World's top copper miner sees metal at $2 a pound for at least two years

Chilean state-owned copper miner Codelco, the world's top producer of the industrial metal, said Wednesday oversupply is likely to last through this year and next, bringing prices down again to around $2 to $2.10 a pound.

After that, chairman Oscar Landerretche expects the market to swing to a deficit of 50,000 to 100,000 metric tons in 2018, with the shortfall expanding to 300,000 to 400,000 tons in 2019, El Mostrador reports (in Spanish).

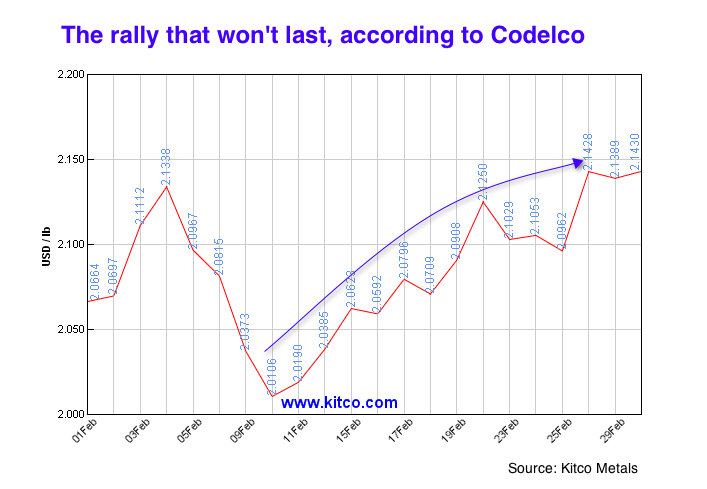

Copper prices have risen 5% since early February, after trading at six-year lows in January and losing about 25% of its value during 2015.Landerretche, who holds a Ph.D. in economics from The Massachusetts Institute of Technology (MIT), also ruled out the possibility of copper prices rising above $3 a pound. He added that those who believe so "must have some secret information that we're not aware of (...) It doesn't look very plausible."

Copper prices climbed to their highest level in over three months Wednesday. On the London Metal Exchange, the red metal rose 1.6% to $4,792.5 a tonne, the highest level since November. In Shanghai, copper for May delivery also climbed 1.6%.

Copper prices have risen 5% since early February, after trading at six-year lows in January and losing about 25% of its value during 2015.

But there still is considerable uncertainty around China, where a slowdown in growth has caused commodity prices to hit historical lows. On Tuesday, Moody's cut its outlook on the country to "negative" from "stable," blaming the government's weak fiscal strength and uncertainty about the authorities' capacity to implement reforms for the downgrade.

Copper is a key component in manufacturing of everything from high tech devices to houses, and it is often looked to as a gauge of economic health. China's speedy expansion of recent years has been a strong demand driver, but weakening conditions there and robust global production have come to weigh heavily on the market.

That is why some, such as Codelco, are simply not buying into the current rally.