Why Palladium Is on a Tear / Commodities / Palladium

Physical palladium and rhodium markets are buzzing. Reportedprices for both metals leapt higher in recent days.

The story behind palladium’s move is that aphysical shortage has developed in London. Traders sold metal they didn’tphysically possess. Now they are being asked to deliver the bars andthey are scrambling to secure the metal needed, bidding prices higher.

It looks like bullion bankers selling paper metal are finallygetting called for selling way more than they can actually deliver!

People have complained about this practice in precious metalsmarkets for decades.

More and more contracts have been sold, but inventories ofactual physical metal have not kept pace. Price discovery is broken when thepaper price of metal is detached from physical supply-and-demand fundamentals.

Today, there are hundreds of paper ounces floating around forevery ounce of physical metal eligible for actual delivery.

As soon as a few contract holders lose confidence in theirability to redeem the paper for actual metal, the jig is up. The rush forphysical bars will drain exchange vaults quickly and anyone still holding paperwhen the music stops will be out of luck.

That may be happening now in the market for palladium.

Sellers with an obligation to deliver physical metal can leasebars, rather than purchase them. But that is now a very expensive proposition.Lease rates spiked to near 30% last week in London. Lessees must promise toreturn the quantity leased plus 30% in additional palladium ounces.

New Cautions on Rhodium

Rhodium prices have surged along with palladium. Pricediscovery in rhodium works differently than for other precious metals, so investorsneed to be especially careful.

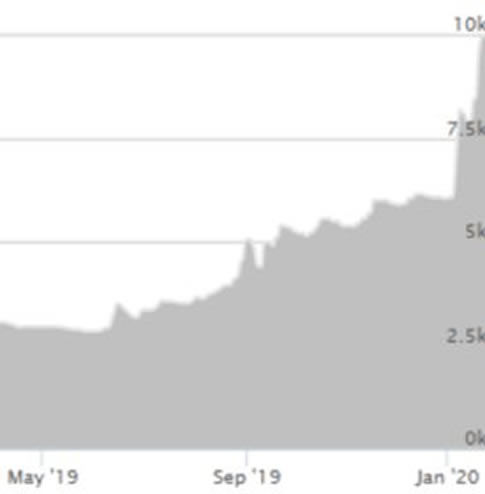

The “spot” price for rhodium surged to $9,985 lastweek. However, that price does not come from a market where regular tradingproduces live, real-time prices.

Rather, the rhodium ask price is simply declared by majorrefiners. Johnson Matthey is one of the firms which publishes a price.

Rhodium2-Year Chart

The price is generally updated twice per day during the tradingweek.

Lately the published ask prices jumped dramatically higher. Bidprices, on the other hand, have not kept up.

The bid/ask spread in the thinly traded rhodium market hasalways been wider than in other precious metals, but it’s wider now than ever.Current bids are roughly $2,000 below the published ask price.

If there really are industrial users paying the refiners’$10,000 ask price for physical rhodium, it is quite an opportunity forarbitrage. Traders could theoretically purchase bars at the bid price and sellthem at a very healthy profit to anyone paying the ask price.

That isn’t happening, at least as far as we can determine.Someone may have published a $10,000 ask price, but we can’t locate anyoneactually paying that sum for rhodium bars.

Despite what the surging “spot” price for rhodium may imply, thebid for physical rhodium remains weak.

Money Metals has taken dozens of calls per day from sellerstrying to cash in on spot prices near $10,000/oz. Many are disappointed to findactual prices are far lower which is a result of wholesalers dropping theirbids. We believe one major rhodium buyer will cease further buying soon.

The rhodium market is tiny and illiquid. Price discrepancieslike the one we are seeing are common. Our advice to clients would be not toput much credence in the “spot” price they see published until the spread ismuch tighter than it currently is.

The true price of rhodium, like all assets, is based on whatreal buyers are actually paying. That is currently closer to $8,000/oz, not$10,000/oz.

By Clint Siegner

Clint Siegner is a Director at MoneyMetals Exchange,perhaps the nation's fastest-growing dealer of low-premium precious metalscoins, rounds, and bars. Siegner, a graduate of Linfield College in Oregon,puts his experience in business management along with his passion for personalliberty, limited government, and honest money into the development of MoneyMetals' brand and reach. This includes writing extensively on the bullionmarkets and their intersection with policy and world affairs.

© 2019 Clint Siegner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.