Will Global Slowdown Support Gold, or Is It Just Temporary? / Commodities / Gold & Silver 2019

Mayday, mayday,we are sinking! The global economy is slowing down. How serious is the currentslump? We invite you to read our today’s article about the true condition ofthe world’s economy and find out what are its likely implications for theprecious metals market.

Mayday, mayday,we are sinking! The global economy is slowing down. How serious is the currentslump? We invite you to read our today’s article about the true condition ofthe world’s economy and find out what are its likely implications for theprecious metals market.

Economists andmarket analysts often make volte-face. We remember that in 2018 the punditswere heralding the synchronized global growth. One year later all thetalking heads prophesy the synchronized global slowdown. What ishappening? How serious is the current slump? And what are the implication forthe precious metals market?

Well, it’s truethat the global economy did not start2019 the best. Stock markets plunged, while the American government was temporarilyshut down. Global manufacturing activity has slowed down. The export-orientedeconomies, such as Germany and Japan, were particularly hit. But even the US industrialproduction fell in January.What happened? It might be tempting to blame president Trump and his trade wars. After all, the slowdown in production began whenTrump raised tariffs on washing machines and solar panels.

However, there aremore factors contributing to the current slowdown that US trade policy. China might be actually the key. To seewhy, let’s go back in time to 2015. In that year, Chinese leaders tried to openthe country’s financial markets and to deleverage its economy, after all thestimulus added in the aftermath of the GreatRecession. It did not endwell – the stock prices collapsed, triggering turmoil in the global stockmarkets.

The downturn wasquickly stopped as the People’sBank of China eased its monetarypolicy while thegovernment ballooned its fiscaldeficit to about 15percent of GDP at the beginning of 2017 (we refer here to Goldman Sachs’estimates of true budged deficit, which is – surprise, surprise – significantlybigger than the officially reported by the government). Then, Chinese leadersfocused again on deleveraging the economy. As China decided to limit excessiveindebtedness, the budget deficit decreased, but domestic demand weakened.

Hence, the globalgrowth’s acceleration in 2018 was partly caused by China’s easy monetary and fiscalpolicy, while the global growth’s slowdown in 2019 waspartly caused by the China’s struggle to reduce its debts. Theanti-leverage campaign sank Chinese stocks, hit the shadow-banking industry andrestrained economic growth.

What is importanthere is that China has started again to focuson growth rather than on indebtedness. The PBOC has cut banks’ reserverequirements in January by 1 percentage point, after four previous cuts in2018, to free up more funds for lending. And regulators told big banks to increase loans to smaller firms by morethan staggering 30 percent, despite all the risks. So, it is not surprisingthat China’s credit growth and total new bank lending hit a record in January.The authorities will also add fiscal stimulus, as the government pledged support of over $300 billionincluding lower fees, tax cuts and massive infrastructure spending.

The fresh stimulusmay, thus, stop the global slowdown, orsoften it at least. The fact that China unscrewed taps with money again isanother argument against the belief that global recession is just around thecorner. Given the developments in China (and the likely end of tradenegotiations between China and the US), thecurrent slowdown should be temporary (however, it will take a few months to start feeding into the globaleconomy).

This is not good news for the gold market. The recession or deeper downturn could help theyellow metal to shine. Moreover, if the global economy accelerates in thesecond half of 2019 or in 2020, the Fed could end its pause and deliver further interestrate hike.

However, thecurrent stimulus is so far weaker than the previous one. It suggests that the global economy will not replay the synchronizedgrowth of 2017-2018. The China’s stimuli may rather provide a soft landingafter the deleveraging campaign and after the waning effects of Trump’s fiscalstimulus.

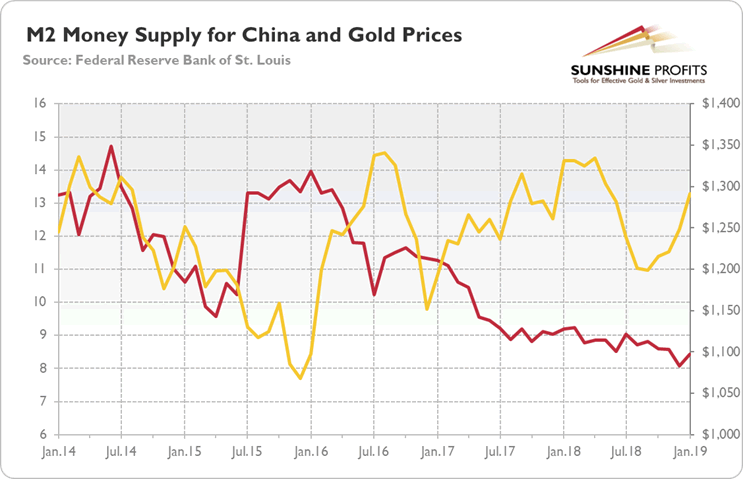

Look at the chartbelow, which shows the M2 money supply for China. We do not have data for February, butthe Red Dragon has just stopped the downward trend. If it really wants to reflate the economy, there is still a lot of workahead of China’s printing press.

Chart 1: M2 moneysupply for China (red line, left axis, % growth y-o-y) and gold prices (yellowline, right axis, London P.M. Fix, $) from January 2014 to January 2019

But if the dataconfirms press reports and we will see a further easing of monetary and fiscalpolicy, then we could see a replay of 2015. And this is not necessarilypositive for gold. As one can see in the chart above, the surge in money supply in China in 2015 coincided with the plunge inthe price of the yellow metal.

Investors have so far welcomed the softer credit conditionsand easier fiscal policy in China. But the debt-fueled bonanza will not lastforever. And when it stops, oh boy, the world will suffer. The China’s demandfor investment goods will drop (poor Germany) and the country will not be ableto add another stimulus and pull out the global economy from the downturn. Then, gold should shine.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.