren’t we concerned it could go lower? No. There are several cornerstones to the pro-bullion thesis.

Monetary to fiscal

As mentioned, bond yields have risen sharply, as prospects for more US fiscal stimulus fuel hopes for a faster economic recovery. US economic growth is expected to run hotter than any time in the past 35 years, and business investment should move twice as fast as the broader economy, feeding inflation fears, according to Credit Suisse, via Reuters.

Rising prices are the enemy of equity investors because it is the job of central banks, including the US Federal Reserve, to control inflation (in the Fed’s case, below 2%) by raising interest rates if necessary. Higher rates generally mean headwinds for corporate earnings because they squelch borrowing.

Investors who experienced the financial crisis may scoff at the idea of a return to inflation. When the US central bank in 2008 introduced the then-radical concept of quantitative easing, to help the economy to recover, many predicted that the creation of trillions of new dollars would lead to a rapid rise in prices.

It didn’t happen. Despite three rounds of QE, and the accumulation of $4.5 trillion in Federal Reserve assets (bonds and mortgage-backed securities) between 2008 and 2014, inflation never went above 4%.

Why? Instead of ending up in the hands of businesses and average Americans, who could have purchased goods and services, the funds stayed with the banks, who used it to replenish depleted bank reserves or to swap financial assets.

This time is different. Since covid struck, there is a new belief among policymakers that their previous adherence to monetary policy, as the cure for economic ills, was wrong. Instead, the focus should be on the allocation of capital by government. As stated recently by former Bank of England Deputy Governor Paul Tucker, “monetary policy should now take a back seat to fiscal policy.”

Spending

In short, this means government spending “on steroids”.

A $2.26 trillion US deficit is predicted in 2021, and that is before the $1.9 trillion American Rescue Plan that President Biden is poised to enact. The covid-19 relief bill that is currently before Congress (we expect it will pass, the Dems plan to use “reconciliation” to get it through the deadlocked Senate on a simple majority), is on top of $900 billion in coronavirus aid passed in December by Trump.

Meanwhile Biden’s economic recovery package, expected to be unveiled next month, has as its centerpiece the biggest infrastructure spending commitments since Roosevelt’s New Deal. It includes roads, bridges and broadband internet access, with progressive Democrats eyeing much more, ie., an expansion of Obamacare and a public sector jobs program.

When campaigning for president, Biden proposed $2 trillion for economic rebuilding, so we expect the infrastructure bill to contain at least that much.

Then there’s his Clean Energy Plan, another $2 trillion program to decarbonize US electricity in 15 years, and create a net zero-emissions economy by 2050.

Biden has signaled he will embrace concepts of the “Green New Deal” — a program first espoused by New York Congresswoman, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez (“AOC” will reportedly serve on a panel helping Biden to develop climate policy.)

His plan calls for installation of 500,000 electric vehicle charging stations by 2030, and $400 billion for R&D in clean technology.

The Biden administration will allow the International Monetary Fund (IMF) to provide a new allocation of Special Drawing Rights to all its member countries; $2 trillion is the number being considered.

Biden has also re-joined the Paris climate agreement. This entails two huge commitments, reducing US greenhouse-gas emissions, and to provide financial assistance to vulnerable developing countries.

Debt

So far the US government, despite criticisms the Trump administration didn’t do enough, has spent a jaw-dropping $4.5 trillion on pandemic-related relief, boosting the national debt to $28 trillion in under a year.

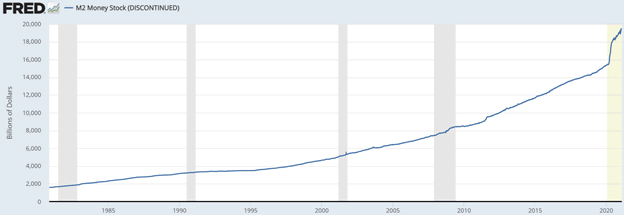

To pay for these expenditures, the Fed printed so much money, that the M2 money supply increased the most since 1943 — when the US was at war with Nazi Germany and tripled its military spending. It’s funny, but not in the ha ha way, how accustomed we’ve become to debt. In 1943, the US national debt “exploded” to 60% of GDP. As Sovereign Man reminds us,

That was an unconscionable figure, more than twice as much debt than the US racked up during the Civil War, or World War I.

Money was tight, and the Treasury Department did everything it could to raise cash. Tax rates soared, with the highest marginal rate hitting 94%. They were constantly pushing the public to buy War Bonds.

But most importantly, the Federal Reserve vastly expanded the money supply, essentially ‘printing’ whatever money the federal government needed to pay for the war effort.

1943 was a record year for monetary expansion, in fact. “M2 money supply,” a key measure of the amount of money in the financial system, grew more in 1943 than almost any other year in US history, before or since.

And then along came Covid.

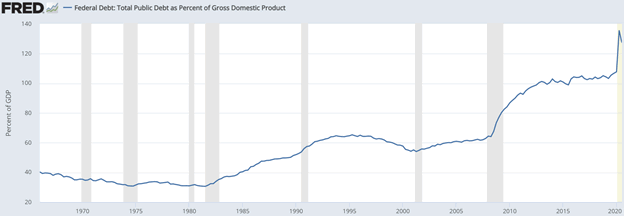

In October 2020 the debt zoomed past 100% of GDP, for the first time since the Second World War, but that was just the beginning. Based on monetary programs the Fed is already executing, the money supply will increase by another $2.3 trillion this year.

Such a jolt to the money supply, obviously, will add to the debt.

This week Fox News reported that the US national debt will swell to nearly $30 trillion this year if Biden’s $1.9 trillion covid-19 relief package is approved by Congress, putting the government on a path to spend more money in one year than it borrowed to finance the Revolutionary War, the Civil War, the two World Wars, and the Cold War.

We need to be very clear. This new spending, which as Fox asserts, would be unprecedented, is in addition to the loose monetary policy that is being followed by the Fed, meaning continued asset purchases to increase the money supply, and keeping interest rates close to zero. Thus we have monetary easing happening at the same time as fiscal spending “carte blanche” (remember Biden believes strongly in the power of the state to tax and spend. A long wish list waits to be filled, with little to no concern regarding the already out of control $28 trillion national debt, courtesy of Modern Monetary Theory, or MMT).

Inflation

The result of these two forces acting together, is bound to create inflation. We didn’t get inflation during the financial crisis because we didn’t have the spending component; in fact, governments cut spending to try and goose economic output. This time is different.

Consider: the primary risk to an extraordinary expansion of the money supply is inflation. Simply put, the more money that is created, the less valuable the rest of the money becomes. This is why inflation erodes the value of currencies.

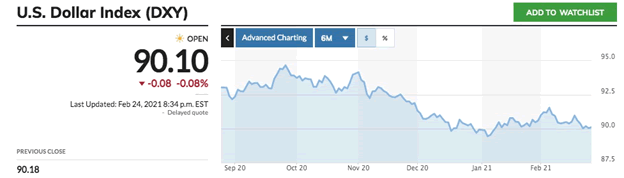

Already we see the dollar down against nearly every major currency over the past six months, and last week, Sovereign Man reports, the Labor Department announced that January’s Producer Price Index reached its highest level in more than a decade.

We know that several commodities, from copper to crude oil, have been surging in price. The CRB Commodity Index is up 15% so far this year. As an asset class, commodities have gained 43% since last April. Many investors are starting to see the light.

When I was interviewed by Financial Sense last fall, I explained the four over-riding global themes I believe are setting us up for a bull market in commodities like no other in history. They are:

Blacktop/ basic infrastructure such as roads, bridges, water & sewer systems, etc., that has been poorly maintained.Electrification of the global transportation system. The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country.Reducing our carbon footprint. Not only do we need to figure out a way to transition from gas and diesel-powered vehicles, but there is also the question of how to fill the batteries demanded by electrification.Meeting the global demand for food. Food supplies are constantly under pressure due to expanding populations, and as developing countries move up the “food chain” to include more protein in their diets.As the cost of raw materials increases, the prices of manufactured goods also goes up, usually passed onto consumers. Covid-related supply chain shortages have upped the prices of certain foods, and inflation is also being seen, as mentioned at the top, in housing prices. The stock market too is way overvalued, with many predicting the bubble could soon pop.

In sum, we already are seeing increased inflation, and it’s only a matter of time before it starts showing up in official statistics.

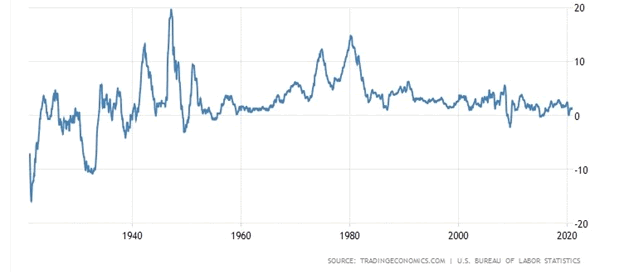

US inflation rate, 1914-2021. Source: Trading Economics, US Bureau of Labor Statistics

Stage 1: base metals

We know from previous articles that certain metals have done very well under government-mandated restrictions. In countries where the virus got into the mining workforce, mines were shut down temporarily, impacting 2020 production. This happened in South America, including top copper producers Chile and Peru, and the number 1 silver mining country, Mexico. When combined with robust demand from China, the top metals consumer, the prices of copper, silver, zinc and nickel, just to name a few, had nowhere to go but up.

So fa,r we haven’t seen the effects of higher metals prices on the juniors who explore for them, but we believe it’s coming. The supply side of the equation for several of these metals is bullish — copper, for example, is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles — so it’s only a matter of time before we get the demand driver, in the infrastructure programs that are being rolled out not only in the US but in China and Europe; they will require a lot of metals that are already facing supply deficits.

This is the first stage of what we, and others including the big investment banks like Goldman Sachs, see as the next commodities bull market. Stage 2 involves precious metals.

Stage 2: precious metals

There is a close relationship between inflation and gold prices. Gold is a hedge against inflation, so it is generally bought when inflation goes up, or looks like it will, to guard against currency devaluation. Also, when inflation rises, there is a risk to gold holders that the central bank will raise interest rates to stop the economy from overheating ie., from goods and services prices rising so high they begin to affect macro-economic spending. When this happens, investors often flee gold to get higher yields from bonds and other fixed-income assets.

It’s interesting to note that the Federal Reserve has already announced it is willing to allow higher inflation rates than normally. Clearly the Fed senses how vulnerable the economy is right now, and it will be very careful about raising interest rates too soon, that might stamp out any green shoots of recovery.

This week Fed Chairman Jerome Powell signaled the central bank is nowhere close to pulling its supports for the pandemic-damaged US economy. “The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,” he told the Senate Banking Committee, Tuesday. Meaning continued Fed buying of assets and keeping interest rates low.

Powell said the Fed will continue buying $120 billion of assets per month, including $80 billion of Treasury securities and $40B of mortgage-backed debt, until substantial progress is made towards its twin goals of maximum employment and 2% inflation.

On the spending side of things, it is significant that Janet Yellen, Biden’s pick for Treasury secretary, has embraced the new administration’s spending philosophy. Earlier this month, Yellen told CNBC’s Closing Bell, “We think it’s very important to have a big package [that] addresses the pain this has caused – 15 million Americans behind on their rent, 24 million adults and 12 million children who don’t have enough to eat, small businesses failing.”

The American government has already spent $4.5 trillion on covid, and the Fed has added around $7 trillion to its balance sheet. The national debt is $28 billion and clearly going higher, with most of the spending promises not yet put into action.

This big-spending environment is bound to be good for gold prices. Not only is it inflationary, on the scale of historical spending imperatives like the New Deal of the 1930s or the Second World War, but the kind of spending we are talking about will increase the debt to GDP ratio, and lower the dollar.

In an earlier article we showed the close relationship between debt to GDP ratios and gold. The lower the GDP and the higher the debt, the better it is for gold. There is a case for higher US economic growth — the economy is predicted to grow about 5% this year — but for the debt to GDP ratio to fall, debt would need to decrease; the tidal wave of new spending virtually ensures this won’t happen.

When gold prices approach or re-take highs reached last summer, silver prices will follow; the white metal’s dual-demand drivers, being both a monetary and an industrial metal, has some analysts predicting it will out-perform gold in 2021.

Dollar weakness

Gold prices and the US dollar generally move in opposite directions.

It looks as though the only direction that the greenback is headed is down, thanks to the Federal Reserve’s accommodation of low interest rates and higher inflation.

Many believe that the dollar, which fell to a 2.5-year low last year, will continue to face downward pressure in 2021 regardless of how the covid situation unfolds.

Alex Kimani, writing for Safe Haven, goes further than that, stating that the buck could stay low for years, based on three factors: a strong euro, a dovish Fed, and more government stimulus.

Economist Stephen Roach stirred up controversy last summer when he predicted the USD will plummet 35% by the end of 2021. In an end of January column in Bloomberg, Roach re-affirmed his belief in a sinking dollar, arguing it will continue to lose value based on a widening US current account deficit, a stronger euro, and the Fed, which will do little to prop up any USD weakness.

CNBC adds that the dollar is also likely to fall due to geopolitical risks being lower with Biden as president, and the fact that US trade policy will probably become more predictable, without escalating tariff threats. (investors tend to move their funds into US dollars, or USD-denominated assets like Treasuries, in the event of destabilizing events like trade wars, civil unrest or military confrontations)

A cheaper dollar, naturally, will be welcomed by many US companies because it makes their goods more competitive abroad, but the problem is in that case, the dollar’s competing currencies are strengthened.

These gains go against foreign central banks’ efforts to boost economic growth, by keeping their currencies low in relation to the dollar. Doing so is necessary for keeping their exports competitive. A lower dollar, then, risks a currency war.

A currency war is what happens when those on the losing end of trading relationships decide to engage in a policy of currency devaluation. By keeping their own currency low against their trade competitors their exports will be cheaper. The race to worthless soon becomes a competition with successive rounds of currency devaluation spreading amongst former trade partners.

When debt to GDP is 200%, meaning that for every $1.00 the economy produces the country must, insanely, borrow $2.00, will the politicians finally realize the only way out is a Debt Jubilee that retires the massive accumulation of debt?

When people begin to realize that big spender Biden and co, are literally destroying the currency, they will instinctively flock to gold and silver for protection against currency debasement.

Conclusion

When just about every asset under the sun is currently overpriced, gold is on sale, as are gold (and silver) juniors which offer the best leverage to rising metals prices.

Copper, zinc, and other base metal juniors are also highly leveraged to metal prices, and they will be the first to move when large infrastructure projects designed to put people back to work and repair covid-damaged economies, begin rolling out. Several of these metals are already looking at supply constraints, such that the increased demand will surely raise prices further and attract investment capital to the junior space.

The second group of juniors to catch fire will be precious metals explorers. When the deluge of spending about to be launched by the Biden administration, starts working its way through the economy, expect investors to revisit their junior gold and silver plays, which had the hot hand last summer.

When spending “out the wazoo” becomes the flavor of this administration, when debt piles up and inflation moves higher, the smart money will flow into gold and silver juniors, especially those with a deposit likely to be of interest to a major mining company or financing partner.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2021 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.