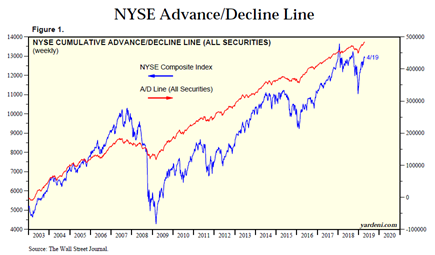

Will stocks follow as NYSE Advance-Decline Line soars to new highs?

New highs in the New York Stock Exchange Advance - Decline (AD) Line are giving the bulls something to cheer about explains Bob Hoye in his April 17th broadcast. The AD line measures the cumulative net number of stocks over time that are gaining in price for a day versus those that are declining.

The NYSE Advance-Decline Line is on the rise (click for larger)

The market historian from ChartsandMarkets.com explains that the line often leads the market higher.

If you have the AD's making new highs, it implies that the senior indexes could make new highs. But I am not certain on that.

Mr. Hoye notes that the market has had a fabulous run in the first quarter of this year and suggests that institutions could push the S&P 500 and Dow Jones Composite indexes higher. Nevertheless, Mr. Hoye is not joining the AD celebration. Right now he is paying close attention to other factors including:

General overbought conditionsValuations in relation to the economic outlookBullish sentimentCredit spreadsIn addition, Mr. Hoye notes that the yield-curve has inverted:

That's a danger sign. It won't go away. It has happened. It is indelible. You know, like you say for the tattoo machine, there is no eraser for it. So, we are looking at a market that has again become vulnerable.

He views the recent rally as a chance to take some money off the table.

When do things go wrong? When you are in an excited market and it is the excited market that is vulnerable.

Mr. Hoye is most concerned about what happens in the second half of the year, noting that credit markets can be benign into mid-year, but things can change:

If you are in a speculative year, then the seasonal turn in credit markets to adversity, it can be a killer.

As a result, Mr. Hoye is going to leave it to others to extrapolate the current rally. Instead, he is going to be focusing on the probability of a change.

In the opening segments of the broadcast, Mr. Hoye discusses the Alberta election and implications for the fall Federal election. Listen to the full interview here.

This post also appeared on INKResearch.com.