Will Nevada turn cold for exploration?

In his March 12th Discovery Watch broadcast, John Kaiser from Kaiser Research Online addresses the question about the future of junior mining exploration in Nevada in wake of the announced deal between Barrick Gold (ABX) and Newmont Mining (NEM) to pool their assets in the state into one giant joint-venture.

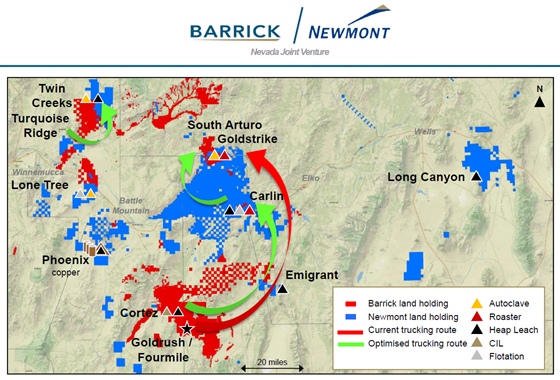

Barrick-Newmont joint venture map (click for larger)

He also suggests keeping a close eye on expected news from Midland Exploration (MD)'s Mythril project in the James Bay area of Quebec and PJX Resources (PJX)'s Vine Property.

The new Nevada joint venture represents 4.1 million ounces of 2018 gold production and the companies hope to squeeze out almost US$5 billion worth of synergies out of the deal. Whether or not the companies actually realize that amount will depend on execution, but Mr. Kaiser points out that it will likely result in some job losses. Kaiser also suggests that when it comes to exploration, the joint venture is likely to focus on its existing properties. That raises the question of whether Nevada will turn cold when it comes to junior company exploration. Mr. Kaiser is hopeful that it does not.

On the plus side, Mr. Kaiser believes new techniques such as the application of hydro-geochemistry may help to find hidden deposits that the two mining giants have yet to discover. If the theories such as those championed by Nevada Exploration (NGE) surrounding the potential of undercover Carlin-type deposits in northern Nevada prove correct, Kaiser suggests:

There is no reason to believe that Newmont and Barrick have it all, they just have what has been found. Everything out there is still open season. But doing this type of exploration is extremely expensive.

The reality of big costs for this type of exploration will require some bigger players to take an interest in the area to partner up with juniors to help pay the bills. With the global mining spot-light now on Nevada thanks to the mega joint venture, Kaiser is hopeful other players will get a stronger appetite for the state:

I don't think there is any mining group out there that isn't there looking at this and thinking do Newmont and Barrick really have it all?

Meanwhile back in Canada, Midland Exploration is starting its 2,000-metre drill program which will test what Kaiser estimates is a 200 to 300 million tonne footprint of rock. The key issue will be what is the grade of this copper-gold-molybdenum-silver system?

It has to be fairly high-grade copper because this is a fairly remote region.

Kaiser explains the grade has to be substantial because infrastructure will have to be built to move out copper concentrates. The stock has moved up in anticipation of the news. Since his February 14th Discovery Watch broadcast, Midland Exploration is up 33% to close Tuesday at $1.45, giving it a market cap of about $95 million.

In British Columbia at its Vine zinc-silver project, PJX Resources (PJX) is giving it another shot at drilling a deep hole to test a magneto-telluric target which is suspected to have a vertical orientation. According to Kaiser, the company is about halfway down, and they may make it to 1,200 to 1,400 metres in a couple of weeks. The hope is to hit massive sulphide mineralization with sphalerite.

This report first appeared on INK Research.