Why You Must Own Silver in 2018 / Commodities / Gold and Silver 2018

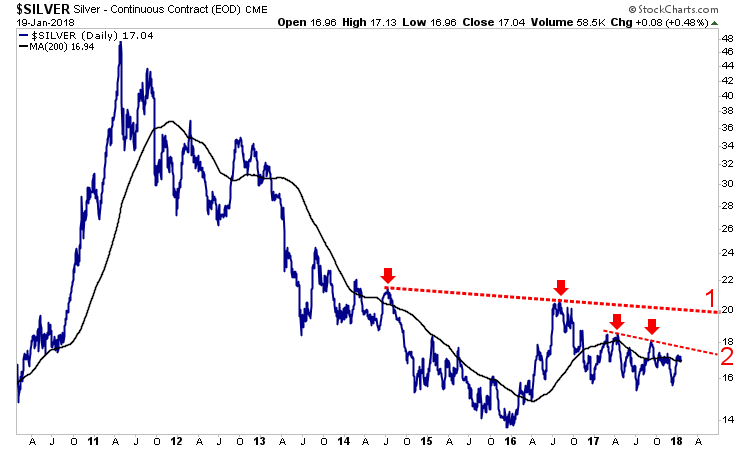

While Gold is very close to a major breakout(in price) its strength has not filtered down to Silver yet. Gold is 3% awayfrom a major breakout and comfortably above its long-term moving averages.However, Silver is well below its 2016 high and is currently battling its200-day moving average. But that is okay. Silver typically lags andunderperforms Gold until Gold gains momentum or breaks key resistance. A majorbreakout in Gold this year and its effect on Silver is just one reason whySilver could have a big year.

While Gold is very close to a major breakout(in price) its strength has not filtered down to Silver yet. Gold is 3% awayfrom a major breakout and comfortably above its long-term moving averages.However, Silver is well below its 2016 high and is currently battling its200-day moving average. But that is okay. Silver typically lags andunderperforms Gold until Gold gains momentum or breaks key resistance. A majorbreakout in Gold this year and its effect on Silver is just one reason whySilver could have a big year.

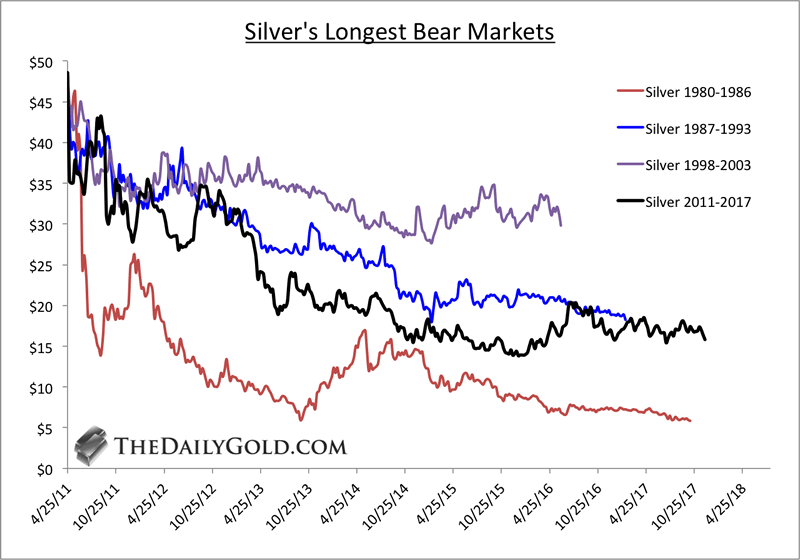

If and when Silver breaks above its 2017highs, we can declare its bear market over (in terms of time). The chart belowplots all of the major bear markets in Silver. They all end at the point whenSilver begins to make higher highs and rises in an impulsive fashion. Silver’sbear market was the second worst by price and potentially the worst in terms oftime.

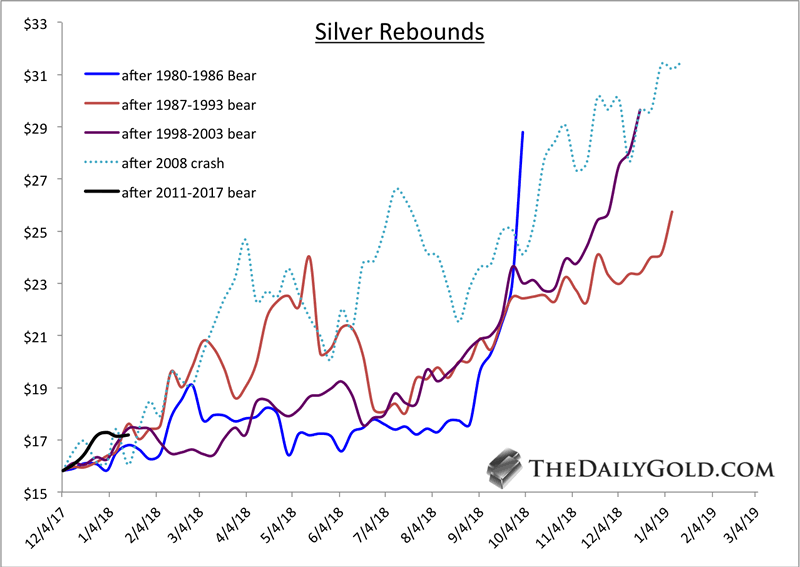

The next chart shows the rebounds in Silverfrom the endpoints in the previous chart. From the three endpoints Silverrebounded significantly in the next 12-15 months. We also included the 2008crash from which Silver rebounded 100% in the following 13 months.

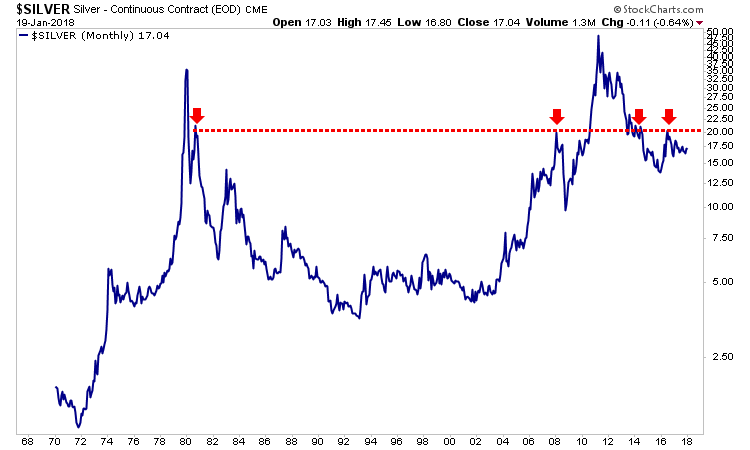

Turning back to the present, we find $20 on amonthly closing basis to be the most significant resistance for Silver. Thechart below is a plot of monthly closing prices. It is quite clear that amonthly close above $20 (the 2016 high) could kickstart a good run for Silver.

Moving from the very long-term to the present,we note that Silver faces initial resistance at trendline 2 as well as the 2017highs near $18/oz. That stands between Silver at present and the important $20resistance (which is also shown at trendline 1).

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.