Why Silver Prices Havent Rallied . . . Yet

Peter Krauth of the Silver Stock Investor shares his thoughts on silver and where he believes it is headed.

I get this question all the time: "If there's so much demand for silver, and it's in ongoing deficits, why hasn't the price moved?"

It's a legitimate question and one that I've been asking myself for a while.

The setup in silver could hardly be more compelling. Supply is flat. Silver miners don't expect any growth in mined silver supply for years. Mine supply peaked at around 900Moz in 2016, then gradually fell to the current roughly 800Moz, and it's likely to stay there for some time going forward.

And yet this is in the face of robust and growing demand, led of course by industrial demand and more specifically by solar. The photovoltaic industry's silver needs have essentially tripled in the last decade, reaching 190Moz last year, and is expected to surpass 200Moz this year.

In the last few years silver industry research has been notoriously conservative. Since I follow silver closely, I decided to compare forecasts for 2023 with eventual revisions for different aspects of the silver market. Here are some main points using Metals Focus data.

Overall supply was expected to rise by 2%, but it was revised down by 2%Industrial demand was expected to grow by 4%; instead, it was revised upward to 8%Solar demand was expected to come in at 140Moz; instead, it was revised upward to 190MozThe supply deficit was expected to reach 142Moz; instead, it was revised upward to 194Moz.These are some pretty big misses. And they further beg the question as to why silver has yet to move significantly higher.

So, I decided to research this phenomenon to try and find an answer. While I can't be certain that my conclusions explain all of silver's sideways movement over the past few years, I'm quite sure they have had a sizeable impact.

First you need to understand what happens with the silver supply brought to market every year. It consists of mined supply and recycling, and dishoarding (holders of physical silver selling back to the market).

A large portion goes to industrial consumers; a smaller portion goes to investors in physical silver. The balance (surplus) typically goes to futures exchanges, like the COMEX (New York), LBMA (London), and SFE (Shanghai). This is what I call "secondary supplies or secondary inventories."

Interestingly, in the last four years the silver market has had structural deficits. This means that demand has exceeded mined supply and recycling supply.

And yet, if there's a consistent shortage, why isn't the silver price higher?

Well, it seems many (I believe mostly large) buyers have been tapping these "secondary supplies." (These are supplies that don't need to be mined and produced they are simply sitting there). In fact, I've had that suspicion for some time. Then I rolled up my sleeves and went searching for data.

Here's what I found.

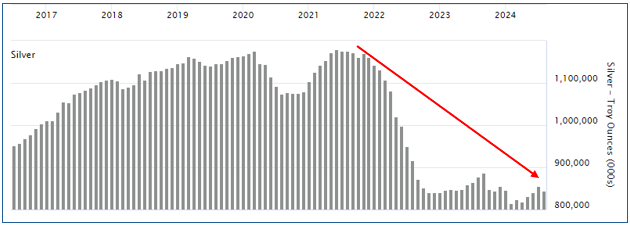

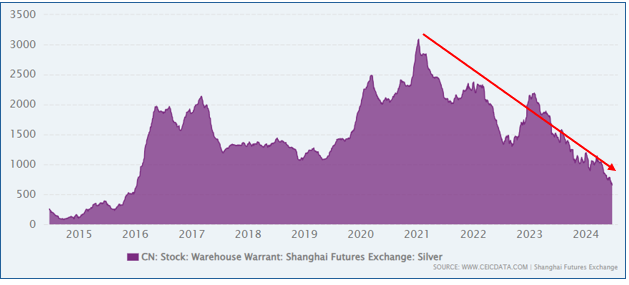

As it turns out, all three major futures exchanges the COMEX, LBMA, and SFE have seen their inventories drop significantly over the last three years, to the tune of about 40-50%.

Here's what that looks like. . .

COMEX Silver Inventories

LBMA Silver Inventories

SFE Silver Inventories

Now, as impactful as this may seem, it's not the whole story.

You see these charts show overall silver inventories. What they don't show is registered inventories, which are the portion of overall inventories that are actually available for delivery. And the numbers I've found indicate that registered silver inventories are down at least 70% over the last three years.

Now let's look at silver ETFs. Globally, silver held by ETFs is down about 30% in the last three years. Consider too that there is some overlap here, as some of the silver that backs ETFs is held at futures exchanges, like the LBMA. Nonetheless, the pattern is clear: physical silver is being drained from the major futures exchanges and silver ETFs.

And one last point to be made on silver ETFs. Established in 2006, SLV is the world's first and largest silver ETF, with a market cap of nearly $10 billion. That's a lot of silver. Actually, that's nearly 425Mmoz., or half of an entire year's mined supply. Add in the other silver ETFs globally, and you reach about 900Moz silver.

Global Silver ETF Holdings

So where is all the silver that's leaving the futures exchanges and ETFs going?

My thesis is that since large consumers are unable to source enough silver from miners and refiners (hence the deficits of the last four years), they are buying long futures contracts and standing for delivery at maturity. I believe some are also purchasing silver-backed ETFs and exchanging their units for the underlying physical silver. (If you own enough silver ETF units you can take delivery).

I believe this is where large consumers are sourcing their badly needed silver. And I say badly needed because one large silver mining CEO recently confided that they sell their silver to China and to the West. But the market is extremely tight. Their Chinese buyers are anxious to get delivery, willing to pay up to two weeks in advance and, get this, up to $3 above spot prices in order to secure their supply.

Given how China absolutely dominates solar panel manufacturing and demand from this sector is soaring, it's not surprising that we are facing very tight supplies and that the Chinese are anxious to get their silver.

The bottom line is these large silver consumers are, for now, tapping secondary supplies. And that's contributing to upside resistance in the silver price.

It's hard to know how many ounces there are in this category as there is no clear data. And if you include privately owned silver, that makes the waters even muddier.

Still, if we continue along the same path, draining futures markets and silver ETFs, my best estimate is that we may have 12-18 months before these secondary inventories dry up.

What could happen at that point? Well, a large futures contract holder may be told that there's no silver left to deliver and that they will have to instead accept a payout in cash for their contract.

But cash is clearly not silver.

When that happens, that large silver consumer is going to scream. And we will hear about it.

That's not to say silver can't move before, for a number of reasons. In fact, I think we'll see silver follow gold strongly higher this year. And any number of economic or geopolitical shocks could trigger a blistering rally.

It's just that if a large silver consumer needs its silver and, if they don't get it, that's likely to surprise the market.

Remember the silver market is extremely tight as it is. For now, I think these large silver consumers are able to tap the futures and ETF market. But that can't go on forever.

When those inventories run out, I expect that will help trigger a huge rally in silver and silver stocks.

[NLINSERT}

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Silver Stock Investor Disclosures

EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by copyright laws and may not be reproduced in any form for other than personal use without prior written consent from the publisher.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Resource Maven (Maven) nor its affiliates assume any responsibility to update this information. Maven is not registered as a securities broker-dealer or an investment adviser in any jurisdiction. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Maven cannot and does not assess, verify, or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Maven in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Maven accepts no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content.

The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Maven does not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites. Maven has not reviewed the Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website's users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer, or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.