Will Gold Continue to Outperform Silver? / Commodities / Gold & Silver 2019

GoldStrength Dominates the Markets

GoldStrength Dominates the Markets

The recent rally in Gold has been hardto ignore. The yellow metal is certainly showing a lot of strength. But unlikeprior rallies, the current one stands out in several ways.

For starters, Gold is trading atrecord levels against four of the seven major currencies. Looking at just spotGold against the dollar does not represent just how strong Gold is at themoment. But not only that, Gold is rallying without the common correlationsthat we have seen in the past. Specifically, equities are not really under awhole lot of pressure at the moment. Neither is the dollar. In fact, thegreenback just broke to a fresh high in the past few weeks.

Perhaps the best correlation to lookat is that with bonds. The strong downwards momentum in global bond yields ispossibly the best indicator and driver for the surge in Gold prices. Nevertheless, dominating appearsto be the correct term here as none of the other commonly looked assets havehad fluctuations that look anything like the rally in Gold.

Silver is Lagging Notably

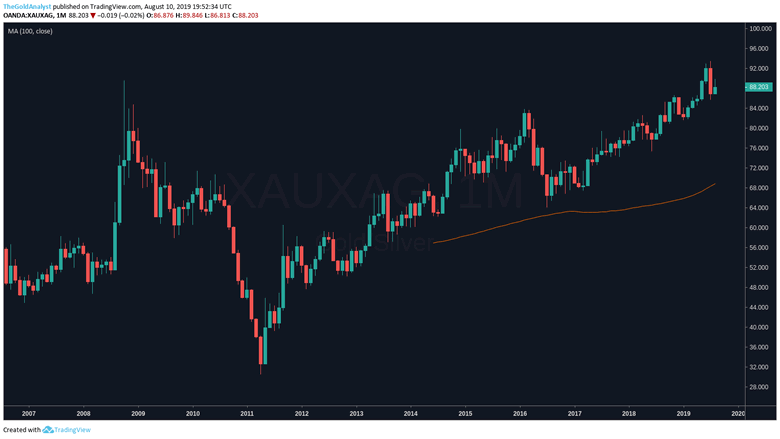

So that brings us to Silver. Sayingthat Silver is lagging is a bit of an understatement. While Gold prices tradeat a 6-year high, Silver prices are still pretty much near decade lows. Thishighlights a huge divergence among precious metals. The Gold/Silver ratio isoften referenced to gauge performance between the two metals. Take a look atthe chart below which is a monthly chart of gold over silver.

First off, it is quite clear thatSilver has been underperforming from a broader perspective. This has been goingon since 2011. However, there are a few things that stand out from the abovechart.

For starters, the ratio certainlylooks extended. The indicator in the chart reflects the 100-month moving averageand the price is currently several standard deviations away from it. As well,the ratio is also trading at a record high. But just because it is a bitextended here doesn't mean it's going to turn. There is however an interestingpattern in the chart. Note that the candle for July took the form of a bearishengulfing candle. This is a commonly known reversal candle and might just behinting that the ratio is trying to top out.

There is Value in Silver

But even if the ratio is not topping,there is certainly a much better risk to reward in holding Silver in presentconditions than it is compared to Gold. This is especially true for investorsthat are in countries where the yellow metal is at a record high in their basecurrency.

As Gold continues to gain traction, itmakes sense that other precious metals stand to gain. After all, newerinvestors are more likely to get into an investment that they perceive to becheap rather than investing at a multi-year high.

By Jignesh Davda

TheGold Analyst

Quality Analysis of the Price of Gold

© 2019 Jignesh Davda - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.