Will Silver Outperform Gold?

Barry Dawes of Martin Place Securities takes a look at the current state of the market to explain why he believes silver may outperform gold.

Barry Dawes of Martin Place Securities takes a look at the current state of the market to explain why he believes silver may outperform gold.

The gold price is moving up again and is in a wave 3 that could show strong acceleration from here. US$2800 is not very far away now, giving the potential for US$3000 to be seen at this rally.

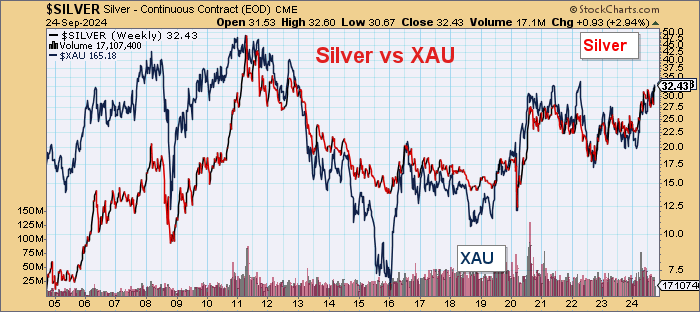

Silver has lagged gold by a long way but it seems now ready to play catch up. The breakthrough US$32 is important, and it suggests that the previous high of US$50 could be tested quite quickly.

Gold stocks are now ready to break out with the XAU and are about to pass through long-term resistance at 165.

Those North American gold indices XAU and HUI have broken their 13-year downtrends, so they should now really fly, REALLY FLY.

Note the 20-year XAU versus silver chart below; they are performing together.

As noted here previously, silver seems to be more aligned with the animal spirits that push gold stocks higher rather than gold itself being the driver.

This helps to explain why small cap gold stocks have underperformed the gold price and the big cap gold indices.

Long-suffering shareholders in small and micro caps should now start to see good rises in their stocks.

The prices of ALL commodities are now starting to move, so watch oil, coal, copper, lithium, grains, and fertilizers.

Futures are already almost at US$2,700.

US$2,800 should be a breeze.

Gold will outperform stocks, but there is no crash coming.

Gold Stocks

Gold stocks are at the 165 level.

The next week should be very strong.

Breaking through this 13-year downtrend.

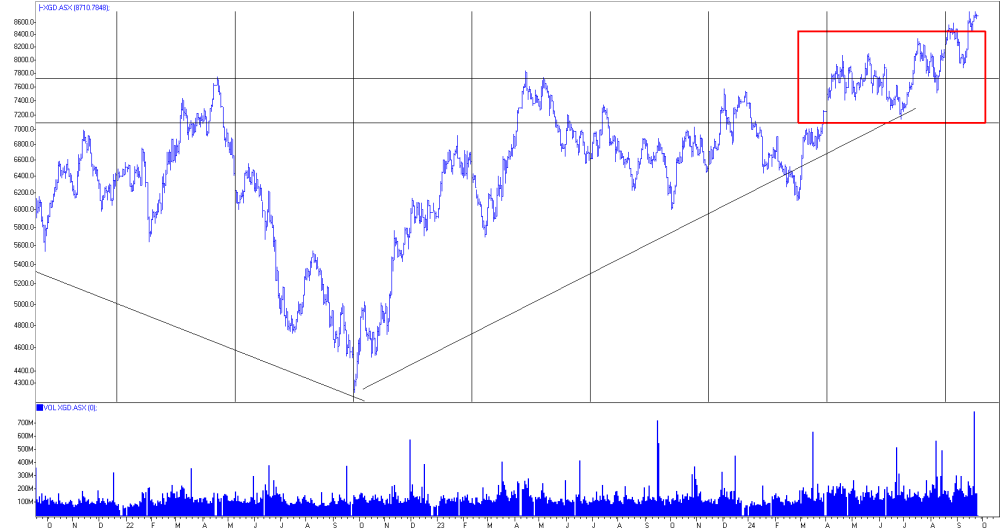

ASX Gold Index

The ASX Gold index is through 8700. Out of its box, it is heading for 10,000.

Below, you can see XGD from 2022 to 2024.

Silver

This is an important move.

Silver should soon head for US$50.

Silver is ready to outperform gold.

Copper

Copper is through US$4.40 per pound.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold,Silver,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.