Will the US Mid-Term Elections Boost Gold? / Commodities / Gold and Silver 2018

Democrats take control of the Congress and moveTrump out of the White House. Sounds unbelievable? So what is probable and whatis not? We invite you to read our today’s article about the upcoming USMid-Term Elections and find out what are the likely consequences for the goldmarket.

Democrats take control of the Congress and moveTrump out of the White House. Sounds unbelievable? So what is probable and whatis not? We invite you to read our today’s article about the upcoming USMid-Term Elections and find out what are the likely consequences for the goldmarket.

Elections are approaching the US again. Two yearsafter Donald Trump was elected as POTUS, American voters go to the polls againon November 6th for the mid-term elections. They will elect all 435 members ofthe House of Representatives and 35 of 100 Senators (as well as 36 stategovernors and many other local officers).

Who is likely to win and how will it affect the gold market? Well, the expectations are thatthe Republicans keep the Senate but lose control of the House ofRepresentatives. Indeed, Democrats areahead in generic congressional polls, which indicate overall sentiment towardsthe parties across the country. According to the RealClearPolitics, 49.4 percent of voters are in favor of them,while only 42.1 percent of them support Republicans.

But what about the seats? The FiveThirtyEight estimates the probability that Democrats win control of the lower house at 83.8percent, but only at 17.4 percent to win the upper house (wait, why is that:don’t Republicans control the Senate by just a single vote? It’s true, but themajority of seats up for election this year are held by Democrats currently, sothere are a lot more opportunities for them to lose than to win seats).

Should we trust these polls? Well, the presidentialelection (not to mention Brexit referendum) showedthat skepticism is recommended. TheUS economy is doing well, so the support for Republicans may hold up. On theother hand, uniquely many of Republican representatives are retiring – and it isharder to defend open seats.

Historically, the party of incumbent presidentusually lose ground during mid-term elections. Indeed, there are few patterns in American politics as regular as the loss ofHouse seats by the President's party in midterm elections. In the last twocenturies, there were only three exceptions: 1934 (during Roosevelt’spresidency), 1998 (during Clinton’s presidency) and 2002 (during George W.Bush’s presidency). And the losses are often dramatic: for example, in 2010, Obamalost 63 seats in House.

OK, but why does the President’s party tend to loseseats during the midterms? The reason is simple: the opposition is energized, while the supporters of the President andhis party are not as engaged. Why should they be, they have already won inthe previous elections! Moreover, some of them may be alienated by thePresident’s unfulfilled promises (Mr. Trump, where are the wall and thereplacement of Obamacare?) or actions undertaken (the funny thing is thattariffs hit Republican states the most). Who like who, but Trump can alienatepeople. He has very high disapprovalratings, so we expect a strong mobilization of Democrats (thus, even theSenate is at risk).

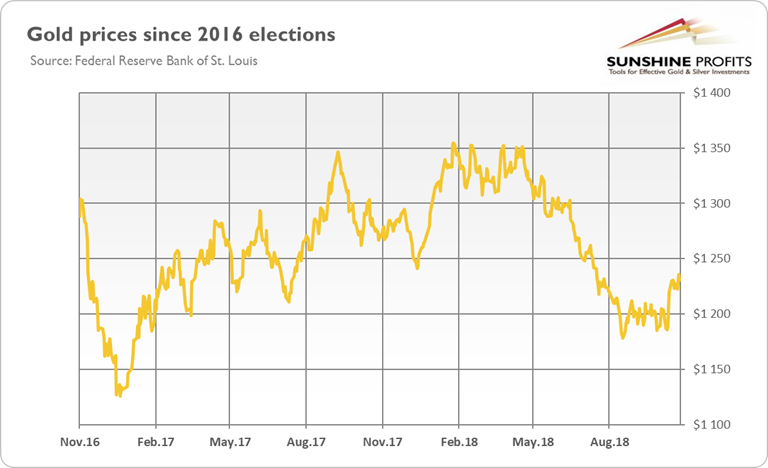

And what does it all mean for the gold market?First, Trump as President and Democrats controlling the House means thepolitical stalemate. Although it is not necessarily something negative, Trumpwill be unlikely to pass any significant law after the 2018 midterms, with theexception of large infrastructure package which could get bipartisan support.It means that investors could scale back their expectations of morebusiness-friendly regulatory or tax changes. The stock market could thenreverse a part of previous Trump rally, which could support the gold prices. As one can see in the chart below, inthe aftermath of 2016 elections, risky assets gained, while the price of goldplunged.

Chart 1: Gold prices from November 2016 to October2018.

Second, facing gridlock in domestic issues, Trumpcould turn stronger into foreign policy. Trade disputes may intensify andgeneral uncertainty is likely to rise. Thepositive effect of geopoliticalevents on goldis often overstated, but that change will not harm gold, at least.

Third, Democratic-controlled House could try to moveTrump out of the White House. They could even impeach him, as they only need amajority of the House. But then the case goes to the Senate and a two-thirdsmajority is needed to remove President from the office. Democrats will not gainso many seats, so they are not likely to start the process (unless theyconvince several Republican senators), as it would be impractical and couldmobilize President’s base during presidential elections. So, although theimpeachment case may not go anywhere far, there will be some noise, which couldrattle financial markets. Some investorswould then turn to gold as a safe-havenasset.

The effect could be temporary, it’s true, but thepost-midterm era should be a better time for gold. Democrats will probably takeover the control of the House. It means that pro-business agenda could beblocked. Trump will focus on foreign policy and concerns about impeachmentemerge. All of these factors shouldfavor safe assets, such as gold. With tightening of monetary policy and nofresh fiscal stimulus, the USeconomy could slow down, while inflation mayincrease (especially that tariffs block the imports of cheap products fromabroad). Hence, although the fundamental outlook for gold remains rather bearish in thenear to medium term, it improves in the long run, but not necessarily becauseof the elections (economics likely overshadow politics). So, we might say that neither blue nor red wave, but gold wave iscoming!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.