Will it take a Fed accident to boost gold?

For those investors who look to gold for inflation protection, it seems they are prone to selling gold when they believe the Fed is going to at some point start raising interest rates. On the other hand, they tend to buy gold when the Fed is expected to get looser. That is what INK has found in this month's Gold Top 20 Stock Report in looking at the relationship between forward gold prices and our monetary tightening indicator. So what does this mean for gold prices now?

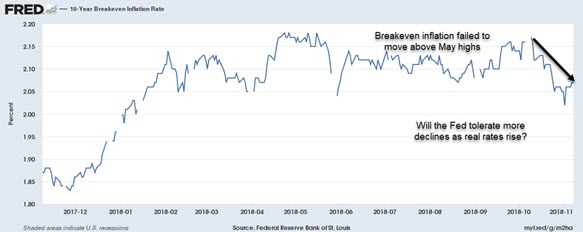

To get some answers, we analyze the forward six-month return of gold in relation to our monetary tightening indicator as measured by the spread between inflation expectations (Treasury bond breakeven interest rates) and real interest rates. When the indicator is positive, monetary conditions are loose and investors appear to expect the Fed will at some point tighten. They tend to sell gold. Conversely, when the indicator is negative, investors are on the lookout for the Fed to become more dovish and tend to buy gold. The big exception to this relationship was during the QE period when investors seemed to believe that the Fed was in a prolonged easing mode. However, since the end of QE, the negative relationship has reappeared.

We are currently in an environment where the indicator is negative as real-yields are on the rise and inflation breakevens have come off their peaks in May. So, how much further will the Fed go before deciding that enough is enough? If you believe what Fed officials are saying, they remain committed to travelling down the tightening road and do not see any need to stop yet.

As a result, we are left with one of two likely scenarios. Firstly, the Fed could surprise the market and start to backtrack on its tightening journey. That would come as a surprise and gold would likely have some quick catching up to do on the upside as investors start to guess how easy the Fed might become. The second scenario is if the Fed keeps tightening until something breaks or crashes (such as the stock market). This is also gold positive, once investors as a group anticipate the crash unfolding. Unfortunately, crashes tend to be surprises, so we would expect a lot of investors will not see it coming. The second scenario also means that gold stock investors may have to endure some anxiety until the Fed's trip down the tightening road comes to an abrupt end.

Our monthly Top 20 Gold Report includes our latest take on the gold market and the 20 highest ranking stocks on the basis of our INK Edge V.I.P. outlook. The report was published this morning for INK Research subscribers and Canadian Insider Club members. Click here to learn more about the benefits of joining the Canadian Insider Club.