Why You Should Wait To Buy Gold: The Opportunity Cost Of Holding The Metal Is Still Rising (For Now)

The opportunity cost of holding gold is short-term real interest rates.

If real rates continue to rise, gold will continue to struggle.

Inflation expectations have been falling faster than nominal rates, keeping real rates high.

When real rates move lower, gold will breakout to the upside.

Why You Should Wait To Buy Gold: The Opportunity Cost Of Holding The Metal Is Still Rising (For Now)

Roughly seven months ago, in August of this year, I penned a note to subscribers of my premium Marketplace service titled, "If You Want To Buy Gold, Watch The Fed." In that note, I wrote that I was cutting my exposure to gold to the minimum allowable exposure for the model portfolio strategy.

The reason I reduced the position in gold was that the outlook was for the Federal Reserve to continue raising interest rates and reducing the balance sheet, which would surely push short-term rates higher (increasing real rates). Since cutting this exposure almost seven months ago, gold has fallen about 7%, dropping as much as 11% at the end of August.

GLD Percent Change Since April:

Source: YCharts, EPB Macro Research

A few months later, in October, I followed up with another note on gold called, "So, You Were Early On Gold? Is It Time To Buy Yet?" in which I reiterated the original thesis on increasing short-term interest rates as well as advocated patience when it came to buying gold. In that article, I said that the time to start buying gold was very close but that it was imperative to wait for real interest rates to stop going higher before stepping in and increasing exposure to the precious metal.

The primary driver of gold is real interest rates. Real interest rates are the opportunity cost of holding gold and thus, gold moves inversely to the direction in real rates. Real interest rates are the inflation-adjusted risk-free rate. Gold is money. The opportunity cost of holding gold is the risk-free, inflation-adjusted yield of short-term interest rates.

The most important thing to understand is that we are not worried about the nominal level of real interest rates but rather the trending direction in real interest rates. Are real interest rates moving higher or lower? More on this to come in the analysis below.

With gold up about 2% since the last writing and the Federal Reserve starting to waver on future interest rate increases, this is a great time to recap the thesis and start positioning for a potential increase in exposure to gold should the expectation be that real interest rates will start to move lower.

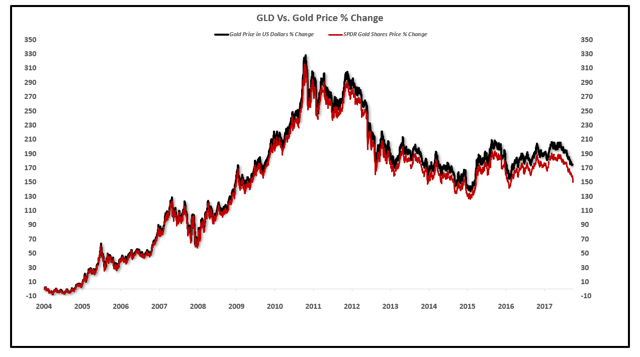

As I wrote in the last two notes on gold, for the following analysis, I will be using the SPDR Gold Shares ETF (GLD). GLD is the easiest replacement for physical gold in a portfolio as the ETF is backed by physical gold holdings and the price change nearly exactly matches the underlying asset as shown below.

GLD Vs. Gold Price % Change:

Source: YCharts, EPB Macro Research

Everyone has an opinion on gold and the ETF GLD.

I am not interested in having a discussion on the downsides of GLD in this article; that is for another time. I am focused on the trending direction in the price of gold, which will be captured by the GLD ETF.

I use the ETF GLD and find that it replicates the change in the price of gold very well, in addition to being a safe ETF.

Others may disagree and prefer to hold the physical metal, which is fine, and having a percentage of total assets in the physical metal likely makes a lot of sense, but for this analysis, GLD will be used interchangeably with gold as their price fluctuations nearly exactly mirror each other.

GLD Vs. Physical Gold:

Source: iShares

The next section will review the relationship between gold, the Federal Reserve, inflation and real interest rates.

Gold, Inflation, Interest Rates, The Fed & More

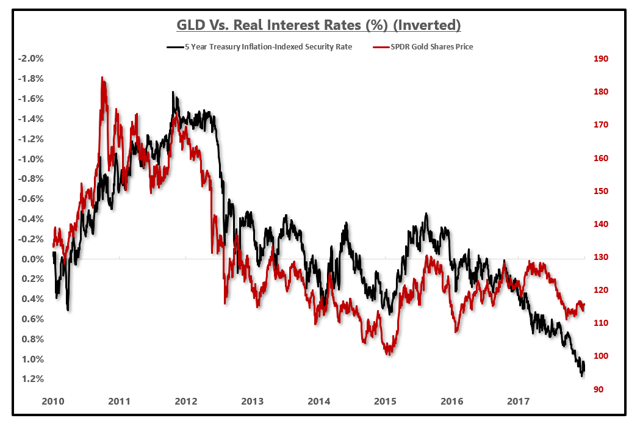

Gold trades inversely to the trending direction of real interest rates.

Real interest rates are nominal interest rates minus inflation expectations.

For example, if the 5-year Treasury rate is 3%, and the 5-year breakeven inflation rate (inflation expectations over the next five years) is 2%, the real 5-year real interest rate is 1%. If the real interest rate moves from 1% to 2%, gold will likely fall as the opportunity cost of holding gold, will be higher. If real interest rates move from 1% to 0%, there is less of a cost to holding gold over short-term paper, thus increasing the price of the yellow metal.

To reiterate a point made above, it is not the level of real interest rates that matters but the rate of change in the direction of real interest rates.

If real interest rates are 10%, there is nothing to be done with that information unless you know where real interest rates were before, 15% or 5%? If real rates are increasing, that is on balance negative for gold. If real rates are falling, that is a favorable environment for gold.

Gold Vs. Real Interest Rates (Inverted): Source: YCharts, EPB Macro Research

Source: YCharts, EPB Macro Research

As mentioned, there are two components to real interest rates; nominal rates (regular Treasury rates) and inflation expectations (breakeven inflation rate).

The time to buy gold is when interest rates, specifically real interest rates, start to move materially lower.

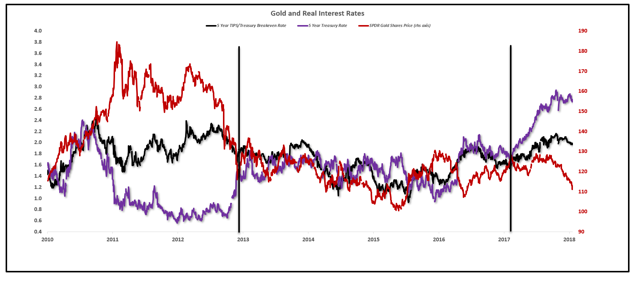

The chart below is broken into three time periods.

The red line represents the price of the ETF GLD. The black line represents the market's expectation of inflation over the next five years (5-year breakeven rate). The purple line represents the five-year Treasury rate.

In the first time period, the expected inflation rate was substantially higher than the nominal interest rate. This is a period of "negative real rates." Gold prices soar during periods of negative real rates as it did from 2010 through most of 2012. The best recipe for gold is a time period of rising inflation and falling interest rates.

Currently, inflation is falling, and interest rates are rising which is increasing real interest rates.

The second time period shows the expected inflation rate and the nominal interest rate moving in-line, and gold responded by moving sideways as well as real interest rates remained relatively flat during that time period.

The final time period shows interest rates rising very rapidly. Inflation has not kept pace with the rise in interest rates. Although inflation expectations have been rising throughout the third time period, the increase in interest rates has been significantly faster causing the real interest rate to rise.

The price of gold performs the worst during periods of rising real interest rates as we have today.

Gold and Real Interest Rates:

Source: YCharts, EPB Macro Research

Source: YCharts, EPB Macro Research

Gold does not trade with inflation in insolation. That is a widespread misconception.

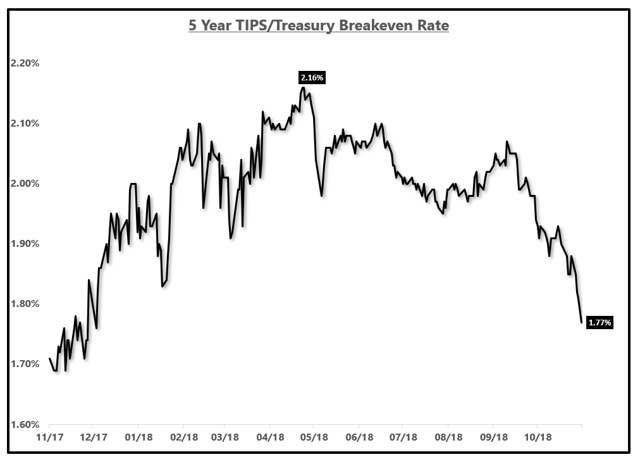

We are currently at a potential inflection point. Inflation expectations are falling due to crashing oil prices which is having an upward bias on real interest rates. The Federal Reserve has not yet blinked and continues to stand strong on raising interest rates which has not allowed short-term rates to move much. The combination of falling inflation expectations and flat short-term rates is keeping real interest rates elevated.

5-Year Inflation Expectations Have Crashed Due To Oil:

Source: YCharts, EPB Macro Research

If the Federal Reserve blinks, which the market thinks they may soon, short-term rates may start to fall rapidly, faster than inflation expectations, pushing real rates lower and gold higher.

Source: YCharts, EPB Macro Research

The two key factors to watch are short-term rates (the Fed) and inflation expectations.

Gold & Inflation: Not Correlated In Insolation

Many investors buy gold as an inflation hedge, and that can be a profitable investment some of the time, but the irony is that the price of gold reacts more to the move in interest rates during a period of inflation rather than the inflation itself. If interest rates rise more than inflation rises, this hedge will not be successful as real interest rates will be moving higher, increasing the opportunity cost of holding the metal.

Inflation must rise faster (or more) than interest rates rise for gold to perform well.

To prove this point we can use recent history.

The following chart shows the three inputs we have been discussing; the price of gold, the inflation rate, and the nominal 2-year Treasury yield, graphed from 2016-present.

Over the time period in the chart below, inflation increased from a rate of 0.82% to 2.52%. In isolation, some investors may have believed that if inflation were going to rise 170 basis points, gold would do well. Over the same time, interest rates rose from 0.65% to 2.86%, 221 basis points. Given that interest rates rose more than inflation rose, real interest rates increased, and gold dropped from $1,350 per oz to $1,214 per oz, a decline of 10% during a period of "rising inflation."

Interest Rates, Gold & Inflation:

Source: YCharts, EPB Macro Research

The opportunity cost of holding gold was increasing, even though inflation was rising.

If the Federal Reserve had not increased short-term interest rates during this time period, and the 2-year yield stayed at 0.65% while inflation was rising then gold would have most likely dramatically increased in value.

With that being said, let's talk about the Federal Reserve and the impact their policy can have on the price of gold.

Gold Will Pop When The Fed Blinks - Why? - Because Real Interest Rates Will Be Moving Lower

The Federal Reserve has significant influence over short-term interest rates. The Federal Reserve cannot control long-term rates, such as the 30-year yield, but the direction of shorter maturity Treasuries, such as 2-year yields and 5-year yields, are heavily influenced by the Federal Reserve and their plans for interest rate changes.

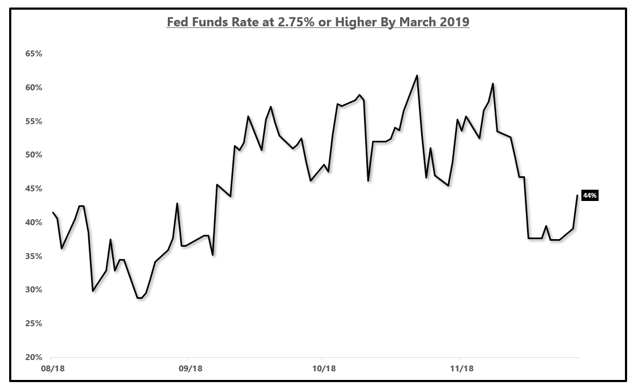

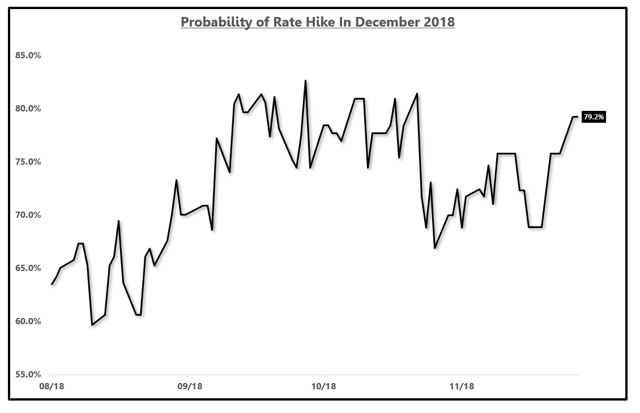

The Federal Reserve is signaling that they want to continue to raise short-term rates and the market believes them. The market is assessing a greater than 79% probability that the Fed raises rates in December of 2018 based on Fed Funds futures.

December Rate Hike Odds History: Source: CBOE, EPB Macro Research

Source: CBOE, EPB Macro Research

Furthermore, the market thinks there is about a 44% chance that the Fed raises rates again in March of 2019.

The Probability of More Rate Hikes In 2019 (March Fed Meeting):

Source: CBOE, EPB Macro Research

If the market continues to believe that the Federal Reserve will raise rates, and the Fed actually continues to do so, that is one major component to real interest rates that will put downward pressure on gold.

If the short-term rates continue to rise, as it appears they will, for now, inflation would need to rise faster than the rise in interest rates to have decreasing real interest rates, a favorable environment for gold.

Inflation expectations have been falling, another ingredient to the recipe for higher real interest rates. Higher short-term rates (Fed raising rates) and lower inflation continue to push real rates higher, a bad environment for gold.

Source: YCharts, EPB Macro Research

If short-term rates rise and inflation falls, that is a double whammy for the price of gold as real interest rates would be rising.

If the Fed raises rates in December and then signals that rate hikes are done, short-term rates may fall in an attempt to price out future increases, which can be positive for gold. It comes down to short-term rates, which are for the most part dictated by the expected path of Fed tightening and the expected rate of inflation.

It appears that gold has some headwinds with short-term rates expected to keep rising and inflation moderating due to oil prices. Gold bulls need the Fed to blink in order to see a major reversal (multi-month trend) in the price of gold.

Once the Federal Reserve ends the tightening cycle, the time to buy gold will be near.

Should You Care About The US Dollar When Buying Gold?

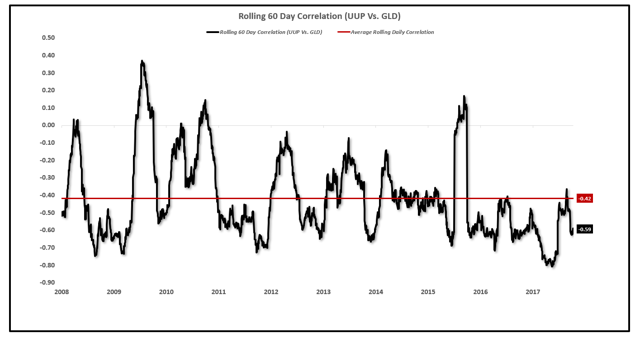

The US Dollar also plays a roll in the direction of gold as the US Dollar and gold, on average, have an inverse correlation. A rising US Dollar has the potential to bring down inflation which can raise real interest rates. A declining dollar is not the biggest factor, but it certainly can help the price of gold. Since 2008, the US Dollar and gold have had roughly a 0.4 inverse correlation with periods of time lower and periods of time with a positive correlation.

60 Day Rolling Correlation (US Dollar Vs. Gold): Source: YCharts, EPB Macro Research

Source: YCharts, EPB Macro Research

The direction of the US Dollar is not as impactful to the price of gold as interest rates are.

If the dollar moves materially, the price of gold may adjust, but small moves in the dollar are not likely to move gold like the direction of real rates will.

A rising US Dollar over the past six months has certainly kept a lid on the price of gold but the increase in real rates has been the key driver.

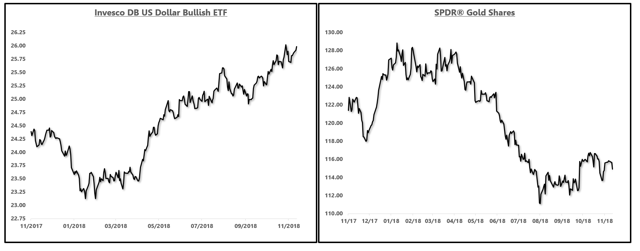

Gold and US Dollar One-Year Performance:

Source: YCharts, EPB Macro Research

Source: YCharts, EPB Macro Research

Risks To Thesis - Why Gold Can Rally

As noted above, but just to reiterate, the main factor that will cause gold to rally is a pivot dovish by the Federal Reserve. Any indication that causes the Fed to back off future rate increases will more than likely cause a significant drop in short-term interest rates. All else equal, meaning no change in inflation expectations, a drop in short-term interest rates will cause real rates to fall as well, pushing up the price of gold.

I am of the opinion that based on the economic cycle slowing globally and domestically and inflation expectations coming down rapidly, and perhaps sprinkled with some added pressure from President Trump, the Fed is near the end of the tightening cycle.

It appears the rate hike in December is a go. While the market is still saying there are better odds of no rate hike in March than a rate hike (44% chance), I think after the December meeting, those numbers come down.

The time to buy gold is getting closer by the day, but you may have to wait until the December FOMC meeting.

If the Fed stands firm and raises rates and guides for more increases to come, gold will dip, and it would have been prudent to wait.

Summary

Gold thrives with declining real interest rates. Real interest rates are still rising.

If you want to buy gold, you need to get the direction of real interest rates right. The Federal Reserve has a major influence over the short-end of the Treasury curve.

Once the Fed blinks on tightening monetary policy, rates will move lower and gold will move higher.

I am a long-term investor focused on capturing the major, multi-year trends in various asset classes. I continue to watch gold and the factors that influence the price.

I am not looking to pick a spot for 5%-10% upside but rather step in at a time when there will be a cyclical change in the direction of real interest rates and thus a major trend reversal in the price of gold.

Risk Management & Portfolio Allocation Strategy

EPB Macro Research uses macroeconomic data to identify inflection points in the economy and provides two asset allocation models that are best suited for the current environment so that your portfolio is always protected from the next downturn.

If you would like to see the complete asset allocation model with exact percentages, consider joining EPB Macro Research.

There is no risk in trying EPB Macro Research for a free two weeks.

Be prepared for the next major market move.

Click Here To Start Your No-Risk Free Trial

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Eric Basmajian and get email alerts