Would Gold Benefit From A Commodities Comeback?

Gold's safety bid is still supportive but not guaranteed.

A more promising factor for gold is the raw commodity bid.

A rising crude oil price is the strongest indication of this.

The question of the hour among investors in all asset categories is whether or not global equities, with the U.S. stock market in particular, are on the brink of another panic sell-off. The resolution of this question will certainly go a long way in determining gold's immediate-term outlook. With safe haven demand for gold in the wake of recent financial market weakness still fairly strong, gold would certainly stand to benefit from further weakness. The question we'll take up here, though, is whether gold can still benefit even without a resumption of the "fear factor." As I'll attempt to prove, the answer is an emphatic "yes."

Gold rose on Thursday, ending a recent losing streak as the U.S. dollar finally pulled back to end a 3-day rally. Although the yellow metal is still down for the week to date, it remains above its critical short-term chart support at the $1,314 level (the Feb. 7 closing low). As mentioned in previous commentaries, gold needs to stay above this price level in order to keep its immediate-term (1-4 week) technical buy signal intact. Spot gold gained 0.6 percent to close at $1,331 on Thursday, while April gold futures settled 60 cents higher at $1,332.

Providing some context for Thursday's gold price rise was another impressive rally in the yen. The yen's value has increased in response to volatility in global financial markets. The CurrencyShares Japanese Yen Trust (FXY) rose 1 percent in reflection of this as it the ETF approached its latest multi-month high which was established on Feb. 15. As I've continually emphasized in recent reports, a steadily rising yen tends to bolster the outlook for higher gold prices. As long as FXY (below) remains above its rising 15-day moving average, the gold price has a reasonable chance of rising in the immediate-term (1-4 week) time frame.

Source: www.BigCharts.com

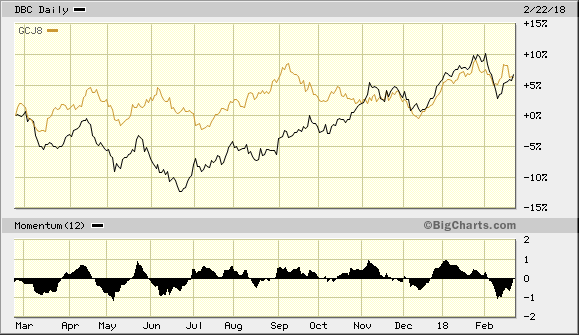

A major question of interest to gold investors involves gold's reaction to the broad market internal weakness. If global equity markets continue to weaken, will it necessarily lead to increased safe haven buying of gold in the immediate term? While this is certainly possible, it's worth noting that gold has been behaving more like a raw commodity lately and less like a safe-haven asset. Compare, for instance, the progression of the April gold futures price (GCJ8) with the price line for the PowerShares DB Commodity Index Tracking Fund (DBC) shown below. As you can see here, the correlation between gold's progression and that of the broad commodities market price trend has been tightening of late.

Source: www.BigCharts.com

The implication of this increasingly positive correlation is that any additional improvement in raw commodities should bode well for gold as well. On this score it should be noted that DBC closed above its 15-day moving average on Thursday for the first time since December. A higher close from here would technically confirm an immediate-term buy signal for DBC based on the rules of my technical trading discipline. This would also likely provide additional support for the gold price.

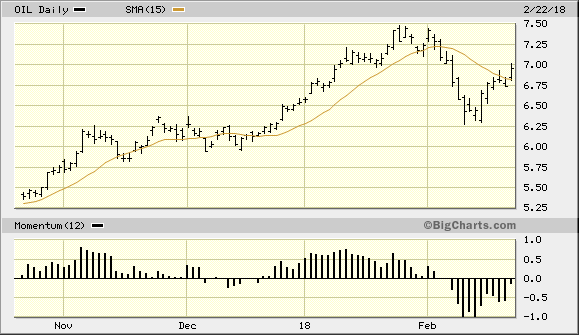

Another factor which has recently hindered a sustained gold price rally has been the weak performance of the crude oil price. It would give certainly commodity fund managers - the big drivers behind gold's interim moves - a good reason for taking a closer look at gold since oil is considered the leading indicator for the overall commodity sector. To that end, Thursday's decisive close above the 15-day moving average in the oil price (below) was a step in the right direction.

Source: www.BigCharts.com

For disclosure purposes, I currently have a long position in the iShares Gold Trust (IAU) as of Feb. 14. I recommend using the $12.62 level (the Feb. 7 closing low) as the initial stop loss for this position on an intraday basis. Longer-term investment positions in gold also can be retained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.