World Bank on a Trump economy and commodities

A pillar of president-elect Trump's economic plan is fiscal stimulus in the form of tax cuts and $500 billion-plus of infrastructure spending.

Trump's victory sparked a rally in the copper price which is seen as a bellwether for metals and industry as a whole thanks to its widespread use in construction, the power sector, manufacturing and transportation.

The World Bank's outlook for the world economy in 2017 released on Tuesday includes a look at the effect accelerating growth in the US could have in the rest of the world and on the commodities sector.

The World Bank predicts that among advanced economies, growth in the United States is expected to pick up to 2.2%, as manufacturing and investment growth gain traction after a weak 2016. But if Trump's stimulus plans are fully implemented, it could lift GDP growth to 2.5% this year and to 2.9% in 2018.

The World Banks says developments in the US economy, the world's largest, have effects far beyond its shores and business cycles have been highly synchronized between the US, other advanced economies, and emerging markets.

A surge in US growth - whether due to expansionary fiscal policies or for other reasons - could provide a significant boost to growth of the global economy, by up to 0.1% in 2017 and by at least 0.3% in 2018 provided that no offsetting policies are implemented according to the report.

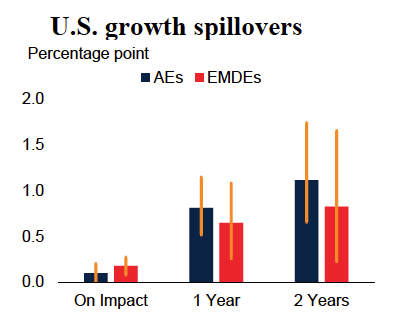

Stronger US growth would help global activity by raising US demand for trading partners' exports. A 1% increase in US growth could boost growth after one year by 0.8% in other advanced economies, and by 0.6% in emerging economies.

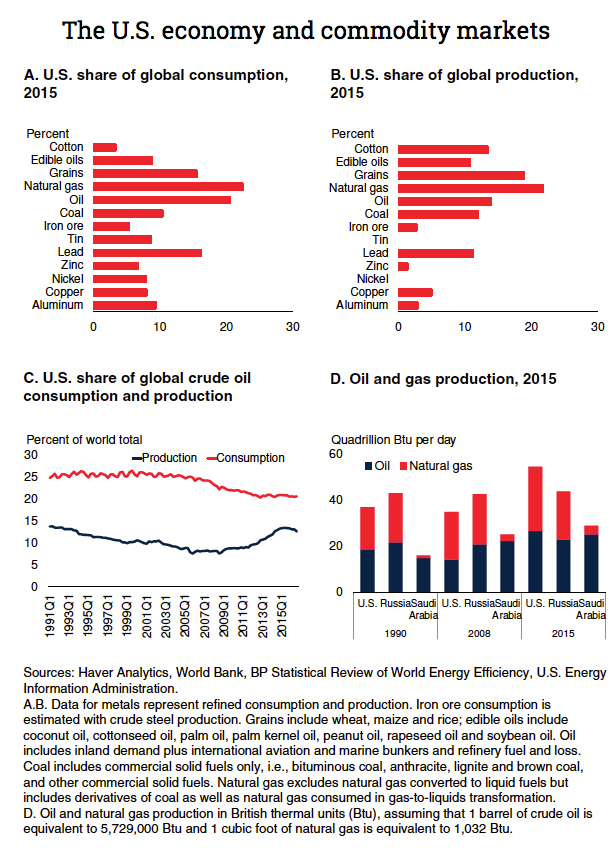

With the rise of large emerging markets, such as China and India, the US impact on commodity markets has diminished over time.

However, says the World Bank the United States is still the largest consumer of natural gas and oil, accounting for more than one-fifth of global consumption.

The country is also the second largest consumer of a wide range of commodities, including aluminum, copper and lead.

While the bank expects faster expansion in the US, commodity-importing emerging market and developing economies, in contrast, should grow at 5.6% this year, unchanged from 2016.

China is projected to continue an orderly growth slowdown to a 6.5% rate.