Will Recovery in Payrolls and Yield Curve Sink Gold? / Commodities / Gold & Silver 2019

US labor market strengthened again and the yield curveinversion looks to be over. Has the sky cleared? Hold on, Brexit is just aroundthe corner. Given the circumstances, are gold prices more likely to rise orfall?

US labor market strengthened again and the yield curveinversion looks to be over. Has the sky cleared? Hold on, Brexit is just aroundthe corner. Given the circumstances, are gold prices more likely to rise orfall?

AmericaCreates almost 200,000 new jobs in March

US economy added 196,000 jobs last month, followinga disappointing rise of 33,000 in February (after an upward revision). Thenumber surprised on a positive side,as the economists forecasted 177,000 created jobs.

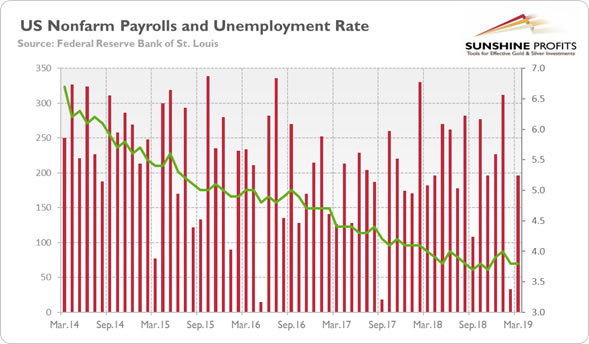

Moreover, the strong headline number was accompanied by positive revisions inFebruary and January. With those, employment gains in these two monthscombined were 14,000 higher than previously reported. In consequence, afterrevisions, job gains have averaged 180,000 per month over the last threemonths, which is lower than several months ago, but still a healthy level, as the chart below shows.

Chart 1: Monthly changes inemployment gains (red bars, left axis, in thousands of persons) andunemployment rate (green line, right axis, U-3, %) from March 2014 to March2019.

The March Employment Situation report indicates, thus,that the current economic expansion still has plenty of room to run despitegrowing worries about the slowdown or even an upcoming recession. It is nota good news for the gold bulls.

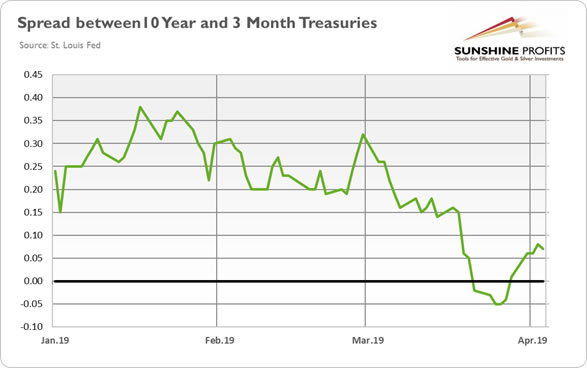

Indeed, the flush of new jobs kept the unemploymentrate unchanged at 3.8 percent. It meansthat the recent yield curve inversion has not been confirmed by the second mostimportant recession indicator. Actually, the yield curve has already returned into apositive territory, as one can see in the chart below.

Chart 2: US Treasury yield curve (spread between US10-year Treasury and 3-Month Treasury) from January 2 to April 4, 2019

It suggests that wewere right warning the precious metals investors (here and here) that theyield curve has lost some of its predictive power, so its inversion did nothave to signal the imminent recession. Of course, the yield curve may returninto negative territory – and then it could be worrying. However, the inversion did last only five days (youcan barely spot it in the long-term chart), while before the two lastrecessions the yield curve stayed below zero for several months. Hence, it seems that it will turn out to be afalse positive and gold bulls will have to wait longer to see a full-blown USrecession. The recovery in Chinafactory activity surveys confirms our analysis in the latest Market Overview that thecurrent global slowdown might be temporary.

Implicationsfor Gold

The latest Employment Situation report shows the boomerang in hiring, indicating that the US labor market tightened further after a sluggish start to the beginning of the year. We are not saying that everything is rosy – for example, the retail sales fell in February for the second time in three months. However, the unemployment rate remained flat, while the yield curved ceased to be inverted. It suggests that the US recessionary risk has recently abated, which should ease the save-haven demand for gold.

However, this week may be volatile in the precious metals market. On Wednesday, the Fed will publish the minutes of its latest monetary policy meeting, while the Governing Council of the ECB will gather again. No policy changes are expected at the ECB meeting, but if Draghi surprises on the dovish side, the euro may weaken against the dollar, which could very well pull down the yellow metal as well.

And also onWednesday, there will be summit of the European leaders to discuss Brexit. As areminder, Britain’s departure is now set for April 12. Yes, on that Friday –and there is no agreement yet, so the scenario of hard exit is more and morelikely (although we bet that the UK will get an extension of the deadline). Ifthis happens, we could see a lot ofvolatility in the gold market. At the end of the week, the picture shouldbe much clearer – stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.