You're too bearish on China growth

Ready for a Shanghai surprise?

Ready for a Shanghai surprise?

China's leaders in October outlined the direction of the world's second largest economy over the next five years.

The country's 13th five-year plan running from 2016 - 2020 is the first one approved by Xi Jinping who led a group on "comprehensively deepening reforms" to overhaul China's investment-led economy into one driven by services and consumption.

The communique issued in October provides only the basic frameworks of programs and policies with a more detailed plan to be made public in March. But it gave some indication that Xi and company, unnerved by slowing economic growth, decided to put their money again on investment to re-energize the sagging economy.

Beijing's decision to let urbanization happen at a faster pace and to stick to its target of "medium-high economic growth"and to double-down on a long-stated commitment to "double 2010 GDP by 2020" gave weight to the argument that the leadership would not balk at adding stimulus to kick-start the world's second largest economy.

And the 2020 GDP goal would require annual growth rates of 6.5% to go from a nominal $10 trillion last year to over $12 trillion in 2020. That's the equivalent of adding an economy the size of Switzerland's every year.

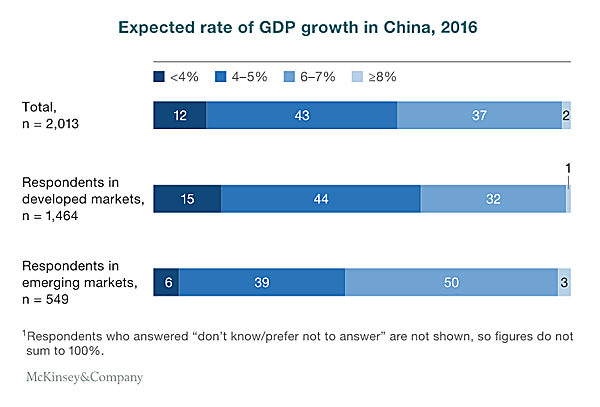

A new survey by McKinsey & Company released on Tuesday asked executives around the globe about their expectations for near- and longer-term growth in China compared to Beijing's goals. On the whole, respondents were skeptical according to McKinsey:

"Roughly half of all executives say it's very or somewhat unlikely that China will meet these targets in the next few years. When asked about expected growth in 2016, more than half of respondents predict the rate of growth will be 5 percent or less-and that China will fall short of the 6.5 percent target."

Developed-market and emerging-market respondents are divided on China's prospects, with executives in the developed world more cautious overall about China's growth according to the survey. India was the outlier: more than two-thirds of execs on the sub-continent expect China will miss economic growth targets.

Given widespread worries about capital flight and bearishness inside the country on commodity prices (viewed as a proxy for economic growth), results of the survey among Chinese executives were surprisingly upbeat:

"Executives in China, by contrast, are the most bullish. Sixty-two percent of respondents there predict China's GDP will grow between 6 and 7 percent in 2016; only one-third of all others say the same. The same share in China believe the plan's targets will likely be met in coming years, compared with 35 percent of all other respondents."

Source: McKinsey & Company