WTI Crude Oil Is Stuck in a Choppy Trading Range / Commodities / Crude Oil

Oil prices ended the week caughtbetween the headwinds of a tighter global supply and a lacklustre economicoutlook eroding consumers' purchasing power.

Macroeconomics

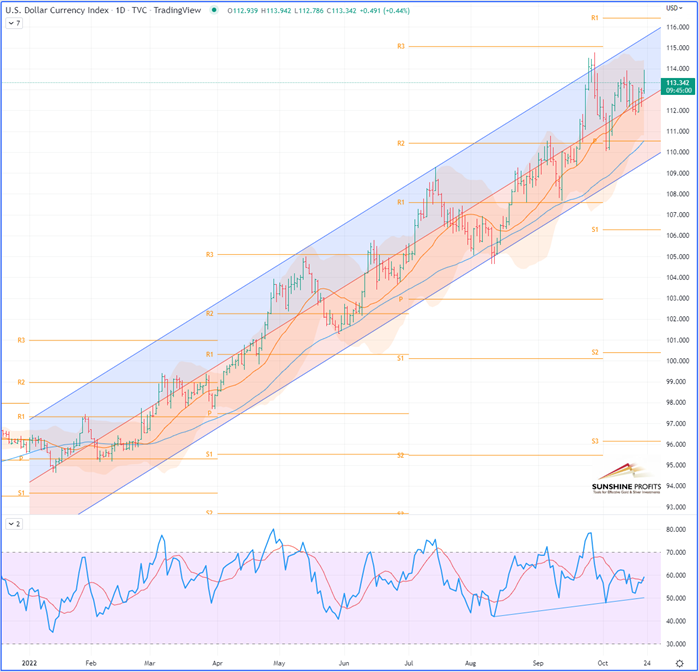

On Thursday, the greenback took off overthe value of 150 Japanese yen – a symbolic price mark – for the first timesince the 1990s.

A strong dollar reduces foreigninvestors' purchasing power in other currencies and thus demand. Therefore, theFed reinforced expectations that the central bank could raise ratesaggressively early next month, which should contribute to a significantslowdown in activity and demand. As for inflation, it barely fell in the UnitedStates in September over one year, to 8.2% against 8.3% in August.

U.S. Dollar Currency Index (DXY), dailychart

FundamentalAnalysis

Crude prices have oscillated betweenlosses and gains this week as concerns over the global economic slowdown clashwith caution over tighter supply. The market seems to be receiving mixedsignals now, with falling US oil inventories indicating increased demand in thecountry, while weak economic signals are having an adverse impact (on prices).

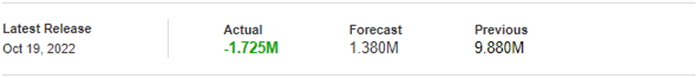

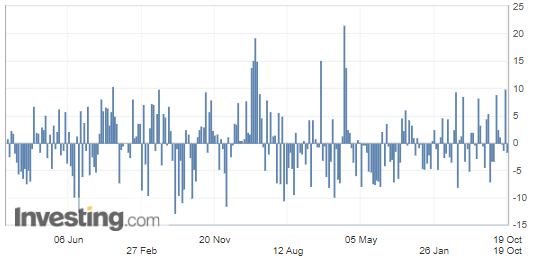

U.S.Crude Oil Inventories

On Wednesday, the Energy InformationAdministration's (EIA) released the weekly change in crude oil stocks, showinga drop of 1.725M barrels, while the forecasted figure predicted 1.380M barrelsin excess.

(Source: Investing.com)

Geopolitics

Belarus could take further steps towardsdirect involvement in the war in Ukraine, As food corridor talks continuebetween representatives from the United Nations and Russia in order to maintainan agreement on the departure of ships from Ukrainian ports. A "hiddenmobilization" would be underway after the announcement of the creation ofa joint military group between Russia and Belarus, according to the independentBelarusian newspaper "Nacha Niva". So far, the Belarusian army hasnot participated in the fighting on Ukrainian territory. Since the beginning ofthe conflict in Ukraine, Belarus has served as a logistics platform for itsRussian ally.

TechnicalCharts

WTI Crude Oil (CLZ22) Futures (Decembercontract, daily chart)

RBOB Gasoline (RBZ22) Futures (Decembercontract, daily chart)

Brent Crude Oil (BRNZ22) Futures(December contract, daily chart) – Contract for Difference (CFD) UKOIL

Havea nice weekend!

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.