Why You Shouldn't Get Excited About Gold Price Mini-Rally / Commodities / Gold and Silver 2021

Gold seems to be sleeping off itslatest mini-rally and lacks the momentum to reach new highs. What happens fromhere? Has the USD bottomed? And what does it mean when we factor in the EUR/USDpair and poor economic indicators from Europe into the equation?

Not much happened yesterday (Jan. 21),but what happened was relatively informative. And by “relatively” I meanliterally just that. Gold moved lower yesterday and in today’s pre-markettrading, doing so despite another small move lower in the USD Index. The movesare not big, but they are meaningful. They show that gold’s inauguration-dayrally was likely a temporary blip on the radar screen instead of being agame-changer.

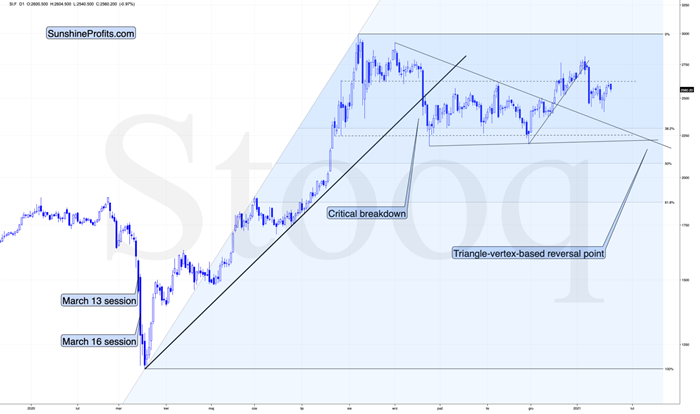

Figure1 – COMEX Gold Futures

Looking at the above gold chart, I markedthe November consolidation with a blue rectangle, and I copied it to thecurrent situation, based on the end of the huge daily downswing. Gold movedbriefly below it in recent days, after which it rallied back up, and right nowit’s very close to the upper right corner of the rectangle.

This means that the current situationremains very similar to what we saw back in November, right before anotherslide started – and this second slide was bigger than the first one.Consequently, there’s a good reason for gold to reverse any day (or hour) now.

Besides, there’s also a decliningresistance line just around the corner.

And that’s not even the most importantthing. The most important thing is that based on the similarity to how thingsdeveloped between 2011 and 2013, gold’s downward trajectory is likely to haveperiodic corrections at this time – up to a point where it simply plunges.

Figure2 - GOLD Continuous Contract (EOD)

When the current situation is compared towhat we saw about a decade ago, it shows what one should expect, assuming thatthe history repeats itself.

Gold kept on declining with correctionsalong the way until April. In April, the decline accelerated profoundly. Thebiggest problem with the latter was that practically nobody expected this kindof volatility. Those who were thinking that it’s just another move lower thatwill be reversed were very surprised.

Right now, you know in advance that abigger move lower is likely just around the corner, and you won’t be surprisedwhen it comes. Whether we have to wait an additional few days or first see goldrally by $10 or $30 is not that important, if it’s about to slide $150 and thenanother $200 or so.

I would like to add that gold isdeclining today and based on the similarity to the November consolidation, it’sexactly the day when we should expect to see a decline. Of course, thesimilarity doesn’t have to persist, and the history doesn’t have to repeatitself to the letter, but what’s happening right now seems to be confirming theanalogy in a considerable way. This means that more declines are likely justaround the corner. If not immediately, then shortly.

Figure3 - COMEX Silver Futures

Silver turned south after reaching(approximately) the price level that stopped the rally in July and November2020, and also earlier this year. This seems relatively natural and the outlookfor silver remains bearish for the next several weeks.

Silver corrected a bit more of thisyear’s downswing than gold, which is normal given the bearish outlook. The samegoes for miners’ underperformance. Let’s keep in mind that silver’s “strength”is temporary – once the decline really starts, and it moves to its final part,silver is likely to catch up big time.

Figure4 - VanEck Vectors Gold Miners ETF

As far as the miners are concerned,mining stocks didn’t correct half of their 2021 decline. They didn’t invalidatethe breakdown below the rising support line, either. In fact, the GDX ETFclosed yesterday’s session below the 50-day moving average. Technically,nothing changed yesterday.

Please note that the November – todayconsolidation is quite similar to the consolidation that we saw between Apriland June (see Figure 4 - green rectangles). Both shoulders of thehead-and-shoulder formation can be identical, but they don’t have to be, soit’s not that the current consolidation has to end at the right border of thecurrent rectangle. However, the fact that the price is already close to thisright border tells us that it would be very normal for the consolidation to endany day now – most likely before the end of January.

If we see a rally to $37, or even $38, itwon’t change much – the outlook will remain intact anyway and the rightshoulder of the potential head-and-shoulders formation will remain similar tothe left shoulder.

However, does the GDX have to first rallyto $37 or $38 to decline? Absolutely not. It could turn south right away, thussurprising most market participants.

Figure5 – USD Index

In Tuesday’s (Jan. 19) analysis , I commented on the above USD Index chart in the following way:

TheUSD Index is after a major breakout above the declining resistance lines andthis breakout was confirmed. Consequently, the USD Index is likely to rally,but is it likely to rally shortly? The answer to this question is beingclarified at the moment of writing these words, because the USD Index movedback to its rising short-term support line that’s based on the 2021 bottoms.

Ifthe USD Index breaks below it, traders will view the 2021 rally as a zigzagcorrective pattern and will probably sell the U.S. currency, causing it todecline, perhaps to the mid-January low or even triggering a re-test of the2021 low.

Ifthe USD Index performs well at this time and rallies back up after touching thesupport line, and then moves to new yearly highs, it will be then that tradersrealize that it was definitely not just a zigzag correction, but actually themajor bottom. In the previous scenario, they would also realize that, butlater, after an additional short-term decline.

It’s now clear that the former scenariois being realized. The support levels that could trigger the USD’s reversal arebased on the potential inversehead-and-shoulders pattern – the red line that’s slightly above 90, and thehorizontal line that’s slightly below it. It’s also possible that the USD Indextests it yearly lows. None of the above would be likely to change the outlookfor the precious metals sector, at least not beyond the immediate term.

Later yesterday (Jan. 21) and also intoday’s overnight trading, the USD Index moved to the upper of theabove-mentioned support lines. Is the bottom already in? This seems likely, butit’s not crystal-clear yet. However, it doesn’t really matter, because theprecious metals market responded to the USD’s strength for just one day (in ameaningful way that is) and taking a closer look at that day reveals that itwas not the USDX’s performance that gold reacted to, but to the underlying news– the inauguration-day-based uncertainty. So, even if the USD Index declinessome more here before soaring, gold doesn’t have to move significantly higher.In fact, it would be unlikely to do so.

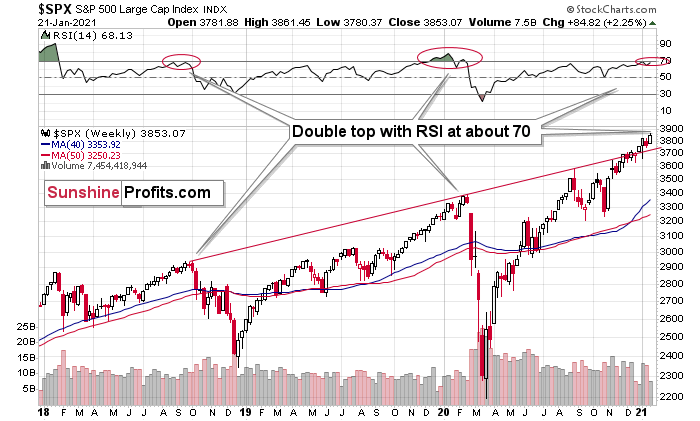

Stocks have rallied, and based on thisrally, the weekly RSI moved close to 70 once again.

Figure6 – S&P 500 Index

This is important because the last twomajor declines were preceded by this very signal. We saw the double-top in theRSI at about 70, exactly when the stock market started its big declines, andwe’re seeing the same thing right now. If this was the only thing pointing tomuch lower stock values on the horizon, I would say that the situation is notso critical, but that’s not the only thing – far from it. Before moving tothese non-technical details, let’s recall why the stock market analysis and theUSD index analysis matters for precious metals investors and traders.

The analyses matter because gold, silver,and mining stocks are likely to decline in parallel with a decline in stocksand the USD’s rally. This is likely to take place up to a certain point, whenprecious metals show strength and refuse to decline further despite the stockmarket continuing to fall and the USDX continuing to rally. This kind ofperformance happened many times, including in the first half of last year.

Since the S&P 500 futures are down intoday’s overnight trading, perhaps we have indeed seen a top. Even if not, itdoesn’t seem that one is very far away, based on how excessive the situationlooks from the fundamental point of view. Let’s discuss some of thosenon-technical issues.

Mind Over Matter

Despite Janet Yellen’s recentassertion that “the United States does not seek a weaker currency,” hertongue-in-cheek comments are actually doing just that. The newly minted U.S.Treasury secretary urged lawmakers to “act big” with regard to prospectivestimulus, saying that the benefits “far outweigh the costs.”

And since her worst-kept secret becamepublic on Jan. 18, the USD Index has been under fire ever since. Furthermore,as her words instill the EUR/USD with borrowed confidence, the precious metalsare displaying the same bold behavior.

Please see below:

Figure7

However, despite the narrativeoverpowering reality, the Eurozone fundamentals don’t support the recent rally.And why is this important? Because as you can see from the chart above, as goesthe EUR/USD, so go the PMs.

Yesterday, European Central Bank (ECB)President Christine Lagarde revealed that the Eurozone economy likely shrank inthe fourth quarter – all but sealing a double-dip recession.

Please see below:

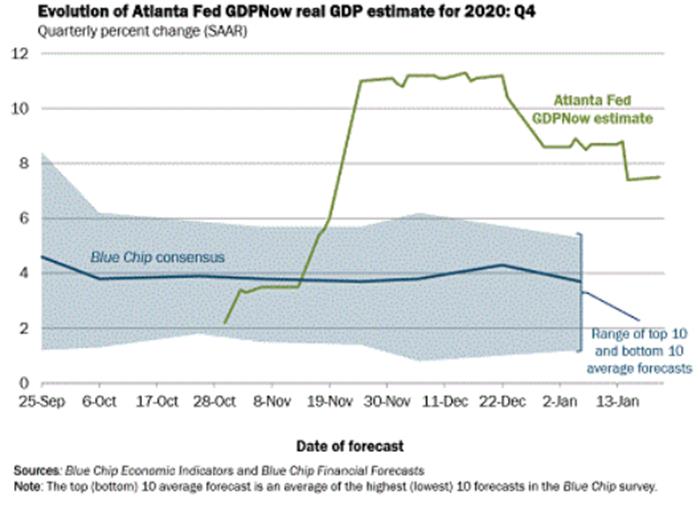

Figure8 – (Source: Bloomberg/ Holger Zschaepitz)

In contrast, the Federal Reserve Bank ofAtlanta’s GDPNow forecasting model (as of Jan. 21) has the U.S. economyexpanding by 7.5% in Q4. Furthermore, even if we take the Atlanta Fed’sestimate with a grain of salt, the Blue Chip consensus (forecasts made byprivate-sector economists) is for growth of nearly 4.0% (tallied as of earlyJanuary). And even more telling, economists with a bottom 10% Q4 GDP forecast ( see Figure 9 - the shaded light bluearea below) still expect positive growth.

Figure9

The bottom line?

We can now add the Eurozone GDP to thelong list of relative underperformances.

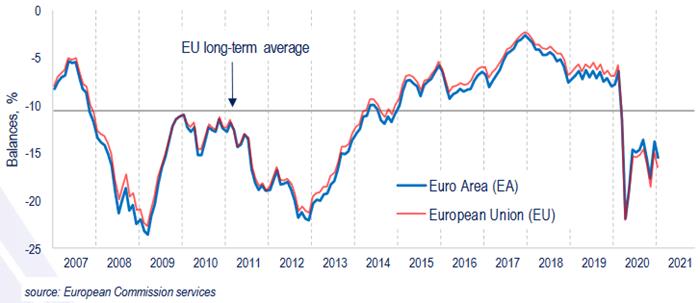

Expanding on the above, European consumerconfidence (released yesterday) went backwards again in January and is now lessthan 10 points above its April low. Furthermore, the current reading is stillwell-below the long-term average.

Figure10

On Jan. 8, I highlighted the significantdivergence between European CPI and U.S. CPI (inflation). For context, EuropeanCPI was – 0.30% in December (negative for five-straight months), while U.S. CPIwas 0.40% in December (positive for seven-straight months).

I wrote:

WeakCPI is a precursor to a weaker euro. Why so? Because since asset purchases failto produce any real economic growth, the ECB will be forced to lower interestrates to stimulate the economy. As a result, the cocktail of paltry economic activityand lower bond yields leads to capital outflows as foreign (and domestic)investors reallocate money to other geographies (like the U.S.). Thus, capitalwill likely exit the Eurozone and lead to a lower EUR/USD.

And today?

Well, it’s exactly what the ECB is doing.

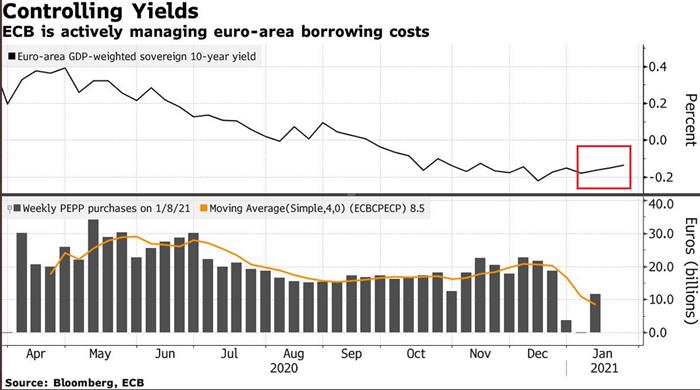

Due to the economic malaise confrontingEurope, the ECB is targeting its bond-buying activity toward financially weakercounties (like Italy) as opposed to financially stronger countries (likeGermany). Essentially, it’s conducting a shadow operation of yield curvecontrol (YCC).

Please see below:

Figure11

If you analyze the red box above, you cansee that Europe’s weighted-average bond yield has increased in 2021. And why isthis happening? Because as Europe’s economic deterioration merges with Italy’sfiscal plight, this cocktail has made European bonds riskier, and thus,investors demand a higher interest rate. And while higher interest rates arebullish for a country’s currency when they’re a function of economic growth, acrisis-like spike in yields (due to solvency concerns) means the exactopposite.

Furthermore, if you follow the gray barsat the bottom-half of the chart, the ECB actually decreased its bond purchasestoward the end of December (2020), Then, once January hit (2021), it was backto business as usual.

As a result, the ECB’s attempt to scaleback its asset purchases was (and will be) short-lived. And as the economicconditions worsen, the money printer will be working overtime for theforeseeable future.

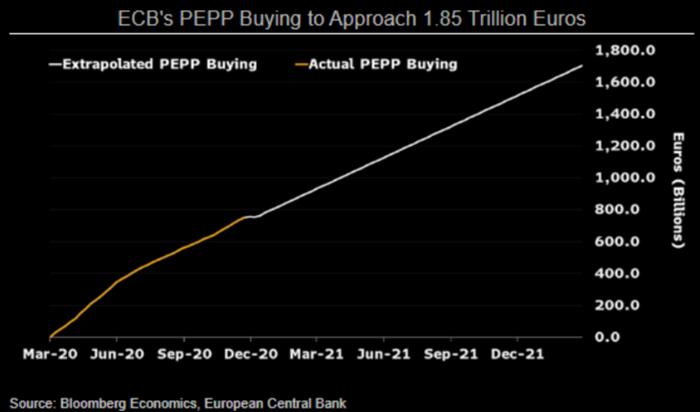

To that point, Bloomberg Economicsexpects the ECB to purchase €15 billion worth of bonds per week until 2022 –more than doubling its pandemic emergency purchase program (PEPP) to nearly€1.85 trillion.

Please see below:

Figure12

And in real-time?

Well, the ECB’s balance sheet hit anotherrecord-high on Friday (Jan. 15) – with total holdings still at 69% of EurozoneGDP (nearly double the U.S. Fed’s 35%).

Figure13

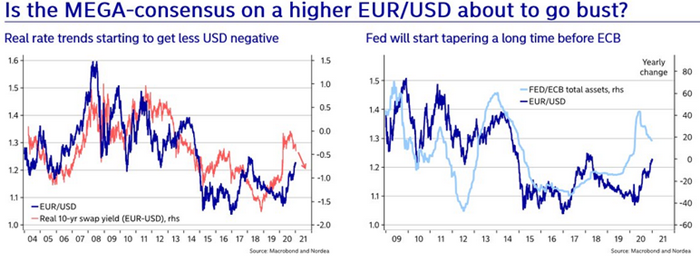

And why does all of this matter?

Because, as I highlighted on Jan. 12, theECB’s relative outprinting is a precursor to a lower EUR/USD.

Figure14

I wrote:

Turningto the second chart (Figure 6 - on the right), notice how the EUR/USD tracksthe FED/ECB ratio? To explain, the ratio (the light blue line) is calculated bydividing the U.S. Federal Reserve’s (FED) balance sheet by the European CentralBank’s (ECB) balance sheet. Essentially, its direction tells you which monetaryauthority is printing more money. If you analyze the EUR/USD (the dark blueline), it trades higher when the FED is out-printing the ECB (the light blueline is rising) and trades lower when the ECB is out-printing the FED (thelight blue line is falling). The key takeaway? With the light blue linefalling, it means that the ECB is outprinting the FED . And if this dynamic continues, theEUR/USD (the dark blue line) should move lower as well.

The top in the FED/ECB total assets ratiopreceded the slide in the EUR/USD less than a decade ago and it seems to bepreceding the next slide as well. If theUSD Index was to repeat its 2014-2015 rally from the recent lows, it wouldrally to 114. This level is much more realistic than most marketparticipants would agree on.

In conclusion, the EUR/USD’s recentstrength is built on a foundation of sand. Instead of following the hard data,traders are letting the narrative cloud their judgment. Moreover, due to theirstrong correlation with the EUR/USD, goldand silver are falling into the same trap. However, once the semblance ofstrength evaporates, a decline in the EUR/USD is likely to usher a move lowerfor the PMs. Furthermore, with gold already approaching the upper trendline ofits November consolidation channel, the momentum may wane sooner rather thanlater.

Thank you for reading our free analysis today.Please note that the above is just a small fraction of today’s all-encompassingGold & Silver Trading Alert. The latter includes multiple premium detailssuch as the targets for gold and mining stocks that could be reached in thenext few weeks. If you’d like to read those premium details, we have good newsfor you. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.