You Think Inflation Fears Are Overhyped? Think Again

By Bloomberg markets live commentator and former Lehman trader Mark Cudmore

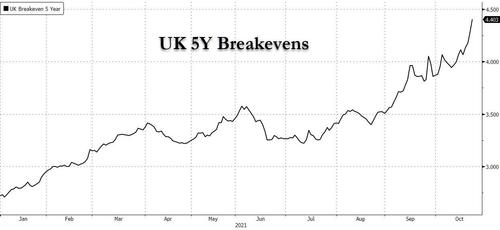

U.K. breakeven rates at the highest levels this century aren't yet high enough...

We're entering the eye of the earnings season and the message from corporates is already coming through loud and clear: prices will climb a chunk further over the coming months, even as output is impaired. Every day brings fresh news of supply-chain disruption and rising costs.

U.K. 5-yr inflation expectations (as measured by breakevens) have climbed an incredible 160bps so far this year, to reach the highest levels on records going back more than 25 years. If you thought you experienced an inflationary environment pre-GFC, you ain't seen nothing yet. The U.K. hasn't seen something like this since the early 90s when the BOE rate was at 15%.

This doesn't mean that we're locked into an inflationary death spiral -- but it does mean that there most people active in markets today have little professional experience of trading in this environment. The corollary is that no one should have high conviction in the inflation-is-transitory mantra; if they do, be suspicious.

One final point: greenhouses are being switched off due to the exorbitant energy and fertilizer costs - the supply of fresh fruit and veg may be a real problem this Christmas.

[ZH: It's not just the Brits, medium-to-long-term market-implied inflation expectations are at or near record highs globally...]

Anything but transitory.